If there is one thing everyone agrees with in relation to the Vitals Global Healthcare / Steward Healthcare concession, it is that this has failed. Spectacularly.

But we’ve known this for a while – The Shift has been investigating and publishing revelations on the hospitals deal for two years. Neither Steward Healthcare, nor the government, was ever forthcoming with answers to questions sent, let alone a stream of stories for weeks all quoting “government sources” or Steward sources.

So why all this fuss now, pushing information we already know as “revelations” while still omitting key questions that remain unanswered?

The promised investment was never made, Vitals effectively went bankrupt, Steward is now claiming the company was “pressured” to take over the failed concession (a bizarre claim), that they are owed millions and want to be paid more to boot.

The government, on the other hand, presumably freed of the toxic trio – Joseph Muscat, Keith Schembri and Konrad Mizzi – appears torn between scrapping the deal altogether (something Prime Minister Robert Abela referred to last Sunday as “populist”) and materially amending the contract terms to appease Steward (something that would potentially open the concession up to legal challenge).

We may disagree on how this state of affairs came about – our informed view is that this is due to a blend of corruption, greed and sheer incompetence – but at least there is wide agreement that we are at a critical juncture.

It is worth taking a look back at how this all started and set the current context in perspective.

The backroom deals

We can start with John Dalli, a former health minister in Malta, in 2013. Freshly returned from his self-imposed medical exile, conveniently after a change in Police Commissioner, Dalli was engaged by Muscat as a consultant on healthcare reform in the country.

By November 2013, Dalli’s report, ‘Mater Dei: a better social return’ was ready. With hindsight, unsurprisingly, some of Dalli’s major recommendations were that Malta should seek to attract medical tourism, that the Gozo General Hospital could be made better use of and Public Private Partnerships (PPP) in healthcare could be a good solution.

The next we would hear of this PPP idea for healthcare would be March 2015 with Mizzi’s announcement of an RFP. But we know that there was a great deal of activity behind the scenes.

Daphne Caruana Galizia had reported that in late 2013 Shaukat Ali Abdul Ghafoor and Sri Ram Tumuluri were already meeting potential subcontractors in Dubai for a deal to take over a chunk of Malta’s healthcare on a PPP basis.

Caruana Galizia had additionally reported how, among others, Schembri and an unnamed former politician whom she identified as likely to be Dalli were offering these subcontractors comforts and tips on how to secure the deal.

The Shift has already reported on Shaukat Ali’s links to Dalli, to whom he had transferred his shares in the company formally known as ‘John Dalli and Associates Ltd’ during his ill-fated stint as EU Health Commissioner (2009-2011).

The Shift has also reported on how Shaukat Ali acted as Muscat’s investment promotion consultant.

By October 2014, the government (acting through Chris Cardona’s ministry) had signed a Memorandum of Understanding (MOU) with Shaukat Ali and a PPP advisor Mohammed Shoaib Walajahi in respect of a Maltese company called Pivot Holdings Ltd.

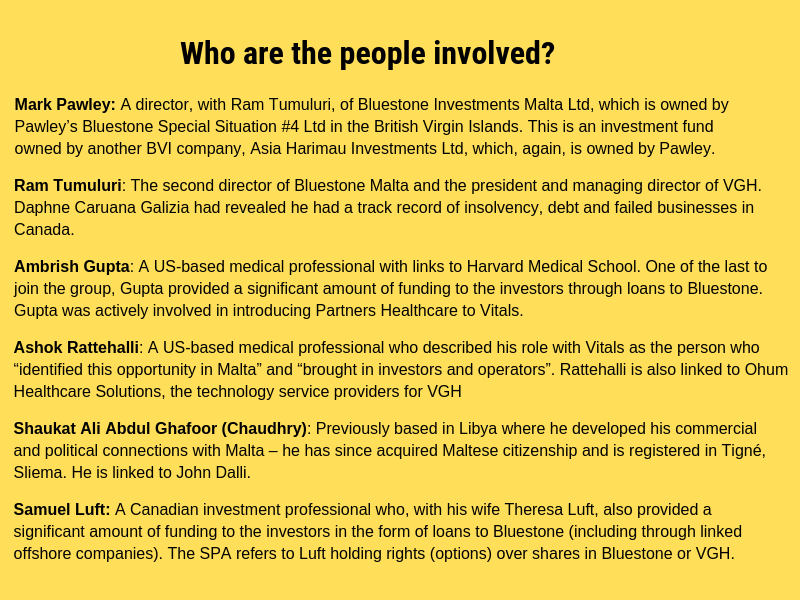

The agreement, a copy of which continues to be denied by the government, also included Ashok Rattehalli in respect of his company AGMC Inc. and Mark Edward Pawley in respect of Bluestone Special Situations #4 Ltd, a company in the British Virgin Islands.

The agreement related to the taking over of the Gozo General Hospital, among other things.

We also know that, armed with this agreement before the government had made a public call, the investors sought to raise further capital. Noting they had “bagged” a deal from the government, they agreed between themselves that, no matter what public records state, the Maltese company they put together (Bluestone) and that would operate the concession would be owned by all of them.

This internal agreement saw the addition of Ambrish Gupta to the list of then secret investors, since revealed by The Shift.

The fake tender

In March 2015, Mizzi announced that the government would be issuing a Request for Proposals (RFP) to operate the Gozo General hospital along with St. Luke’s and Karin Grech on a PPP basis.

The winner of the RFP would need to invest €200 million to revamp the hospitals and build premises for St. Bart’s (a deal that was already signed but added to the RFP).

The government would effectively bind itself to rent beds, pay staff and subsidise other services, thus guaranteeing a minimum income for the concession, on condition that the deliverables were met.

Mizzi had said that the PPP would seek to create a medical tourism industry in Malta and, as a result, would be able to operate the hospitals cheaper than the government could, passing on the savings to the government.

Asked specifically whether this deal structure would attract sufficient interest to ensure the best deal for the Maltese taxpayer, Mizzi had said that the government had spoken to various healthcare providers who showed interest including specialist centres, insurance companies, health funds as well as hospital management companies.

We now know with certainty that the government had done much more than merely speak to potential bidders to gauge interest. Caruana Galizia had immediately announced that this was a done deal, a report that was at the time largely ignored but which, with hindsight, was right on the money. The RFP was written with Vitals firmly in mind.

Konrad Mizzi negotiated the VGH deal.

A look through the 2015 RFP evaluation report obtained by Opposition Leader Adrian Delia through the ongoing court case to annul the Vitals / Steward concession and return the hospitals back to the public, shows just how much of a done deal this was.

At the time, the government had paraded the fact that three bids were received as a demonstration of just how competitive the tender was. What the government failed to mention back then was that, in effect, the only bidder was Vitals.

The evaluation report plainly shows that one “bidder”, BSP Investments, did not actually file a bid but filed a letter saying that it was not interested in the deal as structured, proposing another structure. This was ruled out.

The other “bidder”, Image Hospitals, an unknown Indian outfit that runs a small hospital in Hyderabad, India, and judging from online reviews is nothing more than an overpriced health hazard, also filed an incomplete bid and was immediately excluded.

Faced with just one bid, the evaluation Board composed of Mizzi’s appointee as Head of FMS (later Projects Plus), the GWU’s financial controller and a representative from Panama Papers firm Nexia BT, proceeded to pour irrational praise on Vitals’ bid.

The evaluation report was an exercise in what looked like creative writing, praising Vitals / Bluestone’s detailed understanding of Malta’s healthcare, its past experience (when we know it had none) and how its corporate structure (companies in the British Virgin Islands and a bundle of hidden agreements) was “well suited” to this type of venture. But there were some interesting insights.

The report made it clear that the project was not viable without medical tourism and that it was heavily dependent on the bidders securing external funding. The bidders also included Gupta (who on paper did not feature as being involved in the structure, but who is linked through the secret agreement) and his personal account balance as part of the evidence that the bidders had sufficiently deep pockets.

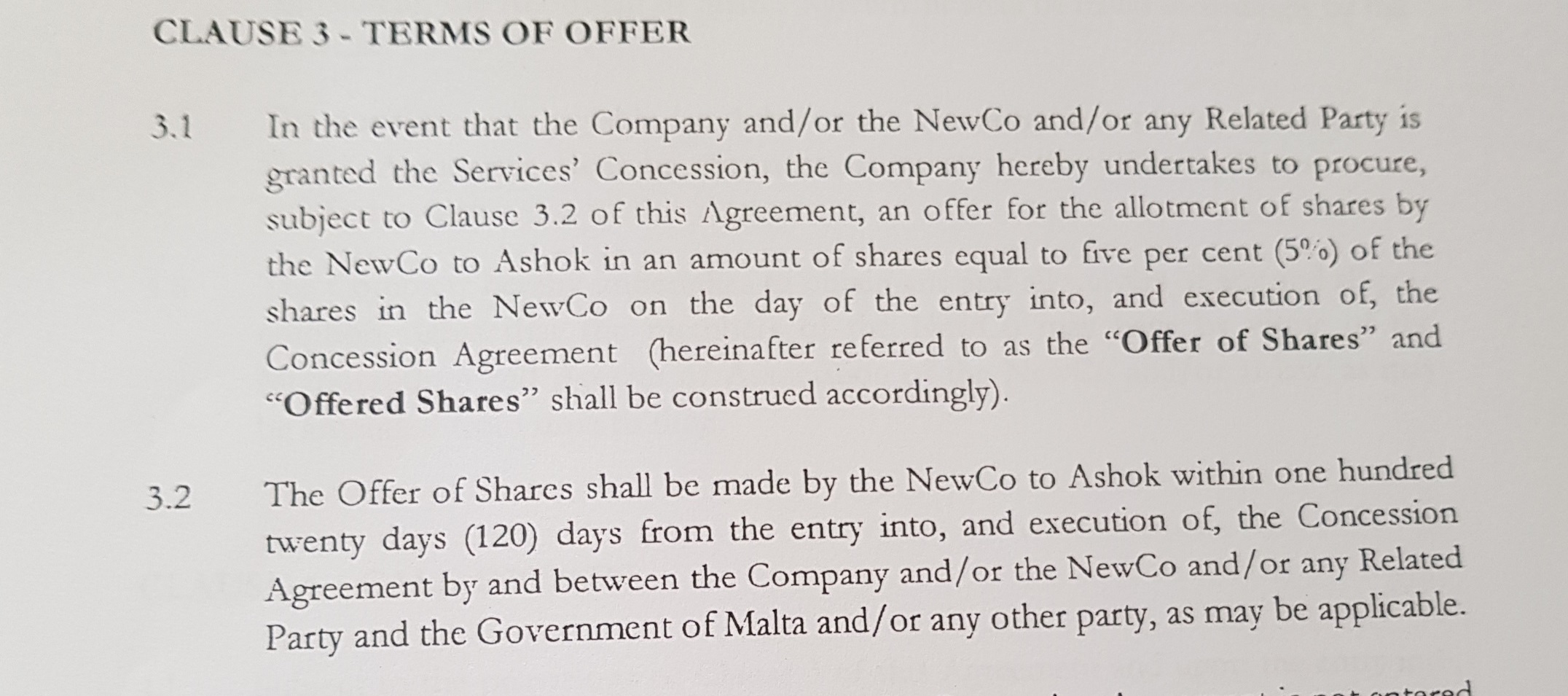

In the background, Bluestone (through Tumuluri and Pawley) was signing option agreements with hidden investors including Rattehalli and Gupta promising them shares in Vitals within 120 days of winning the concession.

Excerpt from Ashok Rattehalli’s hidden Share Option Agreement. The reason why he now owns 5% in Steward Malta Limited.

None of these matters proved to be of concern to Mizzi’s hand-picked evaluation Board. The report also made it clear that the government’s main consideration was that the pricing per day needed to be less than what the government was paying.

With a massive 88%, the Board unanimously recommended that Vitals / Bluestone pitch, effectively the sole bidders, should be awarded the concession in June 2015, exactly a month after the bids were received.

Eight days later, on 27 June 2015, Mizzi announced that Vitals / Bluestone had won.

The concession contracts

On 30 November 2015, Mizzi placed his signature on the ill-fated concession agreements handing over Gozo General Hospital and the management of St Lukes and Karin Grech to Vitals.

Steward is presently grumbling about the lack of clarity in these contracts but we know that this is not all there is to it.

The contracts, full details of which have been resisted by the government for years, are ridiculously pro-Vitals. The contracts include minimum payment guarantees by the government to Vitals for decades (30 years, minimum), a guarantee by the government that if Vitals were to ever default on its debts the government would step in and take them over, and an option in the emphyteutical grant over the Gozo Hospital to extend this to up to 99 years.

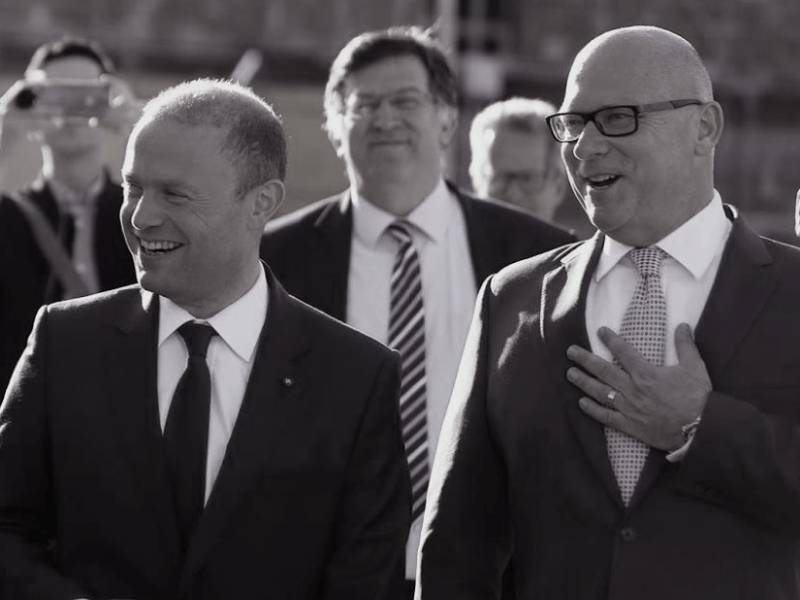

Former Prime Minister Joseph Muscat (left) with Armin Ernst from Steward Healthcare / VGH.

The contracts for this PPP were also considered abnormal by the NSO and Eurostat that concluded in 2018 that, contrary to the entire purpose of a PPP and its treatment since 2015, the Vitals deal should actually be included on the government’s balance sheet.

There’s more. Through a series of side letters and evident wriggle room in the wording on timing of milestones, the government – acting through Mizzi – proceeded to waive the timing (and later it seems the need altogether) to raise external financing, the requirement for Vitals to give a performance guarantee (although its 2016 accounts note that this was granted by a subcontractor on its behalf) as well as deadlines to complete the construction of St Bart’s or to even invest the overhyped €200 million.

Guaranteed income, a guarantee over debts, loose deadlines, little to no oversight, free government PR and a 30-year (extendible to 99 years) concession, this was a sweetheart deal on par with that for Electrogas.

With such a deal, it takes spectacular incompetence on the part of Tumuluri and the others to fail. But fail they did and The Shift has shown why and how.

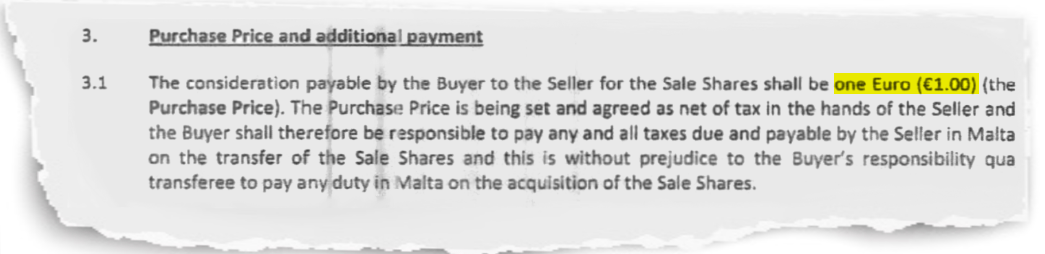

The consideration for all the shares in VGH was just €1.

No interest in running the concession

The narrative presently being pushed is how Tumuluri “squandered” Vitals’ money and failed to raise the funding necessary which resulted in a “pressured Steward” having to quickly take over the concession with little information.

But, based on what we know, this is far from accurate.

Only days before the signing of the concession agreement in Malta, Vitals through Tumuluri and Shaukat Ali were already pitching for a similar deal in Oman and we know that efforts in places as far-flung as Montenegro, Albania and Dubai continued throughout 2016 and 2017.

Steward’s Armin Ernst picked up where VGH left off in Montenegro – a deal pursued on the back of the “success” of the project in Malta even as the company was seeking a bail out from taxpayers’ in Malta.

Tumuluri’s deleted biography on the Board of the Commonwealth Enterprise & Investment Council boasted that Vitals was seeking to expand aggressively into other countries with an 8,000-bed target by 2020.

In 2016, Armin Ernst who is now grumbling on behalf of Steward that the Malta deal needs revisiting, joined Vitals from Steward and he joined Tumuluri and Shaukat Ali in their global pitches and signing of agreements with other countries.

The Shift has shown that Steward is following in Vitals’ footsteps and taking over these shady deals in much the same vein as it did in Malta where it is being touted as the “real deal”.

With such aggressive expansion plans, it is no wonder that Tumuluri drove Vitals into the ground. Their aim was to grow the business and sell it off to a buyer willing to acquire multiple concessions, which is where Steward came in.

When reading articles about Steward complaining about the concession or how Tumuluri “awarded himself” a €5 million bonus, do keep these images of Armin Ernst gleefully re-papering Vitals deals as Steward firmly in mind.

Armin Ernst signing an MOU with Dubai Healthcare City (as Steward) in March 2019. Vitals had previously boasted of a similar arrangement with Dubai Healthcare City.

Tumuluri and Shaukat Ali’s plans for Vitals also included another dimension – taking over suppliers, milking the concession and ensuring that they could profit without the public realising who actually owned Vitals.

The intention to milk the concession is clear right from the start. On exactly the same day that Vitals signed the concession agreements, Mtrace plc, a supplier company that would later be bought by Vitals, was registered in Malta.

Throughout 2016 and 2017 during Armin Ernst tenure as CEO of Vitals, Tumuluri and Shaukat Ali, among others:

- Shifted beneficial ownership of the local concessionaire to a web of companies in Jersey owned by Tumuluri and Shaukat Ali, charging the local concession a “cut” on all contracts;

- Funded (via Jersey) the €5 million takeover of Technoline by Ivan Vassallo and then proceeded to award Technoline exclusivity to act as global distributor taking a cut from all suppliers and outpricing others. As if the deal wasn’t shady enough Shaukat Ali even secured oversight over this company by appointing his brother in law on the Board of directors alongside Vassallo;

- Acquired Mtrace plc, a start up company, for €2 million from its Italian owner appointing it as exclusive supplier for radioactive medicine (cancer treatment) to the Maltese hospitals, at a massive markup.

Other investors such as Rattehalli also sought to milk the concession with appointments to medical Boards and, in his case a deal with Ohum Healthcare solutions, an Indian IT company in which his son was then involved.

Ashok Rattehalli, one of the hidden investors behind Vitals Global Healthcare.

On the other hand, throughout 2016 and 2017 (and to date under Steward) the €200 million investment and refurbishment of the Gozo Hospital, St Lukes and Karin Grech never materialised nor did medical tourism. For much of Tumuluri and Shaukat Ali’s time at the helm all they achieved for the local concession was to dig a hole.

That’s what we know of so far and Steward was not only fully aware (this is reflected in the sale contract) but many took place while Ernst was the CEO of Vitals.

What is Steward playing at?

Reading the news of Steward complaining about how Vitals didn’t keep proper accounts, how the 2015 and 2016 accounts for Vitals show that it was in the red, how Tumuluri gave himself bonuses, how the government owes Steward millions, how Steward was “pressured” to take over the concession from Vitals and how they need to be paid more, you’d be excused for almost feeling sorry for Steward.

But are we being told the full story?

We read about Vitals’ 2015 and 2016 accounts but, for some reason, those for 2017, 2018 and 2019 as well as Steward’s own accounts for 2018 and 2019 are conveniently being held close to their chest.

We also know that Ernst, who is now heading Steward in Malta was the CEO of Vitals during the years that he is complaining about.

Are we saying that as CEO, Ernst had no idea of the machinations, the financial arrangements in place for Vitals with the government and had no access to Vitals’ accounts or its financial situation?

Lovin Malta reports that Steward felt “pressured” to take over the concession in late 2017 but that begs the question as to why a healthcare behemoth owned by a hedge fund that makes a living out of squeezing millions from healthcare could be in a position to feel pressured to enter into what it claims was a bad deal.

Far from pressured, Steward were offered the chance to take over a sweetheart deal that their own person had overseen for over a year and half.

There’s more. While Steward paid the princely sum of €1 to take over the Vitals concession, all the bonuses and severance payments paid to Tumuluri, Shaukat Ali and others were charged to the concession.

As if that weren’t enough, Steward also got to take over the deals in other countries that Tumuluri and Shaukat Ali negotiated with politicians known to accept a backhander or two with Ernst conveniently sitting in the same room, then as CEO of Vitals.

Armin Ernst in Montenegro as CEO of Vitals, a negotiation Ernst continued to pursue for Steward.

If the Maltese government accepts to pay Steward more, the question we should all be asking ourselves (besides whether that would nullify the concession) is whether the original aims: savings and medical tourism, are still going to be achieved.

Far from feeling ‘sorry for Steward’, if there are no savings for the Maltese government we need to accept that this was a sham, walk away and examine who or what is to blame.

Anything less than that is flogging a dead horse at taxpayers’ expense to defend people like Mizzi and Joseph Muscat, the former prime minister now lobbying for Steward.