As the government continues to pump hundreds of thousands of euros into a wall-to-wall propaganda exercise aimed at convincing the electorate that all is well with the country’s finances, the government’s ‘Certainty and Stability’ mantra the public is being inundated with is far from the reality of the situation, according to an analysis of public finances.

Official data published by the Nationals Statistics Office shows that Malta’s national debt is expected to surpass, for the first time ever, the €9 billion mark by the end of this year.

Making matters still more concerning is the fact that the finance ministry’s own estimates for 2023, according to Minister Clyde Caruana’s calculations published in last week’s budget, the government will be increasing the national deficit further still next year, which will, in turn, require more loans the racking up of the already record-breaking debt levels.

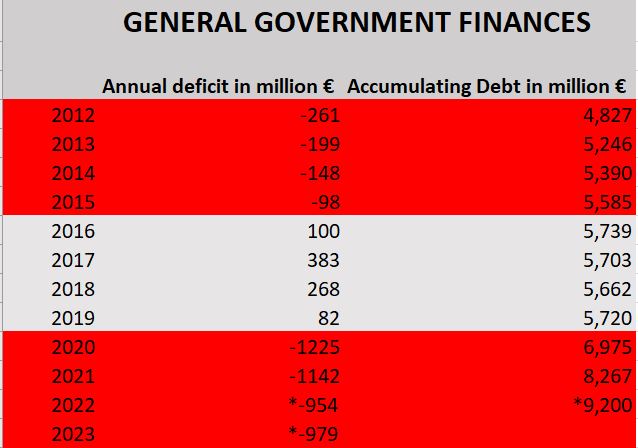

NSO figures for the last decade show how successive Labour administrations have almost doubled the nation’s debt since it took hold of the public purse strings.

While Malta’s at the end of 2012, the year before Labour was swept to power, had stood at €4.827 billion, by the end of last September that figure had risen to €8.516 billion.

The government’s own calculations estimate the country will register a new annual deficit of €954 million this year and that the national debt will have risen to €9.2 billion by December.

But instead of trying to get the situation under control, which will most definitely come back to haunt future generations, Caruana is expected to continue increasing the deficit in 2023 to €979 million. This will mean the government will, once again, have to rely on record levels of borrowing in order to keep the country’s public finances afloat.

An analysis of figures from over the last decade show how current Prime Minister Robert Abela is responsible for having increased the national debt the most.

While under disgraced prime minister Joseph Muscat the national debt had increased only slightly thanks to small surpluses registered between 2016 and 2019, Abela, on the other hand, has registered record-breaking annual deficits and will have increased the national debt by a staggering €3 billion by the end of this year.

This will mean that in 2023, just to finance the current debt levels, taxpayers will have to fork out €220 million in interest payments. This does not include an almost certain hike in interest rates, which will force the public to increase its contributions to make good on the country’s enormous loans.

While the government has blamed the pandemic and, more lately, the international fuel crisis for its growing fiscal deficits, there are several other areas where the finance ministry could have implemented significant savings and restricted expenditure.

These include the ever-growing cost of public sector employment – which has increased costs by some €200 million a year – with an additional 10,000 new employees having been added to the state payroll since 2013.

The government is also spending hundreds of millions of euros in handouts and indiscriminate subsidies to retain its popularity among the electorate, while rampant corruption and graft, in particular when it comes to awarding of contracts and direct orders, are costing taxpayers hundreds of millions of euros a year.

Debt/GDP is still below the EU criteria ie 60%.

There are 15 EU countries that saw this ratio increase above 60%. 7 of which has exceeded it by 100%. No need to punish and condemn Malta.

This is suicide. Nobody will try and save us. This is the doings of a democratically elected government. Hiding behind a deceiving reference called GDP 60%. The real Gross Domestic Product should not include taxes as this government does. A Product is something you can sell for cash. Non Productive Wages produce INFLATION. All Government employees wages should not be included in the GDP. Earnings from services , exports , tourism, anything that effectively creates wealth is the real GDP. Printing Money by employing people to dig holes and even more to fill them up again , does not create wealth. Effectively this government has “PRINTED” €10,000 billion on the back of whose savings, OURS. Is this why getting OUR SAVINGS OUT of the Bank is almost impossible?

The Maltese have steered the economic ship during the covid, during a full year in the grey list and now with a European war going on.

I have full faith in my country.

Playing with percentages doesn’t help much. The National debt is 9.2 billion Euro, and it is significantly high for a small country without any resources.

Unless you compare the National debt with another variable you cannot decide how high really it is.

In economics national debt is compared to the GDP .

And it is less than 60%.

When Malta was accepted as an EU member our National debt was 70%.

Actually Malta just made it at the time, under the Maastricht criteria.

True, but one thing people often overlook is that debt is expressed as a percentage of GDP. This means that if some economists are correct and that a contraction of the economy is on the cards, debt % may increase without necessarily incurring a single additional cent of debt. This is not a partisan issue but a matter of serious concern to the entire population particularly low income earners since they are the ones with lowest savings buffer.

We are in great shape then, no need to worry just compare ourselves to the worst. What a stupid way to reason

Please note that pre-covid the Debt /GDP ratio was nearing the 40%. That gave us the required leverage when economic storms due to the covid and Ukraine war hit the World over.

What you fail to understand is that unlike many other countries Malta is a small nation with no resources to turn too when things turn sour. Comparing Malta to say Italy or Germany is like comparing a mini to a ferrari…..

But EU regulations apply equally to us.

So, you are saying that the 2013 L’aqwa-Zmien policy is working, hilarious.

Gerada, that was the mantra of Scicluna. However, you have to payback in Euros not Ratios!

Another way of viewing this is by having more wealth created, then the debt should decrease not increase. It’s a simple law of wealth creation. If you have debt and your salary increases, then debt should be decreasing.

The debt to GDP percentage is a ratio and is simply an indicator of a current economic situation and fluctuates depending on the GDP. The national debt is however an absolute value. The cost of paying the interest for the national debt and refinancing the debt is not dependent on the GDP, but instead on the base interest rate set by the ECB. The latter is rising and therefore the cost of the national debt and its refinancing is increasing. At the same time, the GDP of Malta is declining.

So here is how it works;

70% of GDP during Gonzi with 4.3 billion national debt at about 3.5% interest rate by the ECB, meant Euro 150 million annual debt financing cost.

60% of GDP today with a national debt at 10+ billion at an interest rate of 5.5% and rising(!) means Euro 550 million annual debt financing cost.

If you also consider that since 2012 the interest rate for Malta was already falling and the GDP is rising, but to the contrary today the interest rate is rising steeply. The GDP is declining, you maybe understand why the situation today is much worse than it was between 2008-2013.

It seems as though he thinks he has a blank cheque. Same as what is happening with Air Malta ex employees. Their pockets are full of tax payers cash. Bravo!

Sur Clyde Caruana

Jekk ghalik l Airmalta hija fireplace il kaxxa ta’ Malta xi tkun? Jew ahjar kif gibtha?

Il Verita’ hija wahda sur socjalista tal isem int ma tafx tisthi.

Int arroganti bhal bqija.

What’s interesting in the table above is that a total reported surplus of €833 million actually resulted in an increase of €135 million in debt over the same period. This shows that, for the most part, the surplus did not result in positive cashflows for the Government. Still a far cry from the billion a year we’ve been increasing since.

And the national debt would have been higher had the Labour govt has not turned to sell the National Gold Reserves which now stands at the LOWEST level for these last 23 years!!!