Updated with response from Bank of Valletta.

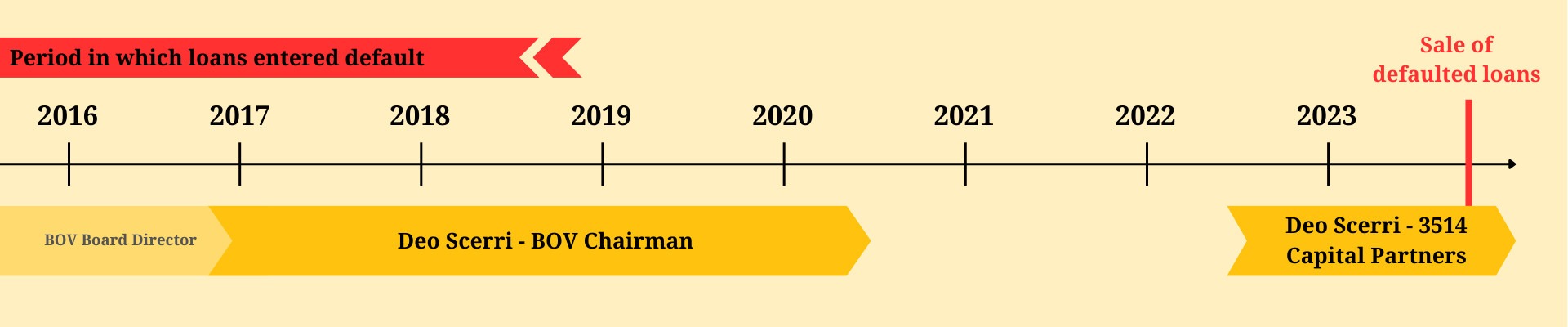

Deo Scerri, an adviser to the investment fund that purchased heavily discounted loans from BOV, served as the bank’s chairman when many of the loans were first declared to be in default, raising questions on whether insider knowledge of the loans’ assessment may have offered an advantage to the company that acquired them.

The portfolio, which comprises some 700 loans across 245 borrowers, was sold by BOV to 3514 Capital for €26 million. Further investigations by The Shift established that the total value of the loan portfolio was estimated to be over €100 million.

While the total value of the “non-performing” loans is deemed unrecoverable, it is understood the transaction will still land a significant profit in 3514 Capital’s hands.

BOV quietly announced the sale of the loans in December but did not specify the company purchasing them. Last month, The Shift revealed it to be 3514 Capital, an investment fund involving law firm DF Advocates’ co-founder, consultancy Polymath & Boffin, and the bank’s former chairman, Scerri.

Upon announcing the portfolio’s sale, BOV noted that “90% of the portfolio comprised of loans and facilities that have been in default for five years or longer”.

In an FAQ document released with the announcement, BOV said it declares loans to be defaulted or non-performing when “exposures are 90 or more days past due” or “the debtor is assessed as unlikely to pay its credit obligations in full.”

The period within which the loans were declared to be in default coincides squarely with Scerri’s BOV chairmanship between 2016 and 2020 – when decisions about the loans were being taken.

Scerri served as a director on the BOV board since 2013, when he was appointed by disgraced former prime minister Joseph Muscat.

Most of the loans sold off by BOV to an investment fund involving Scerri were declared non-performing while he occupied senior positions at the bank.

The situation raises questions on Scerri’s involvement in the transaction and whether insider knowledge of the loans’ ‘defaulted’ assessment may have been advantageous to the company purchasing the portfolio.

Before he was appointed BOV chairman by disgraced former prime minister Joseph Muscat, Scerri, through his company RSM Malta, served as the Labour Party’s auditor.

Responding to The Shift’s questions, Scerri said his role on 3514’s investment advisory committee was limited to “overseeing and implementing self-regulating policies that the company has imposed on itself”.

He claimed his role “has no connection with the origination or acquisition strategy entrusted to the board of directors”.

He said that in his previous “non-executive” role at BOV, he “was not involved in the day-to-day operations” and claimed that “since more than three and a half years have lapsed… no revolving door issues may arise in this scenario.”

He did not comment on the fact that the assessment of the loans occurred while he was chairman of the bank, with knowledge of decisions being taken on the loans.

In reply to questions from The Shift, BOV had said, “The acquirer of the portfolio was selected based on a formal offer submitted as part of a rigorous bidding process conducted by the bank”.

The bank said, “It is expected that for non-performing loans with long vintages, recovery materialises through the liquidation of the collateral following a judicial process, bound to take several years”.

BOV said the transaction would benefit the bank, given the loan portfolio’s value had been revised to €5 million. Therefore, its sale for €26 million represented a significant “positive impact” on the bank’s liquidity.

3514’s investment of €26 million would naturally be based on the expectation that the company can make a significant profit, raising questions on which of the two parties involved left the negotiating table with the better deal.

Response from Bank of Valletta

As already stated in the Q&A issued following the announcement of the sale, a loan becomes non-performing through an established and objective process that follows industry and regulated standards. Neither the executive management of the Bank, let alone the Board of Directors, make a call on which loans are deemed to be ‘non-performing’. As mentioned in the Q&A, Bank of Valletta considers a loan to be non-performing/defaulted when either or both of the following criteria have taken place:

- Repayments are 90 or more days past due.

- The debtor is assessed as unlikely to pay its credit obligations in full without realisation of collateral.

The exercise of categorizing loans as ‘non-performing’ is an ongoing one, and the Bank continuously monitors its loan portfolio to identify any loans that should be classified as ‘non-performing’. Moreover, the non-performing loans selected for sale (and included in the Portfolio sold to 35°14° Capital SCC p.l.c ) were chosen exclusively by the Bank’s experts in debt collection based on pre-determined criteria, through a process that was carried out between 2022 and 2023, with no involvement of the Bank’s executive committee or the Board of Directors (whether past or present). Such process was also shared with the regulators.

The Portfolio of NPLs sold, only includes loans which have defaulted on multiple occasions and in respect of which the Bank has no clear and acceptable repayment plan by the debtor and/or there is an expectation that the recovery of debt will take longer than originally intended. Three-quarters of the Portfolio has a vintage of 10 years and over.

First off, people that play around with money have higher propensity to not say the entire truth. Basically, never trust any bank.

Second, 75% estimated loss, between money loaned and money recouped. Although I don’t know, if inflation was considered on this number, but BOV seems to not be a bank that looks and acts like a profitable one.

Third, I ask, are you willing to pay 26 million to procure a list of people/companies that are open to have their hand slightly to massively twisted?

Fourth, who owns ‘a bunch of numbers for a company name’? And where did they get the money?

Fifth, pure speculation derived from seeing Yes Minister, how is the government involved? or not?

The bank has vast resources at hand to pursue defaulting borrowers. It did not need to sell them to third parties. Time will tell how much the new owners will recover from these which will all be money lost to BOV shareholders. Whatever 3514 can do to recover the loans, the bank could do with its resources.

Yeah right. So mistaken.

No, the bank is a retail bank, heavily constrained.

If the bank hasn’t recovered anything in 5 years, it won’t recover anything in the future. Period. These would have already gone through the recoveries department, entertained legal action, attempted a negotiated discount or deal with the borrower, etc. It becomes more expensive for the bank to maintain on its books, let alone keep trying to recover the money.

Yes, the hedge fund is more likely to profit off of it. It is its speciality, and is more free to be adventurous with it. It affords and is permitted to operate at higher risk return levels. A bank’s licence permits it certain activity, a fund different activities. Then if it is a hedge fund and not a simple mutual/retail/open ended fund, oh Lord Almighty the fun it can have with it!!

For all we know these were low interest loans, and the bank is able to put that sale money to use immediately, loaning it out at higher rates, investing it, etc. It is 26 million today, at today’s purchasing power. It has offloaded the currency risk, interest rate risk, inflation risk and other risks to the other party, not to mention the capital buffer boost it would have gained.

Finally, as someone who’s worked in regulated entities, both at a bank and more recently at investment funds, I can comfortably bet that the chairman’s likelihood of any say or authority with this sale is zero. Zilch. Nada. Fact. Period.

He wouldn’t have been able to get within a mile of it. Too many checks and balances, Chinese walls and parties involved. Unless he’s asked the Ndrangheta to literally blackmail hundreds of people along the way and kill all witnesses.

My main questions on these loans, remain:

1. What due diligence was carried out by the bank on the borrower before granting the loan?

2. Who are the borrowers?

3. What is the original amount of the loan?

4. What security does the bank hold against the loans?

Should one see any affinity with the main character in the parable of the dishonest steward?

b

That previously trusted servant sought to make friends with his master’s debtors – in order to have opportunities to turn to after being dishonourably thrown out of his cushy employment.