The Iranian owner and chairman of the now-defunct Pilatus Bank in Malta, Ali Sadr Hasheminejad, who is currently on bail in the US on charges of money laundering and violating US economic sanctions, has requested that the court extends his home curfew and remove his tracking device, according to Inner City Press.

Journalist Matthew Russell, who was present in the court room when the request was being made, reported that US Judge Alison J. Nathan said she saw no reason to remove the ankle tracking device. Ali Sadr’s lawyer argued he wanted to be able to meet his client until midnight. A decision will be taken in a week’s time.

High profile lawyers from the US firm Steptoe and Johnson representing Ali Sadr are involved in high profile cases, representing clients such as Huawei, that are causing long delays in this case. The trial may not start until March 2020 as further delays are expected.

Ali Sadr was arrested in the US in March 2018 and charged with money laundering and breaching US sanctions against Iran by funnelling more than US$115 million paid under a Venezuelan construction contract through the US financial system.

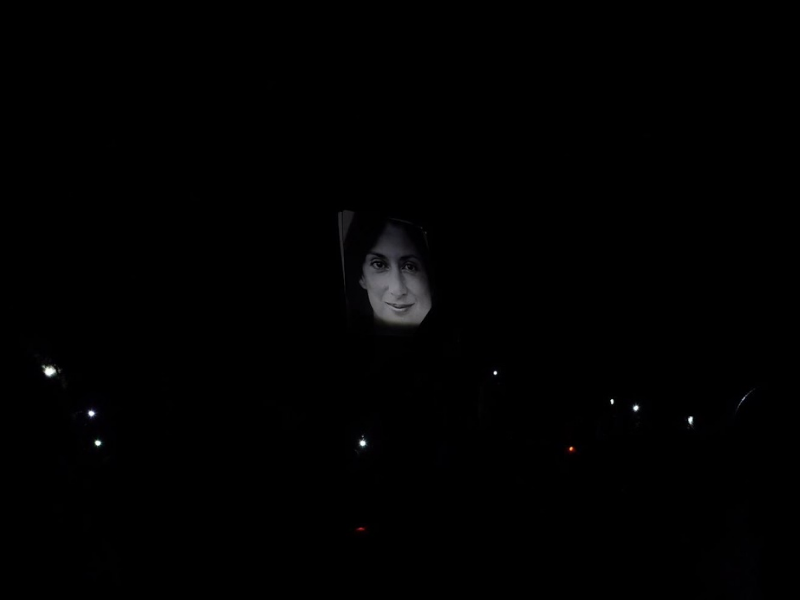

Pilatus Bank first came into the spotlight after journalist Daphne Caruana Galizia accused its owner of a number of crimes including money laundering, kickbacks to Maltese politicians, and large transfers to members of the Azeri ruling elite.

After her assassination in October 2017, it emerged that Ali Sadr had started libel proceedings against Caruana Galizia “to protect his reputation” in Arizona, demanding compensation of US$40 million.

The Shift reported that government inaction on Pilatus Bank had cost taxpayers at least €345,000 as the government issued a direct order for the “review and assessment services” in relation to the bank, according to information published in the government gazette.

The direct order was awarded on 20 September 2018 when Pilatus Bank still had its license despite calls from the European banking watchdog to withdraw it. To date, no further information on the investigation, or any findings, have come to light or been made public.

The European Banking Authority had expressed “significant concerns” over the Malta Financial Services Authority’s handling of authorisation and supervisor practices relating to Pilatus Bank.

The European Central bank withdrew Pilatus Bank’s licence in November 2018.

Ali Sadr had acquired a St Kitts & Nevis passport through Henley and Partners, the concessionaires for Malta’s cash for passports scheme.