The Shift has confirmed that the documentation showing the department’s valuation of the two-tumolo ODZ property purchased by Prime Minister Robert Abela does not exist.

Pressed through a Freedom of Information (FOI) request by The Shift to provide the documents proving the evaluation was made, as typically happens with properties of such size, Inland Revenue Commissioner Joe Caruana could not provide any.

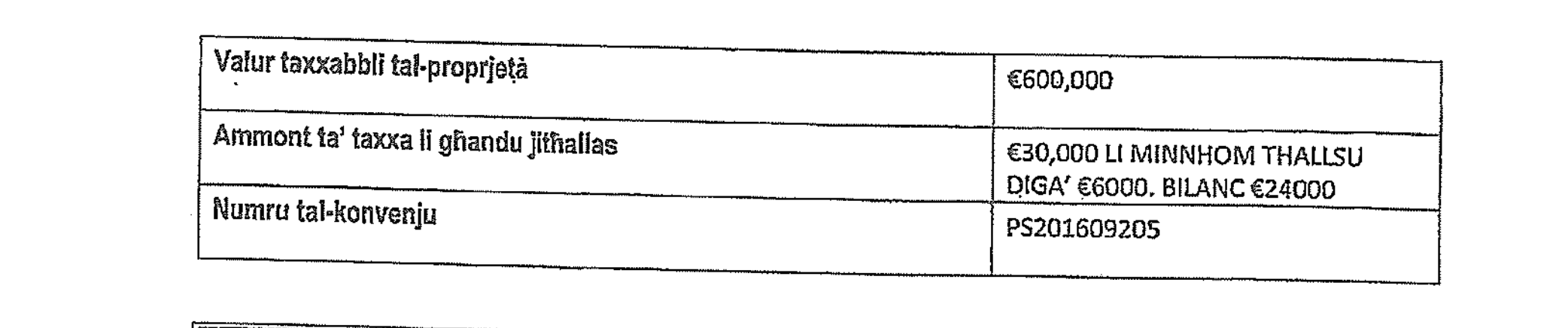

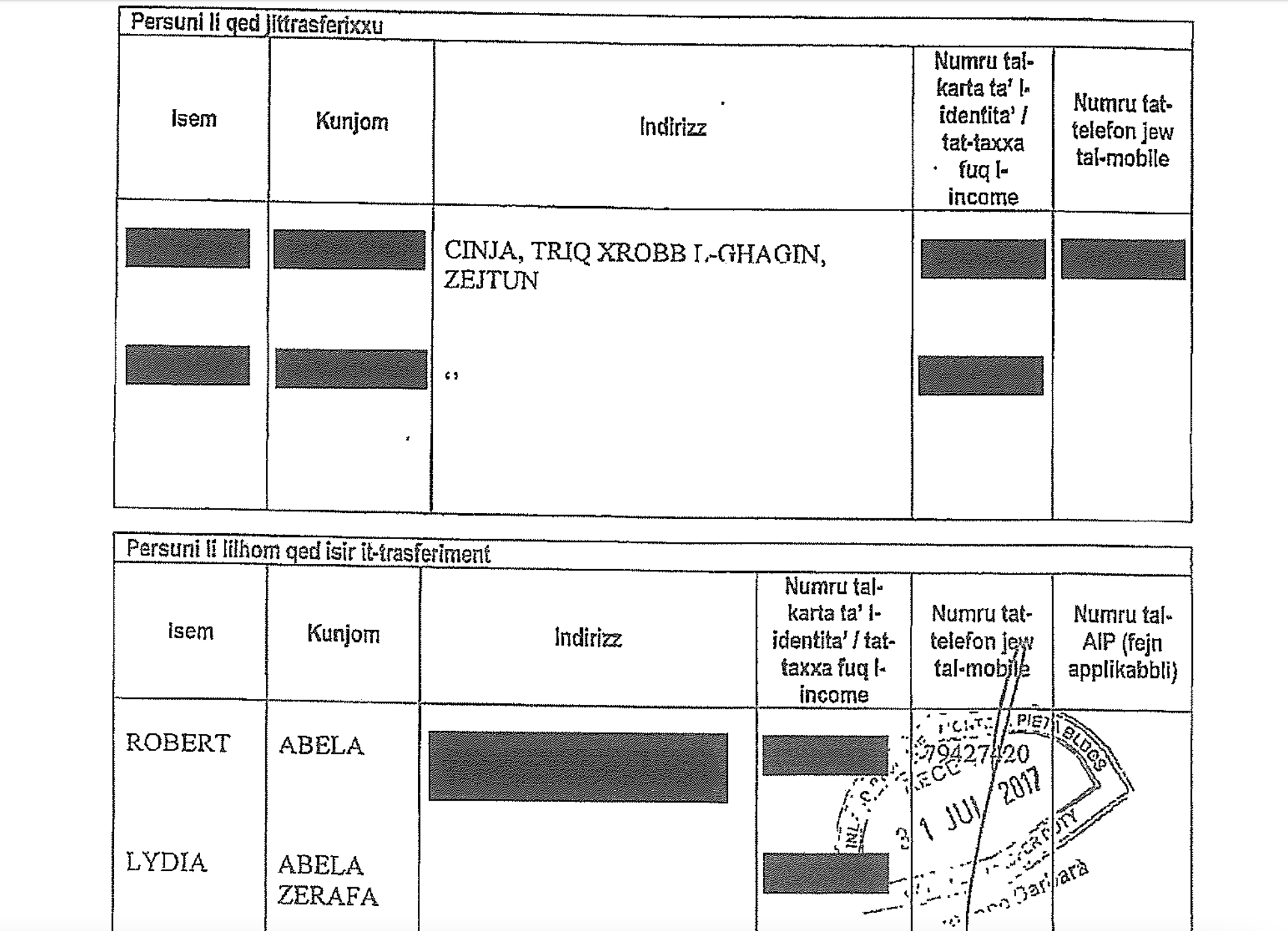

The tax department’s lack of assessment is of concern due to suspicions that when the prime minister and his wife, Lydia Abela, purchased the property, they declared its value to be €600,000 – the price of a penthouse, if that.

As a result of the FOI request, The Shift acquired the declaration submitted to the tax department by the Abelas, which is being published in full.

An extract of the tax declaration submitted by Robert and Lydia Abela.

It shows they paid only €30,000 in tax. No agent fees were paid because the Abelas purchased the property directly from the owners.

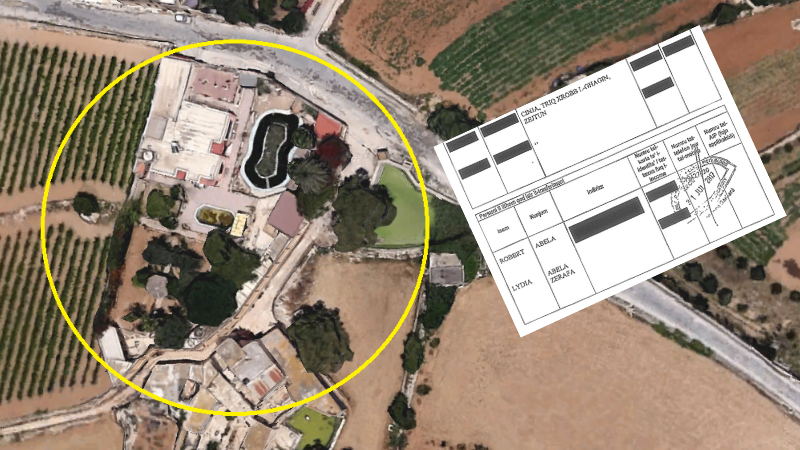

The sprawling fully-detached 2,270 square metre property includes endless gardens, a pool, and a large property built in an Outside Development Zone.

Such properties are no longer easy to acquire in Malta. In 2017 its value was estimated at €2 million.

Tax Commissioner Joe Caruana would not explain why the department did not follow procedure and send one of its architects to assess whether the Abelas had under-declared the value of their property to evade tax.

The tax money the Abelas failed to pay on the property purchase could reach €70,000, apart from penalties on an estimated €2 million value of the property in 2017 by professionals.

The property Prime Minister Robert Abela and his wife acquired for €600,000.

The Commissioner failed to give any reassurances that the department had done its work according to law. “The requested documentation is not available,” Caruana replied.

When The Shift asked for the board meeting minutes to determine why and who decided that no architect should be sent to assess the prime minister’s acquisition, the Tax Commissioner said, “such board does not exist and did not exist in 2017”.

According to the Duty of Documents and Transfers Act as well as internal procedures published on the Inland Revenue Department’s website, stamp duty declarations are reviewed by “an internal departmental board which decides whether an architect is sent to inspect the property in order to establish the market value of the property”.

An Inland Revenue architect who assesses property value told The Shift the prime minister’s case was “very strange”.

“With properties of a certain size and value, like the one acquired by Abela, a valuation is usually automatic, irrespective of what the owners declare. Such a large property declared at such a low price is usually a red flag,” the architect said.

Part of the gardens in the property acquired by the prime minister and his wife.

The red flags ignored

The Zejtun property, ‘Cinja’, in Triq Xrobb l-Għaġin, acquired by the Abelas, was built in the 1980s in breach of planning laws.

The owners had a permit for a built area of some 190 square metres, but they extended it to 350 square metres and added other structures without a permit.

The lack of permits meant it was difficult for the owners, Joseph and Alfrida Camilleri, who now reside in Marsaskala, to sell the property.

Yet while Robert Abela and his wife Lydia were working as legal consultants for the Planning Authority, raking in some €17,000 a month from an agreement granted to them under a previous PN administration, the couple signed a promise of sale agreement with the Camilleris.

An extract from the declaration submitted to the Inland Revenue Department by Prime Minister Robert Abela and his wife Lydia.

The agreement stated that the Abelas would only purchase the property if and when all illegalities were sanctioned.

Within a few months, the Planning Authority considered an application by the Camilleris to sanction all the illegalities. It gave the green light on 5 July 2017 against payment of a small fine.

Five days later, on 10 July 2017, a contract was signed between the Camilleris and the Abelas to transfer the property.

The Prime Minister has already submitted and acquired a development permit from the Planning Authority to flatten the building and build a new mansion over the two-tumoli ODZ land.

The prime minister still insists that his tax declaration was correct.

Meanwhile, Robert and Lydia Abela have just applied to develop a property in Xewkija, Gozo, into a seven-bedroom property with an indoor pool, spa, and wine cellar. The development would suit a boutique hotel, but the Abelas declared it would be a residential development in their application.

This is the “socialist” PM who justifies an oligarch capitalist economy using the argument that the filthy rich pay more tax to the government than normal people do. Oh, the irony, if not something worse.

But they had sent an architect to me and made me feel like I had cheated the system, for my less than 90sqm flat in Bkara which I bought for around €33 in 2004. He had fined me €2000 after my mum had given me €2,000 out of her €4,000 inheritance, to help me with the deposit needed to get a bank loan. Grazzi Tax Commission- I was in my twenties and every cent counted. Small bait I was for you, but you let the sharks free! Shame on you! Komplu kulu minn fuq iz-zghir!

Same happened to me and my wife who bought our 1st apartment in Paola around 2004, we paid Lm 22k for it and we were fined Lm 900 + the difference on government evaluation. Now the board does not exist anymore……

Yes, I meant Lm not €.

Not bad 33eur for an apartment

The joke of it all is that the PM included in presale agreement that the contract would be rescinded if the PA would not sanction the illegalities. Can anyone of a sane mind doubt that these illegalities would not be sanctioned?

Considering that purely agricultural land in an ODZ area is priced at one million euros and there is no way that this would be allowed for development, the valuation of 2 million euros is understated.

bob, is-socjalist kapitalist GIDDIEB u QARRIEQ. Go and hide liar.

Mafialand, what the Don wants the Don gets,don’t ask!

Dan hu l-istess wieħed li għajjar lil Bernard Grech “evażur tat-taxxa”? (Serial Tax Evader)

Kulhadd jithanzer.

GVERN Paxxut u POPLU Batut.

VIVA L LABOUR.

Pigging out. Everyone else does!

Journalistic excellence!

The Prime Boss has many, many questions to… omertà.

No wrongdoings from a true”socialist” PM.

Just goes to show that Abela is just a bigger crook than the rest of the MLP gang.

If Fenech Adami can build illegally on ODZ and get away with it, so can Abela. Different politician- same filth.

Instead of denying the accusations you just drag others into your cesspit

. A worn-out disk.

Wenzu, details please. Fenech Adami won a libel case when he was accused of this by Super One. On the same Tune , when will you heckle Ian Borg about HIS ODZ swimming pool which has been declared illegal by the Courts? Better still get a pick axe and start demolishing the pool. That is what the court ordered , so it is ok.

This is the same person who has demanded that employees within Government authorities and entities are made to tighten their belts (of course the top tier management levels are exempt). ISTHU, ISTHU!!!!!

VOTE FOR THEM ĠAĦAN MALTI U GĦAWDXI SO THAT THEY

BECOME MILLIONAIRES AT THE EXPENSE OF YOUR VOTE.

NEVER, NEVER, NEVER.

The law is clear. Tax should be paid on the value of the property, irrespective of how much one pays. Even if someone buys property much more cheaply than is usual or expected he has to pay on its value. There is a leniency of 10%. The legislator also included a mathematical formula for the difference in value that should be paid. Having said that, Abela’s deplorable and shocking case is not a civil matter it’s criminal.