Key findings:

-

Technoline was not the only company the once-secret owners of VGH (awarded the concession for three of Malta’s public hospitals) bought to secure future profits.

-

Only two months earlier, they took over another medical supplier – Mtrace plc – for over €2 million. It supplies materials for diagnosis and treatment of cancers, among other diseases.

-

For both companies, they secured contracts that would see them earning profits even after they turned their back on Malta, leaving a trail of debt behind.

-

Mtrace would continue to earn money (and pay dividends) on the deal with VGH with a markup of up to 25%.

-

In August last year, the shares in Mtrace were quietly transferred to Steward Healthcare – raising a number of questions on their involvement in the whole set up.

In October 2016, a little known company owned by an Italian was purchased for over €2 million – a hefty price for a company that was set up only a year earlier – but money seemed to be no problem for its buyers, a Jersey company linked to Vitals Global Healthcare (VGH), The Shift News can reveal.

The company – Mtrace plc – supplies, among other things, radiopharmaceuticals used for diagnosis or treatment of certain cancers and other diseases to the Maltese national health service. The purchase was made while VGH (under previous ownership) was still the concessionaire for three of Malta’s public hospitals.

The company that bought Mtrace was the same that later funded the purchase of medical equipment supplier Technoline through a ‘loan’ of over €5 million to Ivan Vassallo’s company Gateway Solutions. The purchase of Mtrace, another supplier, was made only two months earlier.

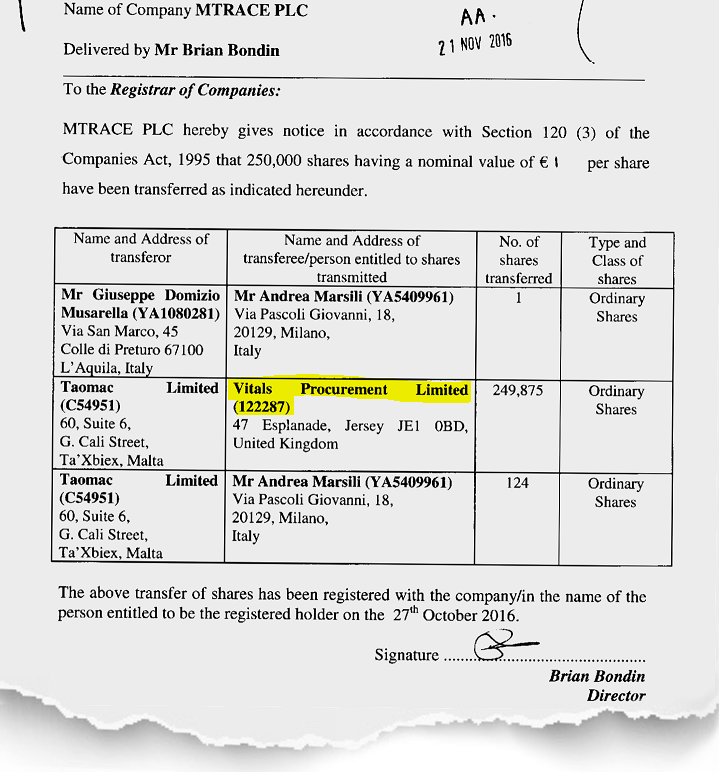

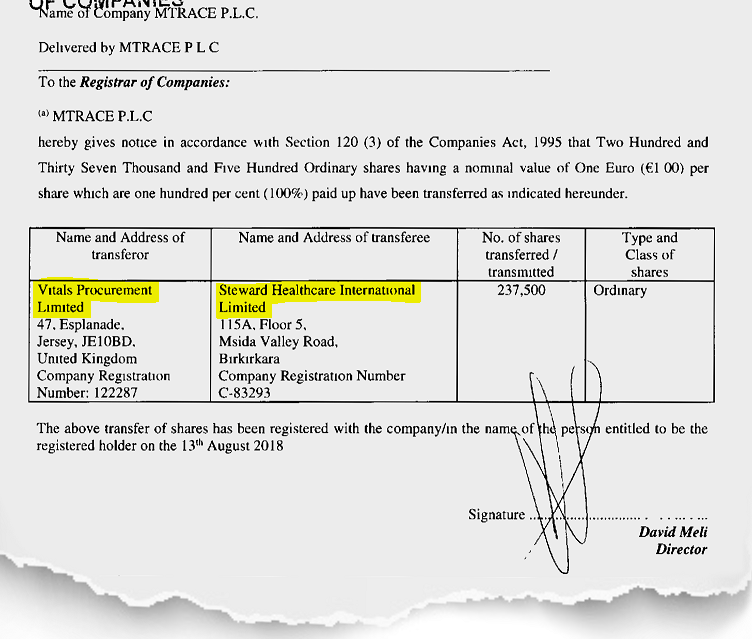

Vitals Procurement Ltd in Jersey bought Mtrace in late October 2016.

As it did with Technoline, which was awarded an exclusive contract with the public hospitals a few months after its take over, VGH also appears to have awarded Mtrace a contract to supply radiopharmaceuticals to Malta’s public hospitals.

Radiopharmaceuticals have a wide variety of uses, including the diagnosis and treatment of cancers, blood and bone diseases, heart diseases, lung, liver and kidney diseases as well as stomach problems.

Effectively, the pattern in the agreement between VGH and Steward that The Shift News has published reveals that the real hidden owners of VGH used Maltese taxpayers’ money to buy off companies that would render profits from exclusive contracts for years to come, even after they turned their backs on the mess left behind when they transferred the concession.

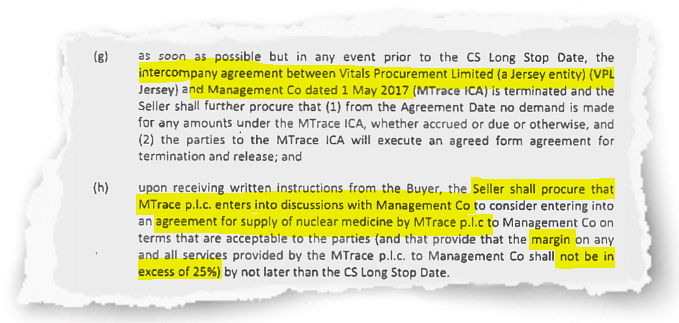

The Share Purchase Agreement exposes the previously undisclosed arrangements in place involving Jersey and Mtrace.

The purchase of Mtrace continues to confirm the intentions of the masterminds behind the takeover of Malta’s public hospitals. Mtrace was formerly owned by a company called Taomac Ltd, involving Giuseppe Domizio Musarella from L’Aquila, Italy, who was indicted in Italy in 2014 for the illegal dumping of waste related to a logistics project another of his companies was awarded at Preturo airport.

Musarella was involved in the setting up of Mtrace the following year in Malta, at the Life Sciences Park at San Gwann. In another exceptionally lucrative deal, it was bought only a year later by a company called Vitals Procurement Ltd in Jersey for over €2 million.

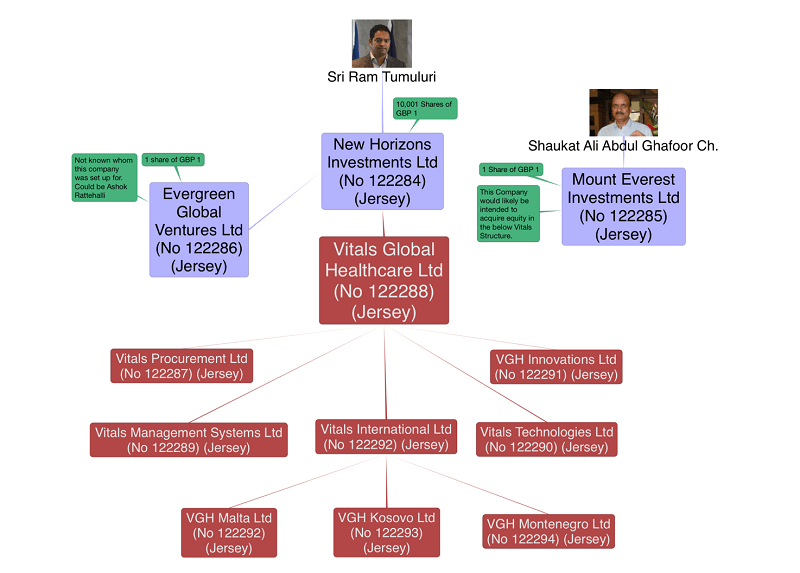

The Jersey Vitals structures

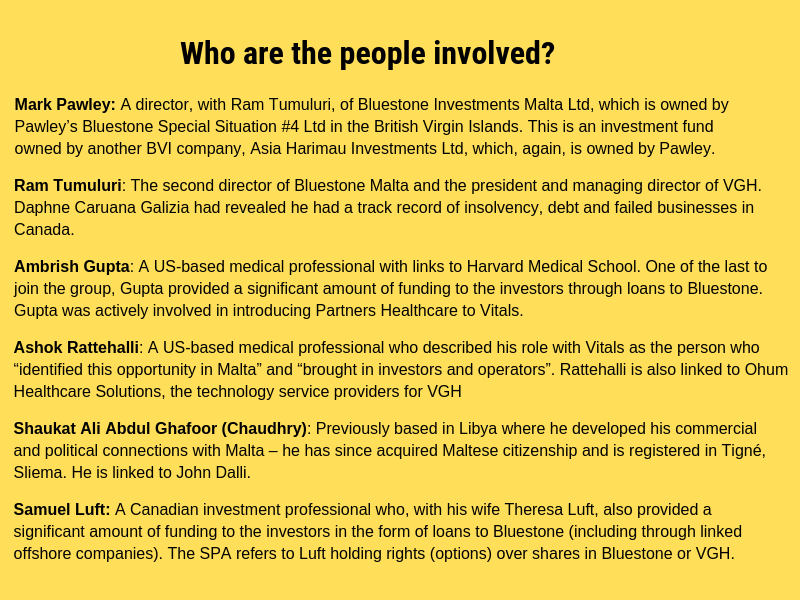

The Shift News has shown how the previously hidden owners behind VGH, the concessionaire of a sizeable chunk of Malta’s national health service, set up a web of companies in Jersey and proceeded to make arrangements to siphon off income from Malta.

Mtrace was purchased only 14 days after the Jersey companies hiding the real owners of VGH were established. The terms of the Share Purchase Agreement point to the source of the loaned money as VGH in Malta.

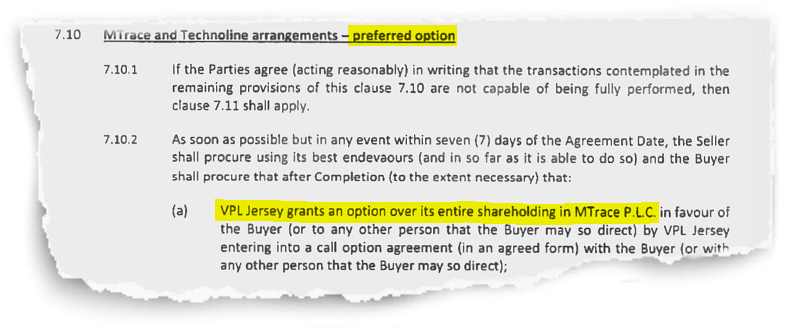

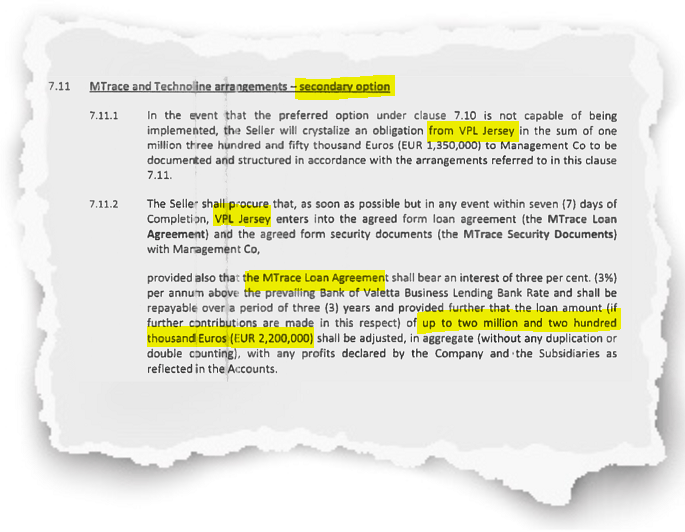

The agreement includes two scenarios of how the sale would happen in relation to each of Technoline and Mtrace with one described as a “preferred option” and the other as essentially what should happen if the preferred option is not achievable.

The Sellers’ preferred option was to keep the shares in Mtrace but grant Steward an option to buy them in the future

In each of the scenarios, one of the Jersey companies would remain involved in Mtrace either by granting an option to Steward to buy the shares at a later date or by being formally registered as owing VGH in Malta.

The secondary option was for Vitals Jersey to keep the shares altogether but owe VGH up to €2.2m (the amount paid in relation to Mtrace)

Either way, Mtrace would continue to earn money (and pay dividends) on the deal with VGH with a markup of up to 25%.

On 13 August, 2018, the same offshore company in Jersey quietly transferred its shares in Mtrace to Steward.

As the concessionaire for three of Malta’s public hospitals – St Luke’s, Karin Grech and Gozo hospitals – VGH received millions annually from taxpayers.

Overheads, such as staff salaries, were also covered by taxpayers as part of the concession agreement. Yet VGH left a trail of debt reported to be some €55 million and without having met a single commitment.

In August 2018, Steward took over ownership of Mtrace plc from the Jersey company

Vitals’ owners were, as previously revealed by The Shift News, using Maltese taxpayer money paid to them for beds and medical care to turn VGH into an international platform pitching the same concession concept to other governments, particularly in countries with weak enforcement of anti-corruption or less than transparent tendering processes.

They were also using taxpayers’ money to buy off companies that would secure a steady stream of income for years.

With both Technoline and Mtrace, Vitals’ owners tried to maximise income by buying suppliers and awarding them exclusive distributorship rights, in turn running the risk of distorting the local medical supplies market and potentially that in other countries.

The Technoline deal had caused an uproar among local suppliers who were forced to bid to a competitor or risk failing in the local market. VGH forced competitors to reveal their mark ups, while securing their main channel of supply.

The Shift News’ revelation earlier this week that the funding came from VGH turned that uproar into sheer rage among some other medical suppliers. The new revelations on Mtrace open a new chapter.