Key findings:

-

VGH’s secret owners funded the €5 million take over of Technoline through Jersey companies. It is unclear whether that money was, in turn, funded from taxpayers’ money – payments under the concession.

-

They used a front: the former sales and marketing manager of the company, Ivan Vassallo, through his company Gateway Solutions Ltd.

-

Then, only months later, they gave themselves exclusivity of supply, forcing all purchases of medical equipment through them and forcing competitors to show their hand.

-

The Share Purchase Agreement being revealed for the first time by The Shift News shows it was a done deal months before it was announced.

The controversial takeover of Technoline last year by one of its managers who put up €5 million to buy out his bosses only months before the company was granted a lucrative deal on Malta’s public hospitals, was funded by the hidden owners of Vitals Global Healthcare (VGH) through their Jersey companies, The Shift News can reveal.

The agreement signed between Steward Healthcare and VGH, which The Shift News is making public for the first time, shows that the hidden owners of the concession funded the takeover of Technoline through companies in Jersey, buying it out through the company of former sales and marketing manager Ivan Vassallo.

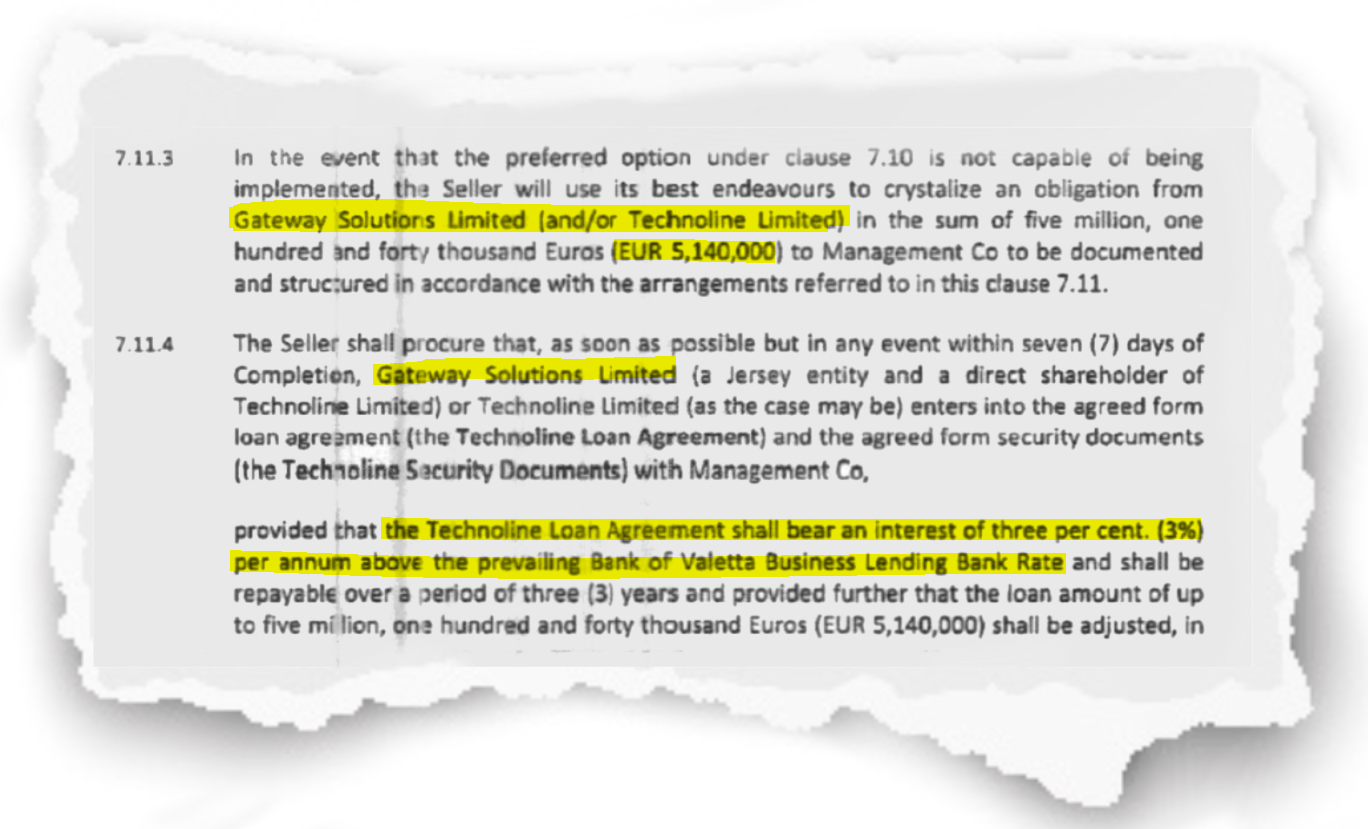

The source of the funding for Vassallo’s company Gateway Solutions Ltd was a €5.14 million loan from the previously hidden owners of VGH granted in December 2016.

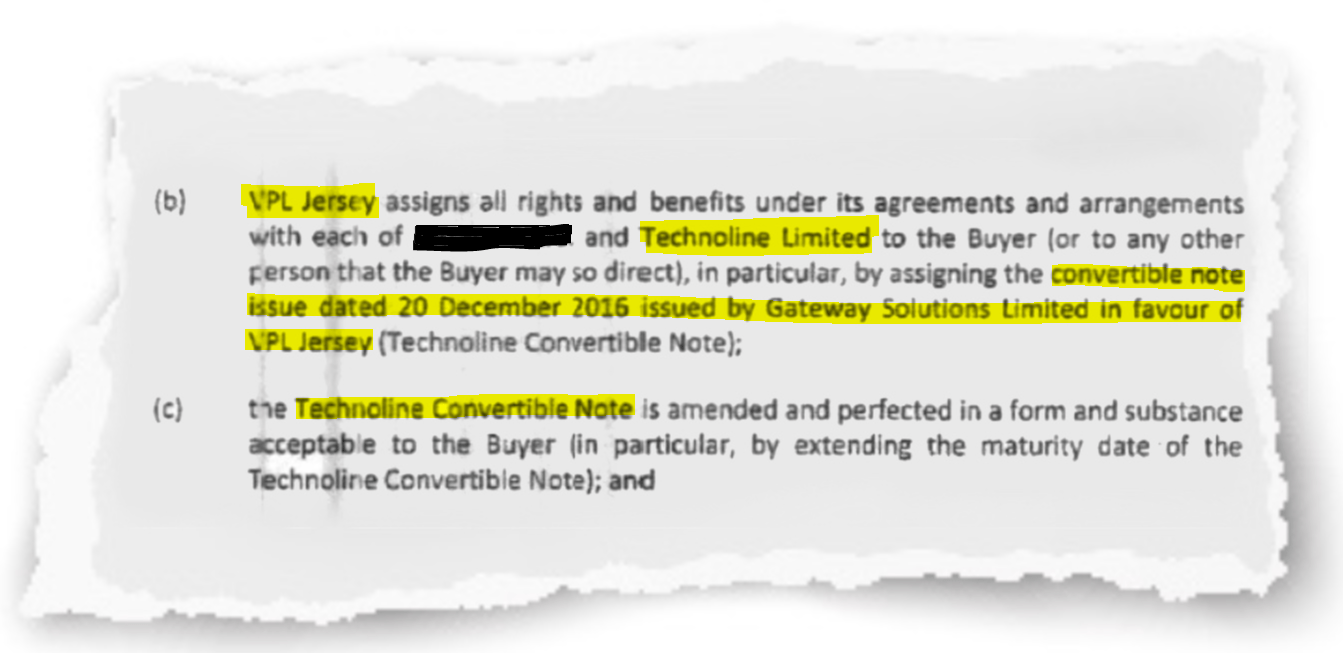

Excerpt from the Share Purchase Agreement referring to the Gateway Convertible Loan Note funded by Vitals Jersey

In the agreement signed between Steward and VGH, the loan referred to is described as a convertible note, meaning it could be converted into shares of Gateway Solutions. Effectively, this would grant the previously hidden owners the option to convert the loan into shares and take over Technoline.

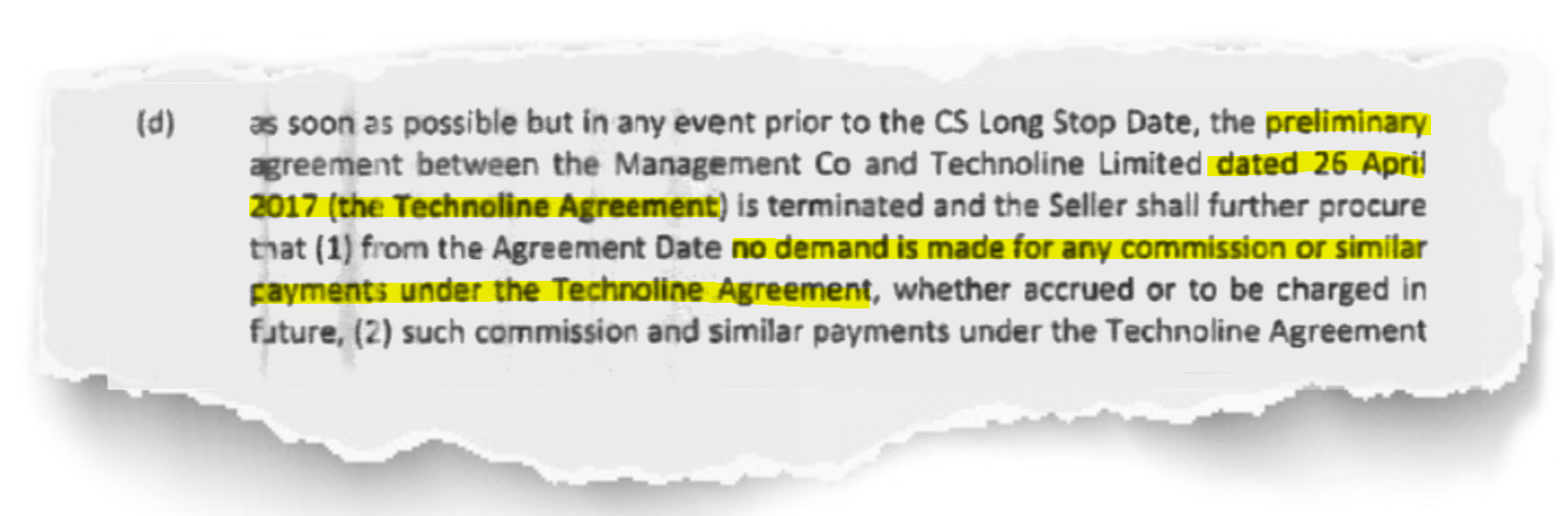

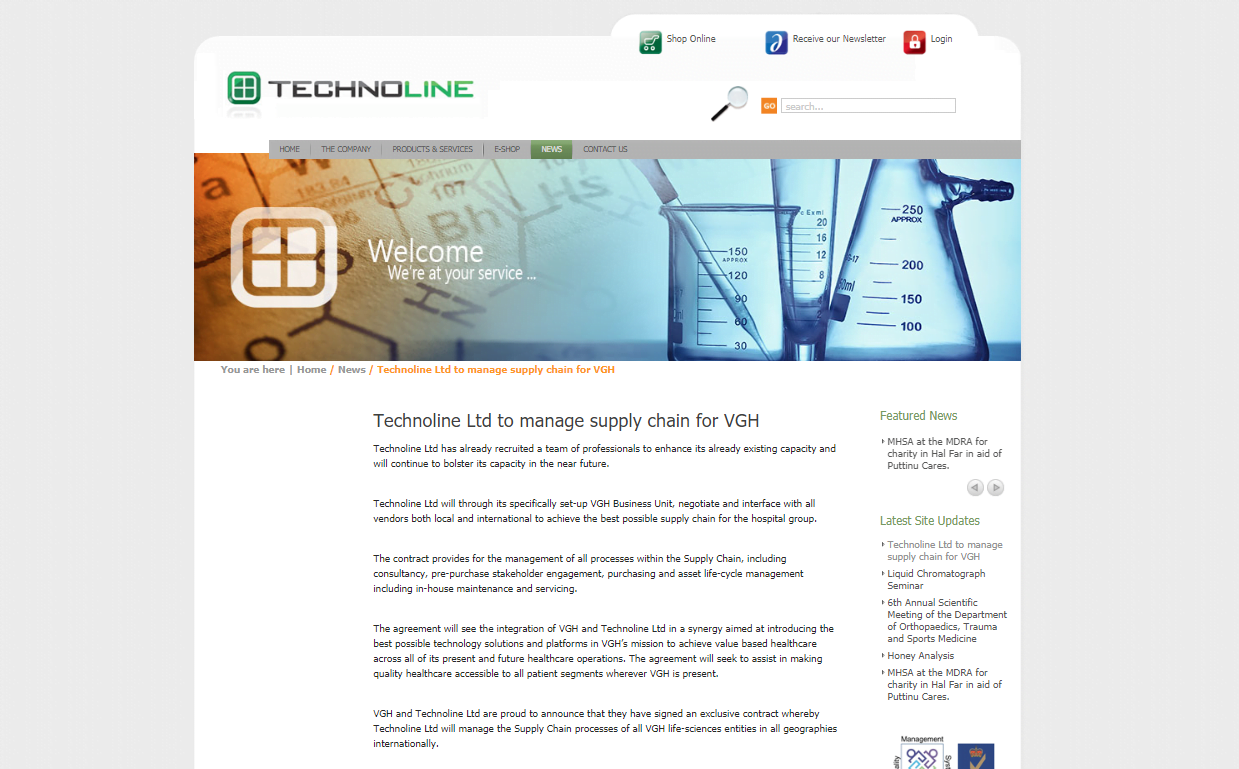

Some three months after Vassallo took control of Technoline, VGH entrusted this company with the procurement of all of its medical supplies. The agreement shows it was a done deal months before it was announced including a reference to a preliminary agreement signed just 19 days after the takeover.

Excerpt from the Steward VGH SPA indicating the €5.14m loaned by Vitals Jersey

What this means is that when VGH granted Technoline exclusivity of supply, the hidden owners behind VGH were in fact awarding the lucrative deal to themselves guaranteeing a steady stream of revenue, potentially even after they were out of the picture.

VGH was granted a 30-year concession, that can be extended to 99 years if the owners choose to, to manage three public hospitals – St Luke’s, Karin Grech and the Gozo hospitals. For this, they received over €50 million from taxpayers in a year. They left without fulfilling their obligations, leaving around €55 million debt.

The Shift News revealed earlier how VGH transferred its shares, and with it the lucrative concession, to Steward Healthcare for only €1. Yet millions exchanged hands in the background, lining the pockets of the hidden owners of VGH, including a company in Dubai – Mount Everest General Trading LLC – received €1.4 million.

Excerpt from the Share Purchase Agreement referring to a Technoline Preliminary Agreement dated 26 April 2017

The companies they had set up in Jersey as they prepared to pack their bags in Malta had pitched and negotiated a number of international agreements with other governments similar to the deal signed in Malta. VGH was pitching to other governments even as it sought, and got, a bailout in Malta.

Through these Jersey companies, the hidden owners of VGH were also signing a number of secret agreements with VGH entities as well as suppliers that would ensure they remained very much in the picture of operations in Malta even without the responsibility of running the country’s public hospitals.

When the sales and marketing manager of Technoline managed to raise an estimated €5 million within a few months to buy out the company’s owners in early 2017, eyebrows were raised.

How Vitals Procurement (Jersey) funded Technoline’s buyout (click on nodes for more information, opens full screen when clicking black box, right hand corner):

Ivan Vassallo refused to answer questions on what he called “a private deal,” saying it was “nobody’s business” how he had managed to raise the capital to buy out all the other Technoline owners by early 2017.

Vassallo had also deflected questions as to why a relative of Shaukat Ali Abdul Ghafoor (a hidden beneficial owner), Yaser Ali Bader, was appointed as a director of Technoline later in 2017.

The exclusive global distributorship given to Technoline had caused an uproar, as it meant suppliers were forced to reveal their prices and mark ups to a competitor, and to sell to them in order to supply this significant part of Malta’s national health service. Many called it a blatant conflict of interest and others noted the cost of medical supplies ballooned as a result, impacting taxpayers again.

It was also reported that Technoline was engaged to purchase replacements for equipment at the hospitals that had only just been bought, implying major wastage of public funds. Staff at the hospitals who spoke to The Shift News confirmed spiralling costs.

When Steward took over the contract from VGH last year, it promised a review of all contracts and obligations entered into by its predecessor, including the Technoline agreement, but nothing was announced.

Technoline announces its “synergy” with VGH, seven months after Vassallo’s Gateway borrowed €5.14m from Vitals Jersey funding the buyout.

The public hospitals’ concession, negotiated by Minister Konrad Mizzi when he was Health Minister, was controversial from the start as VGH was fronted by an unknown who faced past accusations of fraud, Sri Ram Tumuluri.

The agreement signed between Steward and VGH last year which was hidden from public view thanks to the government protecting this as a “private” deal while millions are being forked out by taxpayers annually, makes it clear that the government was intentionally misleading the public on the real beneficial owners of VGH. It also shows Tumuluri, and others who stayed below the radar, got paid off for the deal.

Read more in The Big Sell Out series:

Steward bought Vitals for €1, but millions changed hands

Dubai company funded Vitals, gets over €1 million payoff