The European Parliament voted in favour of measures proposed by the Tax3 committee to clamp down on “tax haven characteristics” and golden visas in seven EU Member States, including Malta.

Over 500 MEPs voted in favour of the resolution, while 63 voted against.

Following a number of multi-billion euro scandals over the last few years, the European Parliament created a special committee in March 2018.

A 70-page report was then issued that called for thoroughly improved cooperation throughout the EU on all matters relating to tax and finance-related areas. It recommended new legislation and the creation of new bodies at both EU and global level, including an EU financial police force and an EU anti-money laundering watchdog.

Belgium, Cyprus, Hungary, Ireland, Luxembourg, Malta and the Netherlands were all specifically mentioned for shortcomings in their tax systems that facilitate aggressive tax planning. The report argues that this undermines the integrity of the European single market, resulting in a loss of €43 billion from EU Member States.

The report found that Malta was one of the destination countries for dirty money as well as exhibiting a high level of inward and outward foreign direct investment, something the report said could only be explained to a “limited extent” by real economic activities taking place in the country.

Criticism was also levied against the country’s golden visa scheme and shortcomings on due diligence procedures were noted, resulting in a high risk of security, money laundering and tax evasion. The report called for phasing out of such schemes as soon as possible.

Malta’s Financial Intelligence Unit (FIAU) was accused of breaching EU law in respect to its failure to conduct effective supervision of Pilatus Bank, due to “procedural deficiencies and a lack of supervisory actions”.

It was also noted that the authorities had failed to provide answers to questions regarding the alleged involvement of Maltese PEPs in money laundering and tax evasion connected to Dubai-based company 17 Black. Particular concerns were raised around the fact that no action had been taken in requesting evidence pertaining to the company from the UAE, and that the bank accounts should be frozen and remain frozen while the investigation is carried out.

Criticism was made regarding the lack of independence of Malta’s FIAU and the Police Commissioner for not taking any action against those implicated in the case.

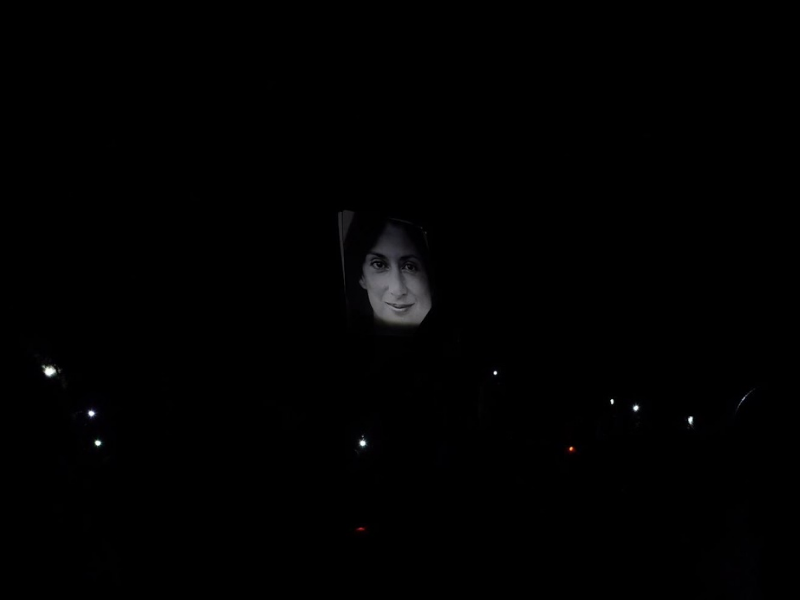

The murder of Daphne Caruana Galizia was included in the report in relation to the fact that at the time of her murder, she was investigating leaks form Electrogas and noted that the owner of 17 Black and Electrogas director, Yorgen Fenech, was due to transfer large amounts of money to the Prime Minister’s chief of staff Keith Schembri and Tourism Minister Konrad Mizzi.

The committee stated that a public inquiry into her murder should be called “without delay” and that Member States should implement mechanisms to protect journalists against the use of SLAPP suits that are designed to “censor, intimidate, and harass”.

The result of this vote reinforces a call on the European Commission to carry out “fitness checks” on relevant laws and regulations to address tax fraud, aggressive tax planning, tax evasion, money laundering and other crimes. It also calls for effective counter measurements against non-cooperative jurisdictions.