The argument made by DF Corporate Advisory Ltd in a judicial protest filed this week, that the company had not yet been set up during the Vitals concession, does not appear to hold water in terms of money laundering, lawyers consulted by The Shift said.

The protest was filed as the company was among those facing charges of money laundering, among other accusations, in the wake of the magisterial inquiry on the privatisation of three of Malta’s public hospitals.

The Times of Malta reported this week that ‘A company accused of money laundering in connection with the Vitals hospitals concession said it had not even been set up when it was alleged to have committed crimes’. It was based on a judicial protest filed by the owners of DF Advocates.

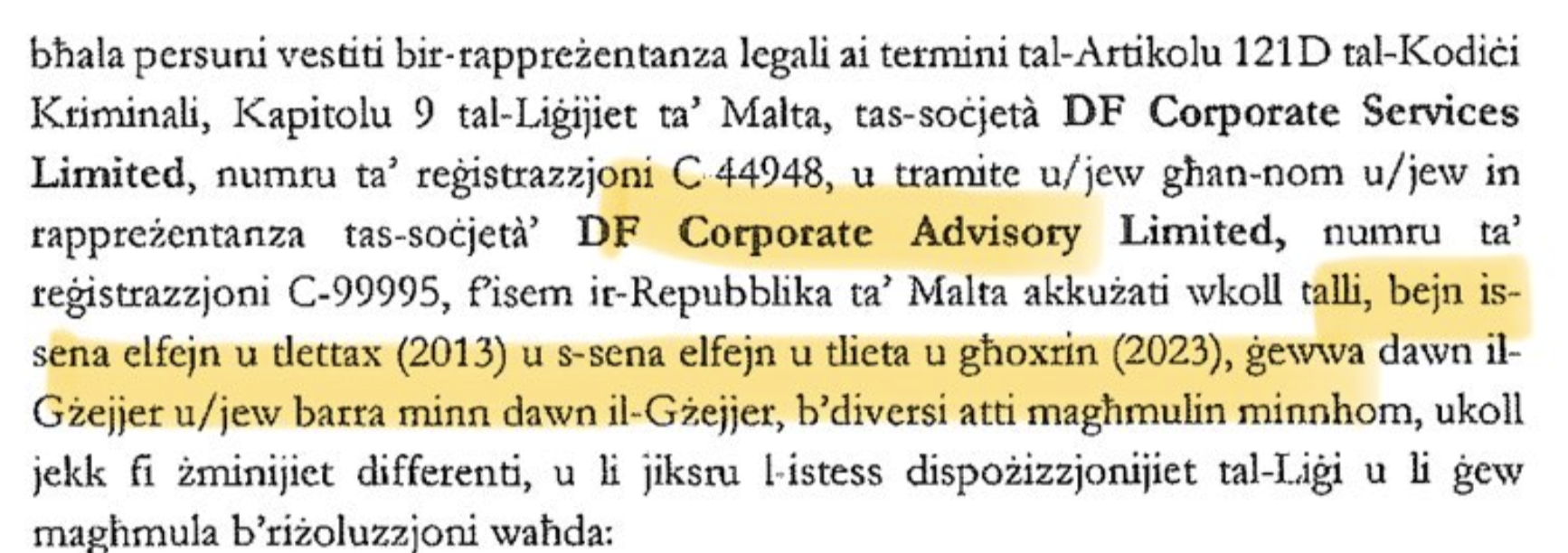

Prosecutors from the Attorney General’s office and the police accused the company of having committed the crimes “between 2013 and 2023”.

DF Corporate Advisory Ltd was set up in 2021. It acquired a corporate service provider licence on 1 June 2023.

Yet in the judicial protest, the owners are arguing the company only opened a bank account in December 2023 and started operating on 1 January 2024, which just happens to pass that deadline.

While the company seems to be playing around with dates, a financial expert said it did not matter: “Money laundering doesn’t necessarily involve handling of money; even helping with drafting documents or establishing structures to disguise provenance of cash or ownership (a process known as layering) can involve money laundering. Whether the company was set up during the Vitals concession is neither here nor there.”

“The company could have been laundering the proceeds of crime within that period. It is too early to say since the inquiry has not been published. But the company’s statement seems to be a PR tactic to discredit the inquiry.”

DF Corporate Advisory Ltd is a sister company of DF Advocates, owned by Jean Carl Farrugia and Kevin Deguara. The lawyers provided counsel to Vitals Global Healthcare and Technoline – with those involved also facing charges related to deals struck.

The firm’s founding partners are being charged not only as representatives of their firm. Farrugia and Deguara, as individuals, also face money laundering charges and charges of having actively participated in criminal activity and criminal association.

While the details are unclear since the Attorney General has so far refused to publish the inquiry, Farrugia and Deguara have repeatedly drawn journalists’ attention over the years through their involvement in major controversial deals negotiated by the government.

Two other DF Advocates employees, Chief Financial Officer Kenneth Deguara and lawyer Bradley Gatt, are also facing charges.

“The reason why money laundering involves the layering of companies is because it is intended to hide the illegal proceeds. One company feeds another and then another and another until you lose track of the ultimate beneficial owners,” another lawyer told The Shift.

He added that the magistrate engaged international experts. “The expense meant there was a lot of material and a number of experts. There are 78 boxes of evidence.”