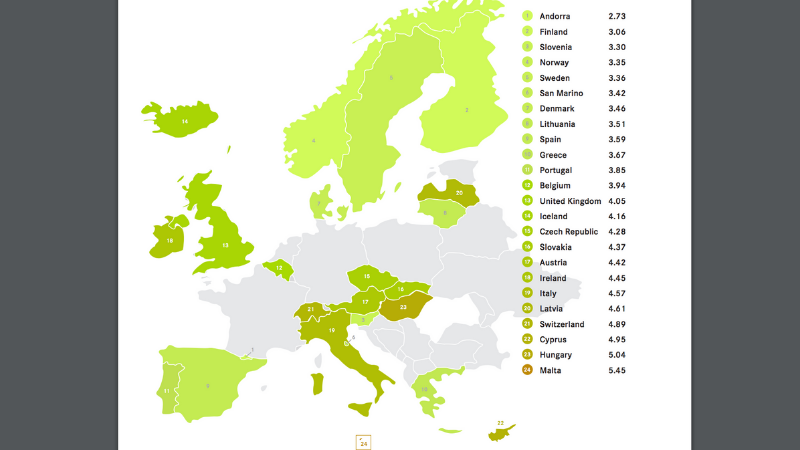

Malta is the riskiest jurisdiction in the European Union for money-laundering risks, according to a new study. The 10th public edition of the Basel AML Index 2021 lists the island in 47thplace among 110 jurisdictions examined for money-laundering and terrorist financing risks.

Ranked at a similar level to countries like the Philippines, Cuba, Albania and Serbia, Malta was given a score of 5.45, the highest score, and thus highest risk, calculated for any EU country.

The next EU country on the list is Hungary, in 63rdplace with a score of 5.04, followed by Cyprus, in 67thplace with a score of 4.95.

Italy (84th with a score of 4.57), Ireland (87th with a score of 4.45), Belgium (95th, 3.94) and Spain (100th, 3.59) are among several other EU countries that make it to the list. The UK also features, in 93rd place, with a score of 4.05.

Haiti emerges as the riskiest country in the world for money laundering and terrorism financing, with a score of 8.49. Second on the list is the Congo (DRC) on 8.35 points. The least risky country is Andorra, in 110th place, with a score of 2.73.

Malta was placed on the global anti-money-laundering watchdog FATF’s grey-list in June this year, after having been put on alert a year earlier when the country failed a crucial Moneyval assessment.

The first EU country to ever be grey-listed, Malta’s failure to tackle glaring shortcomings around regulatory and enforcement practices, the failure to investigate and prosecute financial criminals, the lack of beneficial ownership transparency, as well as growing concern over issues such as its passport-selling programme, have been cited as the main reasons for the demotion.

The Basel AML Index, published annually since 2012, measures a jurisdiction’s vulnerability to money laundering and terrorist financing and its abilities to combat it. The study is based on publicly available data from the Financial Action Task Force (FATF), Transparency International, the World Bank and the World Economic Forum.

The points allocated to each jurisdiction studied are established based on: the quality of its anti-money-laundering and counter-terrorism-financing framework; bribery and corruption; financial transparency and standards; public transparency and accountability; and legal and political risks.

The report highlights various globally emerging risks around money laundering, as well as established areas of concern. These include money laundering threats related to virtual assets and cryptocurrencies, which, the authors write, jurisdictions are failing to respond to effectively.

Despite scant data on how many of the estimated 106 million cryptocurrency users worldwide may be using these for criminal purposes, the borderless nature and lack of regulation makes virtual currencies easy options to conceal proceeds of corruption and other crimes.

The publication cites a 2021 report by blockchain analysis firm Chainalysis, that found of the estimated USD 21.4 billion in cryptocurrency transactions in 2019, criminal activity represented around 2.1 percent (USD 450 million).

The Index also questions the effectiveness of jurisdictions’ AML systems, in which not enough effort is put into preventing money-laundering crimes from taking place. “Ineffective systems are the general rule, but jurisdictions consistently score worse for prevention than for enforcement,” the report says.

Slow and ineffective implementation of beneficial ownership registries is another major issue of concern that “continues to provide safe havens for dirty money,” the authors of the Index write. They stress, this is damaging for individual jurisdictions, but more importantly undermines all global efforts to combat money laundering.

A further weakness in jurisdictions’ ability to fight against money-laundering is the underperformance of lawyers, accountants, real estate agents and other non-financial businesses and professions on compliance with AML/CFT standards.

The report calls for more stringent supervision of service providers and says this is “urgently needed to close that gap”.

This is the result of the incompetence of the likes of FIAU’s Deputy Director Alfred Zammit and his buddies.

Malta is being punished due to the lack of foresight and lack of action of these incompetent officials.

This was deliberate. The Road Map, remember?

‘Incompetence’ is what they will plead at best. This was an instalment of a criminal syndicate.

The government of Joseph Muscat made it a policy to work hand in hand with crooks.

The muvument KORROTT should frame this latest certificate with that of the most corrupt artful dodger in the mediterranean and hang them both on the forth floor of the their corrupt den where corruption was baked.