Castille’s favourite bank has been shut down and unsurprisingly Prime Minister Joseph Muscat has nothing much to say about it.

If I were Prime Minister I would be totally peeved at whoever allowed the bank to open shop and who refused to take action against a bank whose chairman was arrested in the US on money-laundering charges.

Any Prime Minister would be fuming if the country has been brought into disrepute by incompetent financial regulators. Any Prime Minister would call in the bigwigs from the anti-money laundering agency and give them a good dressing down for failing to do their job.

But Muscat cannot do any of the above. Pilatus Bank was not only allowed to operate in Malta under his watch, but it also enjoyed the trust of his closest aides, with Muscat’s chief of staff Keith Schembri among the bank’s clients.

Like it or not, Muscat will be forever associated with Pilatus Bank and its owner Ali Sadr Hasheminejad who is now facing money-laundering charges in the US (and the real reason why we got to this point).

Together with Schembri, Muscat was among the guests at Ali Sadr’s “small wedding” held in Italy in 2015. He cannot deny his intimacy with Ali Sadr and ultimately the buck stops with him. The Malta Financial Services Authority (MFSA) chairman and its board members are all appointed by the Prime Minister as are the board members of the Financial Intelligence Analysis Unit (FIAU).

If it weren’t for European supervision, Pilatus Bank would probably still be operating with total impunity. But thankfully, the European Banking Authority and the European Central Bank did not close an eye (or two).

In a letter sent to MEPs who called for the bank’s closure, the European Banking Authority said it had found various shortcomings in the FIAU supervision of Pilatus Bank. It said that Maltese authorities failed to implement robust due diligence checks during the authorisation process and did not respond to concerns on money-laundering and dubious banking practices.

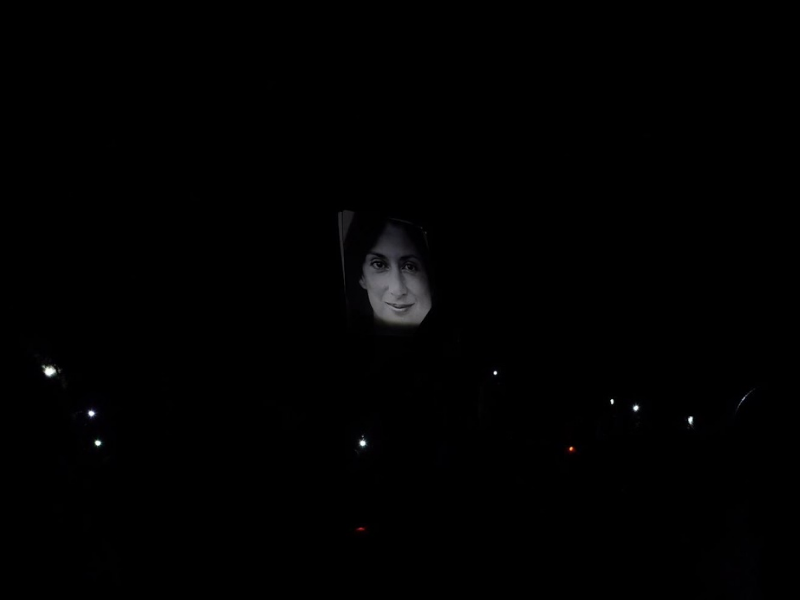

And thankfully, European authorities had absolutely no interest in shielding a bank at the centre of corruption scandals exposed by the murdered journalist Daphne Caruana Galizia and former Opposition Leader Simon Busuttil.

In any functioning democracy heads would roll, especially following the failure to take action against a bank which was initially subject to an investigation by the FIAU. After concluding that Pilatus Bank showed a “glaring, possibly deliberate disregard” for money-laundering controls the FIAU decided to drop the case against the bank.

Despite the damning report, the FIAU had a change of heart and said the shortcomings it had identified in terms of compliance with money laundering laws “no longer subsist”. A pesky investigator had been removed in the meantime.

The bank’s closure vindicates all those who have been hounded for uncovering the bank’s shortcomings and exposes the connivance of those who gave the bank the benefit of the doubt.

But no heads will roll and the very same people who toasted Ali Sadr’s marriage still run the country. They might successfully disassociate themselves from Pilatus but the damage they have done won’t go away. For they have created an economic miracle built on global tax evasion, money-laundering and cheap labour.

A national risk assessment which the government is refusing to publish confirmed that Malta is at a high risk of being used for money laundering and of receiving foreign proceeds of crime.

The report also found that Malta’s banking sector, company service providers, lawyers and trustees as well as remote gaming pose the highest risk of being used for money-laundering.

But the umpteenth alarm bell will be once again ignored. Muscat and his vassals allowed Pilatus to operate despite of all the warnings. And they did absolutely nothing after US prosecutors alleged that Ali Sadr founded Pilatus Bank with criminal proceeds.

The Labour regime will not ditch its cunning plan. It’s too late at this point.

They have lost some pieces along the way but they still believe that they can get away with it. Too many people have too much to lose at this point. The stakes are too high and they will not allow Humpty Dumpty to fall off the wall. Because if he does, who will put all the pieces back together?