When one of the investors in Vitals went to court to try to stop the transfer of the Malta hospitals concession to Steward Healthcare, the documents submitted shed new light on how commissions are hidden in complex company structures behind shady deals.

READ MORE:

Vitals investor tried to stop sale of Malta hospitals concession to Steward Healthcare

Names of hidden investors in Vitals Global Healthcare revealed

On 19 December, Ashok Rattehalli filed a warrant of prohibitory injunction “to defend his rights” under the agreement he had signed with other investors four months before the government issued a request for proposals on the hospital concession in Malta, as revealed by The Shift News.

When Rattehalli tried to stop the new deal with Steward Healthcare, he lifted the lid on a mystery surrounding the shady deal in which an unknown company with no experience in healthcare management got to operate the Gozo, St Luke’s and Karen Grech hospitals for up to 99 years while handsomely funded by taxpayers.

The documents shed light on how commissions are negotiated for people who never appear on public records and how deals are hidden behind secret agreements and complex company structures. Understanding these structures is not for the faint hearted. The complex set up is there by design. It is there to avoid detection and deter any real scrutiny.

The information would never have been discovered. It only came to light because Rattehalli felt he had been stabbed in the back by Ram Tumuluri. Rattehalli had been promised things, but he got nothing. Then, when he heard about plans by VGH to sell the hospitals concession to Steward Healthcare, he hit back and tried to stop the new deal because he believed he would never be able to recover what was owed to him if the sale now went ahead.

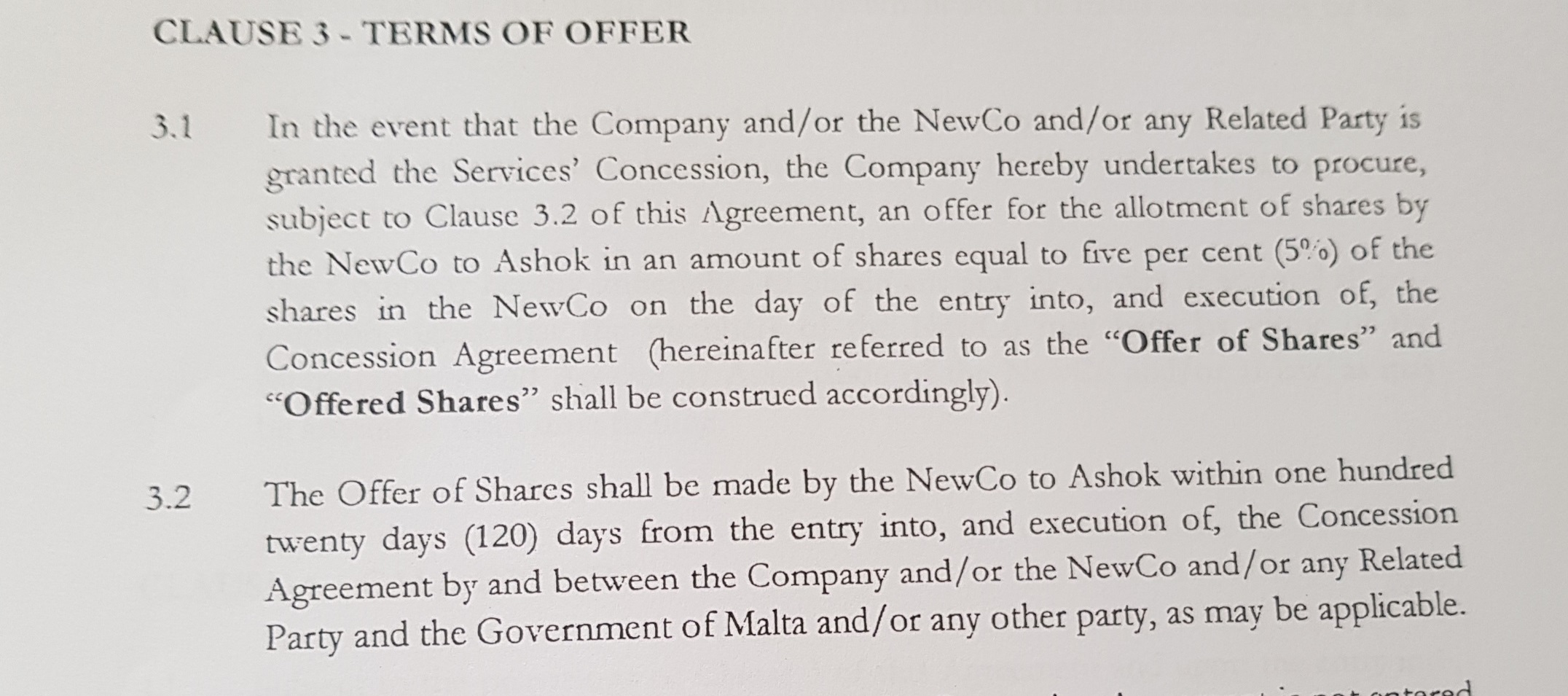

Rattehalli was promised a seat on the Medical Board as well as in the Operating Management Team. On top of that, he was promised 5% of the shares in Vitals Global Healthcare (VGH) that would kick in once the agreement with the government was signed. The Shift has already shown how this was a done deal – investors knew exactly what the government would be giving them.

Yet Rattehalli’s agreement with investors sheds new light on how secret commissions can be handled in such a way as to never appear on public records. He was granted hidden backdated options over the shares in VGH. Rattehalli was given the right (that would kick in soon after the bid was awarded) to acquire 5% of VGH for the starting value of the shares (known as nominal value) which is €60.

The Agreement grants Bluestone Malta – the company that controls VGH – the right to buy Rattehalli’s 5% shares back, but this time for the “market price”.

After VGH ‘won’ the bid which includes guaranteed multi-million cash flows for up to 99 years, transfer of the hospitals and their assets, 5% of such venture would be worth much more than €60.

“A neat (and secret) way of giving someone 5% without him ever appearing on the public records,” a corporate lawyer told The Shift.

It is not known whether the other original investors have similar hidden option agreements in place or have interests represented through other means.

Four months before the government had issued the Request for Proposals for the Malta hospitals concession, the investors who eventually won the bid had already signed an agreement among themselves with very specific details related to the concession, The Shift has revealed.

In November 2014, a Memorandum of Understanding (MoU) was signed between “on the one hand Dr Ambrish Gupta and on the other hand Dr Ashok Rattehalli in respect of AGMC Inc (a US company owned by Rattehalli), Sri Ram Tumuluri in respect of Portpool Investments Limited (a BVI company) and Mark Pawley in respect of Bluestone Special Situation #4 Limited (the BVI company that purportedly won the bid),” according to court documents.

This was a month after the government had already signed a secret deal with the investors, that the public was unaware of because the request for proposals for the bid was only issued in March 2015.

The investors in Vitals Global Healthcare were not known up to now. The investors revealed so far, which documents show were evidently short of capital, owned 70% of the project. The question of who owned the other 30% and whether this is the going rate of commissions for enablers in the project is yet to be determined.

Lastly, given that Rattehalli’s original 17.5% share (25% of 70%) got diluted to 5%, once the investors found some external capital, begs another question: who else joined the party?