Citco, an international hedge fund administrator which oversees around $1.5 trillion in assets worldwide, has surrendered its Recognition Certificate to the Malta Financial Services Authority (MFSA) earlier in September, one of 21 companies that have partially or fully suspended operations since the beginning of last month.

This brings the count of financial services firms withdrawing operations in Malta to around three a week since the Malta jurisdiction was greylisted by the FATF in June.

The Recognition Certificate which Citco withdrew is a licence to operate for fund administrators, otherwise known as firms that administer hedge funds. Citco’s local fund administration arm, Citco Fund Services (Malta) Ltd was set up in 2012 but failed to attract any clients in the country, informed sources have told The Shift.

On 4 September, The Shift published revealed that 24 companies had fully or partially surrendered their licences – either suspending their local operations altogether or withdrawing specific investment funds – since the FATF greylisting.

Since then, 21 other financial companies have followed suit, making a total of 45 since end-June, nine of which surrendered documents necessary for their operations while a total of 11 companies suspended 12 sub-fund operations on the island.

Besides Citco, which operates more than 50 offices across the world, seven other overseas-based firms scaled-down or withdrew their operations completely, including UK-based capital management firm Haven Cove and international firm Custom House Global Fund Services Ltd, a subsidiary of Apex Group, a multi-billion dollar enterprise.

While Citco and Custom House seem intent on scrapping localised fund administration operations, Haven Cove suspended one of its sub-funds. Octet Europe Ltd, a previously operational, local subsidiary branch of the Octet Group, a logistics supply chain services provider, also handed in its licence to operate as a financial institution.

As for locally-based firms, 13 different companies have scaled down their operations through the handing in of licences related to the services they offered. 10 local sub-funds bit the dust since 4 September, along with four companies that handed in their licences to operate.

In particular, three companies whose interests were inextricably linked with the ‘Blockchain Island’ experiment, DWP VFA Agent Ltd, Blockchain Technology Value Fund and DF Consultancy Services Ltd, all folded their business interests, with Finance Minister Clyde Caruana pointing fingers at the industry promoted by disgraced former Prime Minister Joseph Muscat as one of the reasons for Malta’s greylisting.

DWP and DF Consultancy both surrendered their Virtual Financial Asset (VFA) Agent Registration licences, while Blockchain Technology Value Fund surrendered its collective investment scheme licence altogether.

While in the past week, the government has issued an onslaught of PR outlining its expenditure plans for the upcoming year, along with reassurances that the government will manage to cut down spiralling costs, it’s still difficult to gauge just how hard Malta’s economy is going to be hit by the effects of greylisting.

A recent survey carried out by Ernst & Young detailing Malta’s attractiveness for foreign investment indicates that out of 110 foreign companies which answered the questionnaire, just 37% view Malta as an attractive jurisdiction – a deep plummet to almost half of the 62% recorded last year.

Despite the reputational issues dogging Malta and its financial services authority, the composition of the board of governors of the MFSA remains the same, including Chairman John Mamo and board member Edwina Licari, both of whom oversaw scandalous hand-outs during former CEO Joseph Cuschieri’s time.

It also still includes former Economy Minister Edward Scicluna, who was appointed governor of Malta’s Central Bank last year, despite his track record as the finance minister who signed off on the controversial Vitals hospitals deal, among others.

A month ago, The Shift also reported that the MFSA has secretly made at least five settlements with finance companies or individuals who were found to be breaching compliance rules, meaning that these five entities were spared the reputational damage which generally acts as a deterrent for anyone caught out breaching such rules. No details of the nature of these settlements have been disclosed.

The short lived lie from the government that there is no impact on the economy for grey listing.

With all those millions of Euro spent on advisers and experts, the prime minister Robert Abela got it wrong on the grey listing.

When will the penny drop that the world is not full of Gahans as the Government seems to believe it is?

The evidence of the effects of the FATF grey listing is there for all to see, except seemingly to the Finance Minister who has just announced a budget which flies in the face of reason.

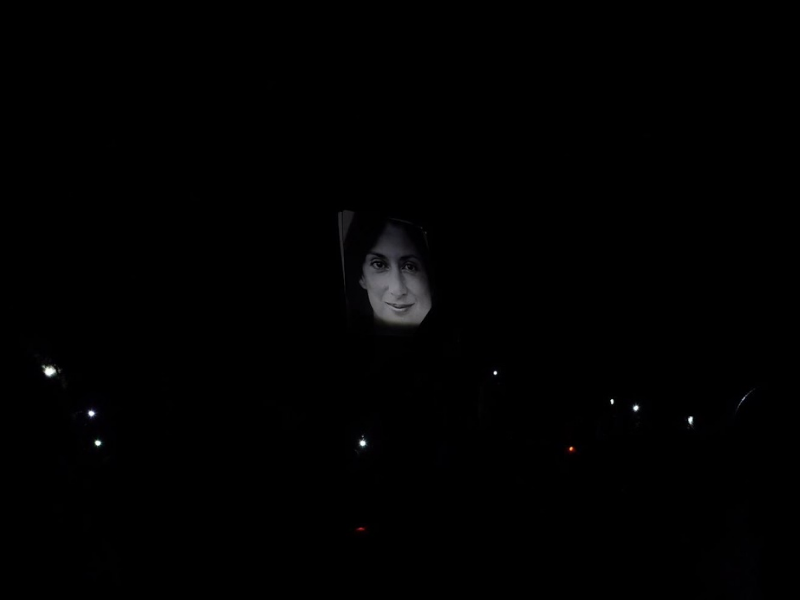

But that’s about par for the course… ignore any evidence which the FATF, the Moneyval and Venice Commissions, the Daphne Caruana Galizia Inquiry Board see because it doesn’t suit.

The MFSA Executive Committee still includes Christopher Buttigieg who came up with the flawed idea of Blockchain island. It also includes disgraced Edwina Licari who acted as consultant to Yorgen Fenech in her free time, following the Las Vegas trip.

What is the new CEO of MFSA waiting for to kick them out?

His contract of employment probably contained clauses that he had to follow the Government’s overriding mantra of “ continuity “??

He’s only a puppet – waiting for orders from the den of thieves in castille.

SHAME ON THIS MAFIA LAND WHICH IS ALLOWING ALL THIS TO HAPPEN.