Matthias Krull a former Swiss banker who worked for a company in Venezuela that assisted the stepsons of President Nicolas Maduro with embezzlement and money laundering has turned star witness in a US federal criminal investigation called Operation Money Flight.

The investigation seeks to understand how kleptocrats in the troubled South American nation stole billions in oil profits from the country and funnelled it through a web of companies in offshore jurisdictions, including Malta.

Krull was arrested on suspicion of money laundering in 2018. He had been working for the Julius Baer Group, a private banking corporation founded and based in Switzerland, and involved in mapping shell companies for clients across secretive jurisdictions like Malta, Hong Kong and Antigua.

These companies were used by a string of high profile Venezuelans to hide their “ill-gotten wealth”, according to the Associated Press.

A statement from the US Department of Justice (DoJ) explained how Krull had been involved in a currency exchange scheme, designed to embezzle more than $600 million, later doubling to some $1.2 billion from PDVSA, the State oil company, which is also Venezuela’s “primary source of income and foreign currency”.

Money was obtained via bribery and fraud and then laundered by Krull, according to the DoJ investigation.

Krull pled guilty and turned State witness, assisting with several European investigations, getting other bankers to testify and pressuring Venezuelan money launderers. The Julius Baer Group denied wrongdoing and painted Krull as a rogue employee.

Alleged conspirators included PDVSA officials, professional money launderers, and “members of the Venezuelan elite” including Maduro’s stepsons. Yet, to date, only Krull has been prosecuted in the US.

He told AP: “The goal was to bring in new money…They didn’t really care about the portfolio’s profitability. If I didn’t take a client, someone else surely would have.”

Krull told AP that In 2017, a client asked him to move $200 million in profit from a fake loan made to PDVSA into a foreign bank account for two friends. Krull connected them with a money manager in Panama. Later that year, Krull finally met the beneficiaries of the sum – three men donned in gold chains and baseball caps, introduced as “Los Chamos”. They were the sons of Maduro’s first wife, Cilia Flores.

The US Justice Department also implicated an unnamed Maltese bank and investment firm in the conspiracy.

A subsidiary of PDVSA had entered into a $476 million contract with the Iranian International Housing Corporation, owned by Iranian national Ali Sadr Hasheminejad who was also the owner of the now-defunct Pilatus bank in Malta.

The contract was to build thousands of houses in Venezuela. To hide the fact that the contract was a violation of international sanctions, Sadr set up a network of companies. Funds were paid via a Swiss company and bank account “given the current difficulties for transfer and movement of funds”, referring to the existing sanctions on doing business with Iranian nationals.

Sadr then continued his construction ventures by opening a company in Malta in 2014, called Malta International Construction Ltd, which was a subsidiary of Pilatus Bank.

Sadr was then arrested and charged with money laundering and breaching US sanctions by allowing millions of dollars of payments for the Venezuela project. The Assistant US Attorney accused him of deliberately obscuring his identity by buying a St Kitts and Nevis passport.

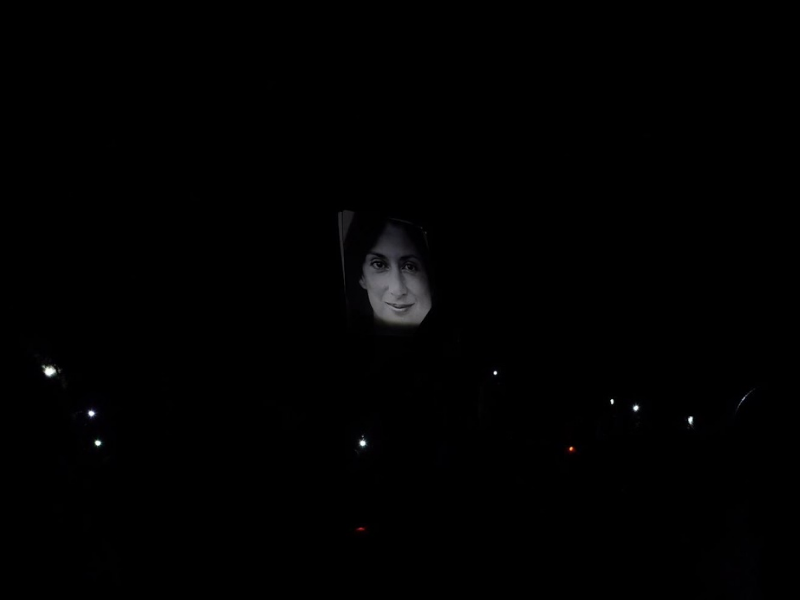

It was then discovered that more than €120 million in transactions from Malta-based Portmann Capital Management was funnelled into and through Pilatus Bank. This came to light during the public inquiry into the assassination of journalist Daphne Caruana Galizia following testimony from Assistant Commissioner Ian Abdilla.

Portmann was one of the firms identified as being used in embezzlement and laundering schemes involving Maduro’s stepsons, and Krull. They were found to have processed more than €553 million for just 53 clients between 2011 and 2018.

Other clients of Portmann included Venezuelan national Jose Vincente Amparan Croquer, described by US authorities as a “professional money launderer”.

US investigators confirmed a flow of funds from PVDSA to Pilatus Bank. It’s believed some €20.4 million was transferred from Venezuela to Malta. A US court found Sadr guilty in July 2020, then dropped the case.

The MFSA and FIAU became aware of the situation in 2016 but failed to impose fines until two years later, just 13 days after the scandal hit the media.

“The US Justice Department also implicated an unnamed Maltese Bank and investment firm in the conspiracy.” The Maltese people have a right to know the identity of these establishments so that due processes will be able to take place.

The Maltese bank counterpart was not Pilatus Bank but Sparkasse who were fined. Till today cannot understand how no journalist picked up on the fact that Andilla either lied or got confused under oath.