Key findings:

-

When Vitals Global Healthcare (VGH) turned up in Malta, there was nothing ‘global’ to its name. Its hidden owners used payments by Maltese taxpayers to build a network of companies that would bid for similar projects in other countries – putting the ‘global’ in ‘Vitals Global Healthcare’.

-

Rather than focusing on delivering on the concession over three public hospitals in Malta, the priorities of VGH’s once-secret owners were to milk the concession and expand to other countries at Maltese taxpayers’ expense.

-

They were using the fact that they got a concession in Malta as a selling point to other governments. They were signing agreements in other countries even as they were negotiating a bail out in Malta.

-

They also focused on expanding into other areas, by funding the €5.14 million take over of medical supplier Technoline, and giving themselves exclusivity of supply. It was not the only deal of its kind.

-

They gave away the concession for three public hospitals for only €1, while fleecing commissions for themselves even when it was doomed to fail.

The secret owners of Vitals Global Healthcare (VGH) were both receiving commissions as well as structuring key supplier agreements and using payments by the Maltese government to fund ‘an international network of Vitals’, The Shift News can reveal.

When VGH turned up in Malta, there was nothing ‘global’ to its name. Now we know they used payments by the Maltese government – they received over €50 million in taxpayers’ money – to prepare and build a network of companies that would bid for similar projects using the contract in Malta as a selling point in other countries. They were literally putting the ‘global’ in ‘Vitals Global Healthcare’.

The previously closely guarded Share Purchase Agreement that The Shift News is revealing in a series of articles reveals that while the ownership of VGH in Malta remained unchanged on paper, a material change of control happened back in April, 2017.

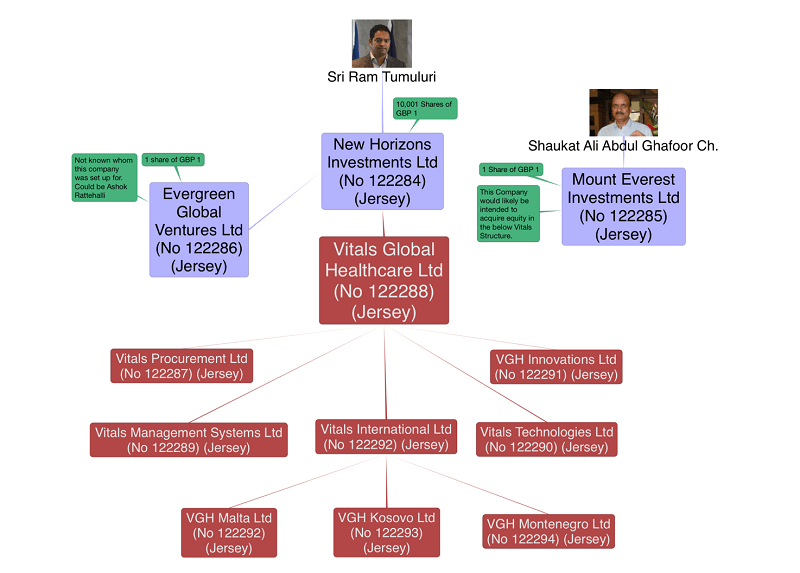

The Shift News had previously reported how on 13 October, 2016, 12 companies were quietly registered in Jersey, each with successive registration numbers and familiar names such as Vitals Global Healthcare Ltd and VGH Malta Ltd and interesting names such as VGH Montenegro Ltd and VGH Kosovo Ltd.

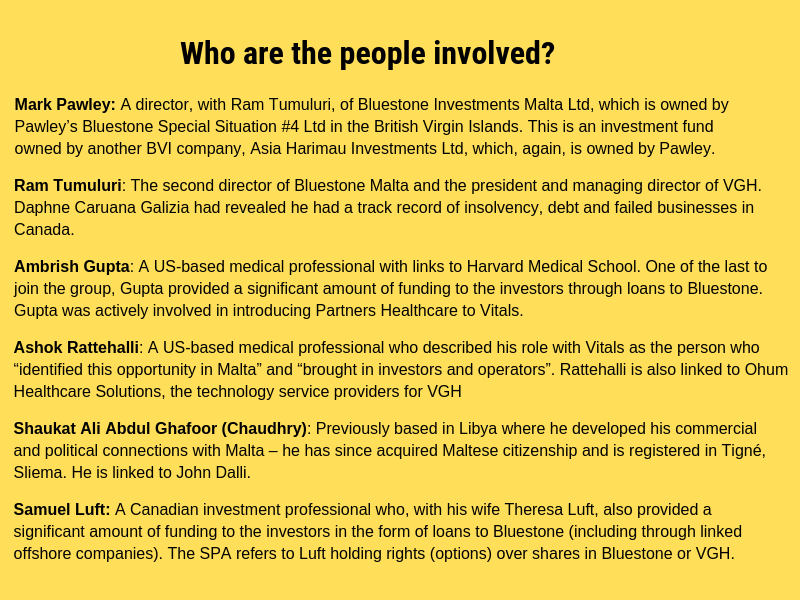

It was also shown how these companies were linked, through yet other Jersey companies, to former VGH frontman Ram Tumuluri and Shaukat Ali Abdul Ghafoor, a Pakistani businessman.

The VGH Jersey companies.

The Shift News has revealed how Steward Healthcare paid the total sum of only €1 for all the shares in VGH and the concession over three public hospitals – St Luke’s Hospital, Karin Grech Hospital and Gozo Hospital.

Yet the terms of sale in the agreement they signed include other repayments, settlement agreements and termination contracts which would ensure that others benefit from the sale.

A company in Dubai got €1.4 million, and a previously unknown investor – Samuel Luft – got €1.85 million.

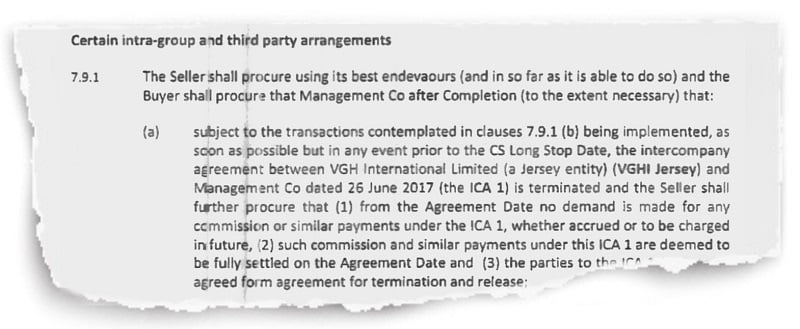

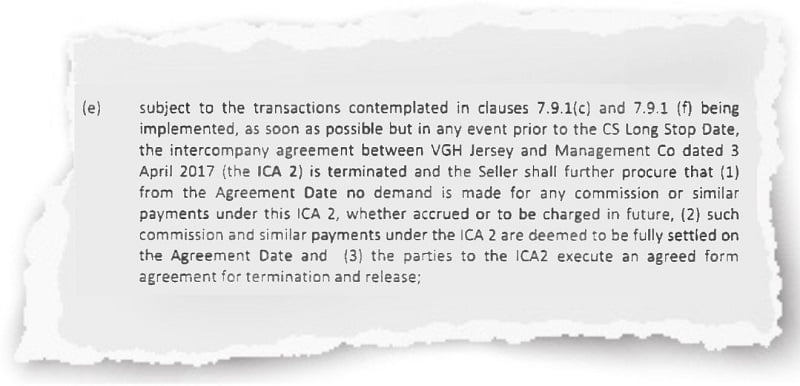

The agreement also reveals that Ram Tumuluri and Mark Edward Pawley, along with their partners including Shaukat Ali Abdul Ghafoor, signed a series of intercompany agreements between the Maltese companies and the hidden Jersey companies.

Each intercompany agreement considered the payment of commissions and other fees from the Maltese concessionaire to these Jersey companies, effectively siphoning off income.

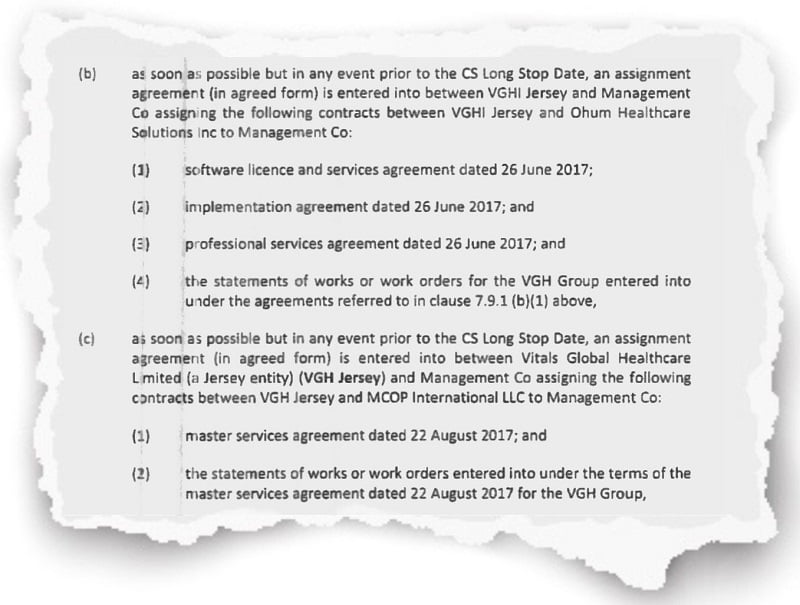

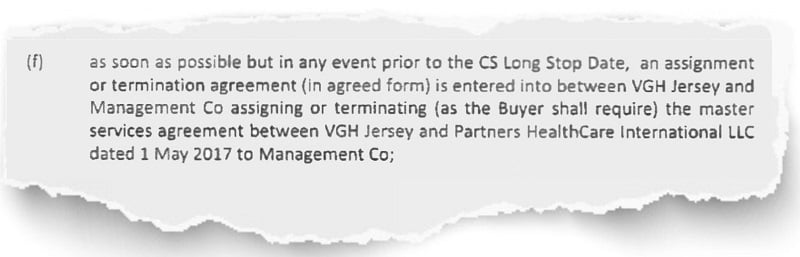

As a result of the inter-company agreements signed, the Maltese ‘management company’ effectively transferred various of its management functions to Jersey. These included shifting procurement and key contracts with suppliers to the Jersey companies.

The share purchase agreement with Steward needed to terminate the web of inter-company agreements between Jersey and Malta.

The inter-company agreements between Jersey and Malta contemplated the payment of commissions and fees from Malta to Jersey.

Practically simultaneously, the Jersey companies and VGH proceeded to repaper each Vitals key supplier agreement so that Jersey became the client of each key supplier.

In turn, through the inter-company agreements, Jersey would make these suppliers available to Malta, but Jersey could take a cut or commission – VGH Malta became a client of VGH Jersey.

Transferring key supplier contracts to Jersey is likely to have served another purpose, financial practitioners told The Shift News. In this way, suppliers could also be made available to concessions in other countries though intra-group agreements, such as those signed with VGH in Malta.

The Jersey companies held the key contracts including with Ohum (IT supplier) and MCOP (prosthetics).

Even the contract with Partners Healthcare was repapered to include Jersey.

The companies set up in Jersey had negotiated a number of international agreements with other governments similar to the deal signed in Malta, The Shift News has shown. VGH was pitching to other governments even as it sought, and got, a bailout in Malta.

In short, the previously secret owners of VGH were using the fact that they got a concession in Malta as a selling point to other governments. Worse, they were quietly using Maltese taxpayer funds to create a ‘platform’ to expand internationally.

Although they received over €50 million from the Maltese government, they left a reported €55 million in debt.

It is not known whether other concessions were in fact awarded to Vitals Jersey before the Malta concession imploded and needed to be bailed out. What is clear is that rather than delivering on the Maltese concession their priorities were on milking the concession and expanding to other countries at Maltese taxpayers’ expense.

The previously secret owners of VGH were also intent on expanding into other areas. The Shift News has already shown how these Jersey companies granted a €5.14 million loan to Ivan Vassallo’s company to buy out all shareholders of Technoline Ltd – a medical supplier.

A few months after the company was bought, VGH proceeded to award Technoline a lucrative and exclusive contract as “global” distributor.

What this means is that when VGH granted Technoline exclusivity of supply, the hidden owners behind VGH were in fact awarding the lucrative deal to themselves guaranteeing a steady stream of revenue, potentially even after they were out of the picture.

And this was not the only deal of this nature. There is another Maltese company that was bought out by Vitals Jersey, that has so far remained below radar. More in our next story…