Aqra dan l-artiklu bil-Malti

A company that has purchased a portfolio of loans from Bank of Valletta for a fraction of the original value involves the bank’s former chairman, Deo Scerri, raising questions on revolving doors and influence, an investigation by The Shift has found.

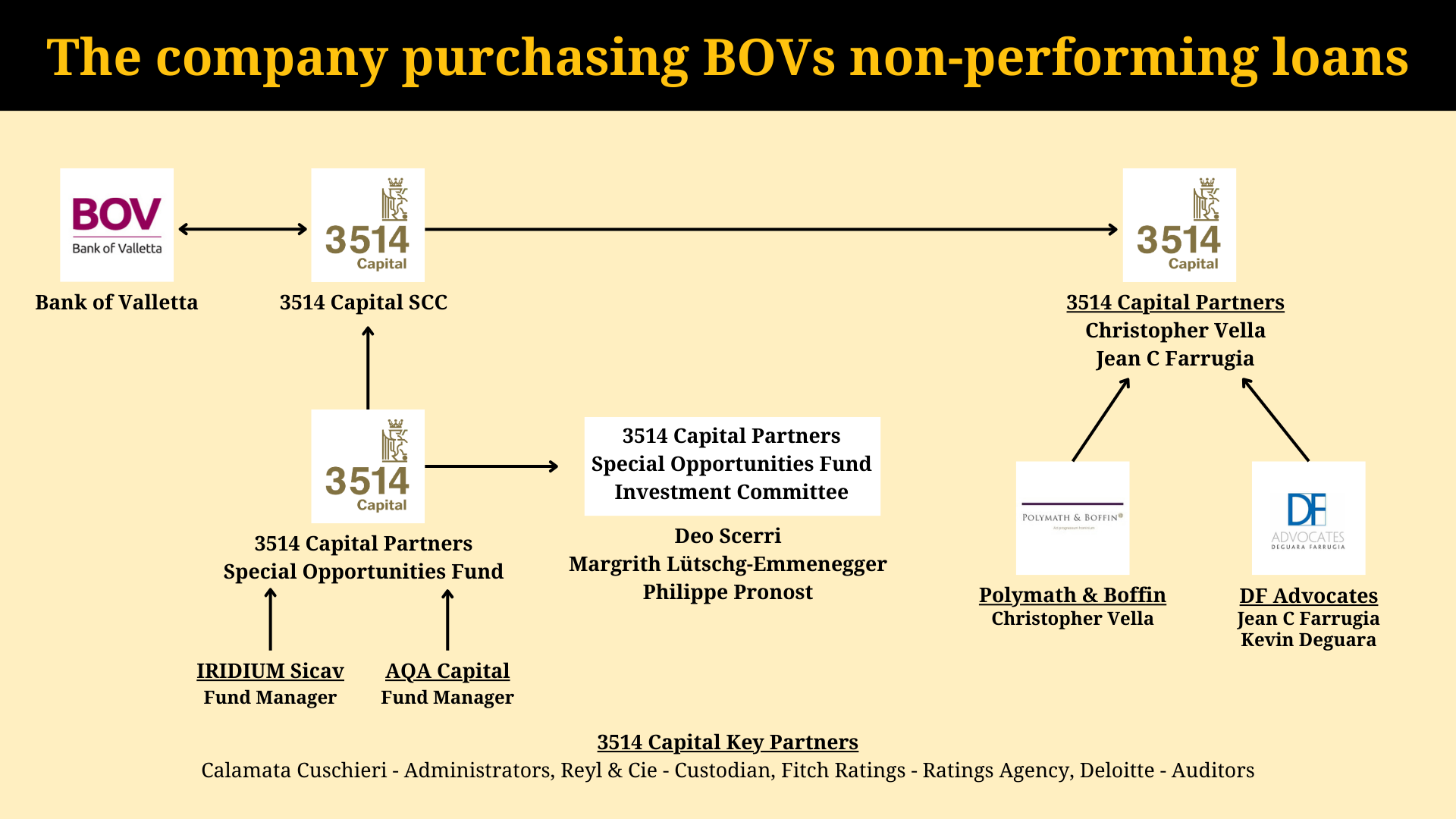

The bank announced it was selling the portfolio on 19 December, but it did not specify which company would buy it. The Shift’s investigation revealed that a company called 3514 Capital SCC would be the one purchasing the portfolio.

The company bought some 700 BOV loans for €26 million. The original value of the loans has not been disclosed. BOV cited commercial sensitivity in reply to questions from The Shift.

The bank’s decision is based on the reasoning that it would be more cost-effective to sell off these loans to others prepared to collect the money than tie itself up in man hours and litigation fees to recover part of the money when considering risk and losses.

Scerri sits on the investment committee of the company that decided to buy these loans – 3514 Capital SCC. An investment of €26 million would naturally be based on the expectation that the company can make a significant profit from such an investment.

Scerri was chairman of BOV between 2016 and 2020 after being appointed by disgraced former prime minister Joseph Muscat. Before that, he was the auditor of the Labour Party.

Responding to The Shift’s questions, Scerri said his role on 3514’s investment advisory committee was limited to “overseeing and implementing self-regulating policies that the company has imposed on itself”. He claimed his role “has no connection with the origination or acquisition strategy entrusted to the board of directors.”

He said his previous role at BOV was non-executive and that he “was not involved in the day-to-day operations of BOV”. He claimed, “since more than three and a half years have lapsed… and since I was not involved in any dealings with the bank on the acquisition of the NPL portfolio, no revolving door issues may arise in this scenario.”

The Shift contacted BOV to ask for the portfolio’s original value, but the bank refused, citing commercial sensitivity. The Shift’s investigation is ongoing.

Old ties, new beginnings

The structure behind 3514 Capital SCC, which purchased BOV’s portfolio of non-performing loans in December.

Investment firm 3514 Capital Partners bought the collection of some 700 loans for €26 million through subsidiary company 3514 Capital SCC (securitisation cell company).

3514 Capital is a partnership directed by Jean Carl Farrugia, founding partner at DF Advocates, and Christopher Vella, CEO at business consultancy Polymath & Boffin set up in 2011 and in which he is the sole director.

Polymath & Boffin’s offices in Floriana are the same as those for 3514 Capital.

Farrugia and Deguara are the founding partners of DF Advocates – a firm that made a name for itself for being involved in several controversial deals negotiated by the Labour Party in government, including the rezoning of Smart City for private residences and the hospitals scandal.

Farrugia and Deguara were direct beneficiaries of rushed legal changes allowing residential developments at Smart City in 2018.

In 2021, Deguara’s house and office were searched by police investigating the ‘fraudulent’ Vitals-Steward hospitals deal.

Deguara is also involved in a string of other businesses and sits on the boards of various companies, including D Shopping and Dizz Finance – the financial arm of Diane and Karl Izzo’s Dizz Group – and Sadeen Education Investments Ltd – the company behind the beleaguered American University of Malta.

The bank’s explanation

In reply to questions from The Shift, BOV confirmed the company purchasing the deal, adding that “the acquirer of the portfolio was selected based on a formal offer submitted as part of a rigorous bidding process conducted by the bank in which multiple interested parties participated”.

The bank also said, “It is expected that for NPLs with long vintages, recovery materialises through the liquidation of the collateral following a judicial process, bound to take several years. Realistically, the Bank shall have recovered the minimum between the (i) legal amount due by the customers and (ii) projected future value of the collateral adjusted to reflect risk factors and liquidation costs.”

The bank commented that in line with established practices, since amounts received in the future are worth less than the equivalent amounts received today, these are discounted on a present-value basis.

“In this case, the present value is dependent on the rate used in discounting future cashflows (based on the cost of capital), the recovery timeframes on each NPL, the rate at which interest accrues on outstanding balances, the change in the risk-adjusted value of the collateral over time, and the cost of servicing the NPL portfolio over its lifetime.”

BOV has become a very shady bank indeed. No need to mention its involvement in controversial agreements and decisions which even costed the same Bank to pay back millions. Is this a safe Bank any longer? Is this Bank a vehicle to launder money and a tool to support illicit dealings? Time will tell, but the coffee is already smelling and it has been smelling for a while now.

I would not surprise me if we see a run on the bank within the next couple of years. I closed my accounts with BOV three years ago. Something wasn’t smelling right.

A run on the bank because it boosted its buffers and cash balance? And because it offloaded bad debts?!

Pft lol.

I wish retail shareholders were treated just like this…

This Bank is just a covienance money exchange point for a Mafia government to exchange I’ll gotten gains a d make them look legal, and it works, no question. WHO here is going to question its activities?

I hope that if the Nationalists ever come to power, it will end this charade with the BOV government’s majority share.

Dream on; the Nationalists danced along similar dirty and foul smelling transactions at Bov during its time and was apologetic for Bov management all along. Bov is apolitical in the sense that it is corrupt and dirty irrespective of who is in government.

When is the European Commission going to impose sanctions on Malta? Despite being a committed Europhile, I have to confess that the EU has been one major disappointment. My hopes were raised when Metsola was elevated to her exalted position but, from a local perspective, what a letdown she has been!

You are mistaken to expect the EU to perform the resistance that is squarely the local population’s task. At least comment with your identity revealed

Ah! The return of Paul Bonello … the very chap who told us all what a good idea it was to vote Labour in 2013. I could say more … but I won’t.

While methodology of valuation of the recoverability of the loans is important, what is key to the public in terms of the selling of this portfolio is the following information:

1. Were these loans fully provided for in the audited financial statements and, did the

auditors express any reservations on their recoverability?

2. A detailed list of the loanees, corporate and individual.

3. The amount of the original loan and the term of the period of the loan.

4. The hypothecs and guarantors on these loans.

5. The purpose for the taking of the loans.

6. Any pending litigation on the loans.

7. Did the bank carry out a due diligence or enhanced due diligence on the loan applicants?

8. Were any of the loans referred to the Board and formally approved by the Board?

9. Was the transfer of the portfolio notarised and registered at the public registry, and was this done for every individual loan or for the portfolio as a whole?

I ask these questions and expect to see the information as transfer of loan and other portfolios could be a vehicle used for money laundering purposes.

In fact I expect the FIAU to investigate in detail this transaction.

On another note to show the importance of investigating, I have already on different occasions been questioning a reported issue by a string of competent persons of Pilatus Bank where a loan with a hypothec on foreign property was refused by the MFSA to be fully repaid before its maturity date and is still refused some 3 years after its maturity and no reason for this highly suspicious loan has ever been reported by any one of the 4 competent persons that had been appointed including the present one. Also no audited financial statements were filed with the Malta Business Registry since 2018.

shady dealings, MLROs generally stop such transactions … but ….

Shameful given it’s the largest bank in Malta!! Action needs to be taken immediately.

Shareholders and also all Maltese citizens (considering the State’s stake in BoV), would expect the Board of Directors to thoroughly explain the justification of such “sale at a discount”.

Say they can compare BoV’s non-performing loans to that of HSBC, and elaborate why BoV thought it will be in the interest of its stakeholders to sell such loans at such discount – considering that BoV is not on average, so bereft of liquidity compared to other European banks.

Furthermore, and more crucially BoV MUST be transparent on what effective efforts were made in making such offer to the widest potential interested parties (internationally), rather than restricting itself to local fat cats and/or individuals with inside knowledge.

One would hope that the individual Board Members are aware of their responsibility towards the Bank’s owners (shareholders & the State), and the personal exposure that arises therefrom.

You are spot on in mentioning director’s personal liability to all decisions that are carried out under their term. Hopefully they also understand that they do not have any personal indemnity for criminal actions.

The Labour Party Take Away, Cash and Carry.

It is important to note that the sale of NPLs is also exercised by banks in foreign countries. However what differs from this sale is that the process should be transparent, a tender is issued and shareholders are requested for their approval through a resolution given that this is a material item. Also the affected customers are given due notice of the change in ownership. None of the above have been affected and thus this sale should be scrutinised by the European Central Bank and Mfsa. Immediate action is required cause every day that passes by is for sure at the advantage of the buyers of this mega super deal or in other words mega super bust for the shareholders of Bov. The FIAU should also be roped in cause such actions definitely dent the financial integrity of our financial institutions. It seems that the grey listing saga did not teach us any lessons!!!!!!!

I’m certainly no expert, but as a former junior fund manager, I will venture to bet I am a bit more knowledgeable on the matter.

1. I am quite sure the MFSA & EBA would have had to approve it. At the very least been notified.

2. 25% payout is actually quite a decent payout compared to market norms. 75% haircut…keeping in mind these would have already been accounted as bad debts on the books, plus 25% of CURRENT value. Keep in mind the value would have decreased over time had the bank held the loans, due to inflation, rates, etc. 25% of PRESENT value! I very often saw 90% haircuts on deals.

3. You have to see whether the whole loan book was sold as is, or whether these loans were repackaged as CDOs or some other derivative or packaged product.

4. I am quite sure the hedge fund would already have a plan to offload to a third party or repackage itself to a new product. More curious to see if the fund financed it with cash or leverage.

5. Such deals happen daily y’all…. nothing shady. In fact I am impressed as I always thought BoV was very risk averse and unwilling to tap into market opportunities and participate in professional deals.

6. The bank knows the details, not us. Its one thing if the loans were Maltese families, who typically do not default on loans, or at least ultimately pay, or if most are foreigners, who statically default more frequently and chances of recovery are low. Keep in mind the bank can put that money received to use and make 5%+ p.a. on it starting immediately, increasing the returns.

7. Considering BoV’s bureaucracy and inefficiency, and the resources and waste to service such defaulting loans, it is certainly more likely such sale is more profitable for the bank.

8. These are loans already written off or due to be. We should, as Maltese, be happy that a local bank, partly government owned, managed to sell them to a private third party, thus offloading the risk.

9. This means the bank is more cash rich ta!! Basta hafna nies joqgħodu jeqirdu. This is a boost to their capital and buffers. Helps their cash flow.

It seems like you are trying to justify this sale. It is all your right however please note that giving notice to the regulators does not mean that you have their go ahead. Trust me the regulators are already on this scam.

Also for the benefit of the readers you should also explain the value of collateral. Is the value of the collateral held by the bank worth €25 million? If the NPL size was at least €100 million which I tend to believe that it was even higher, than for sure this is divided into €50 million Capital and €50 million accumulated interest. The bank for sure had those €50 million Capital backed by the equivalent in assets. Now simply reason €50 million worth of assets 5 to 10 years ago how much are they worth today. So if the purchasers of this NPL also forego the interest element they will sure do a great profit through the sale of assets. My wild guess is circa €60 million profit over and above the €25 million paid.

So the buyers would be getting a lot more, no?