Recent company registry filings in Jersey show that Sri Ram Tumuluri has placed nine of the previously hidden Jersey companies involved in the Vitals Global Healthcare (VGH) concession’s web of offshore companies and contracts into liquidation.

These offshore companies, revealed as the result of an investigation by The Shift News, appear to have been established to extract ‘commissions’ from the Maltese companies holding the concession in Malta.

This arrangement was exposed through the release of the secret sale agreement with Steward Healthcare – that involved the concession for three of Malta’s public hospitals worth just over a billion euros over 99 years being sold for €1.

As revealed by The Shift News, the transfer of shares agreement beween Vitals and Steward Healthcare was enabled through the involvement of of top government officials, including a late night meeting at the Prime Minister’s office involving Panama Papers Minister Konrad Mizzi and the Prime Minister’s chief of staff Keith Schembri.

The sales agreement with Steward Healthcare included clauses on paying undisclosed settlement amounts to the Jersey companies in order to terminate the commission payments. While it is impossible to verify exactly why these offshore companies created in secret jurisdictions are suddenly no longer necessary, it is reasonable to assume that these settlement amounts were paid (stopping commissions), making the companies unnecessary, according to corporate lawyers consulted by The Shift News.

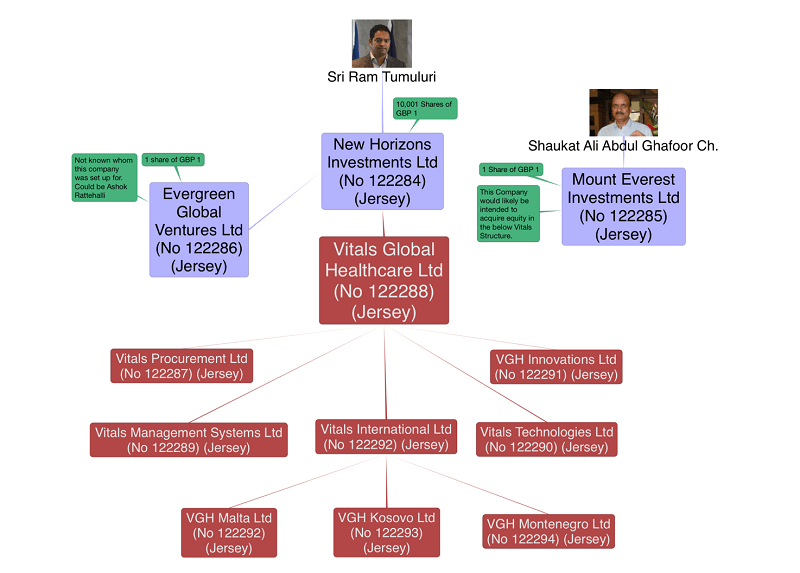

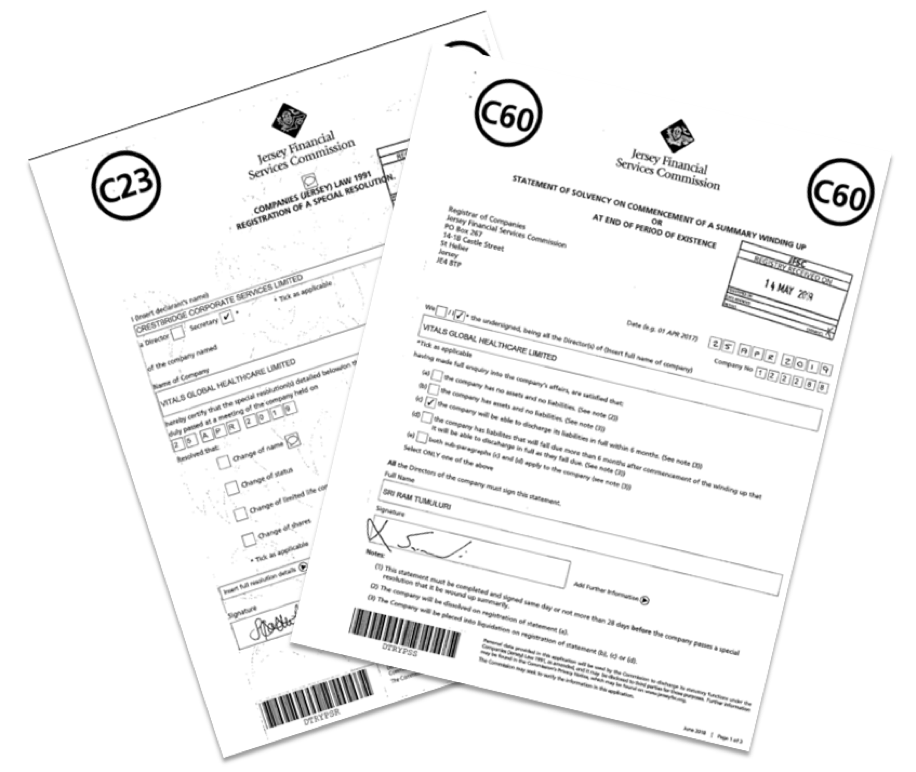

The nine companies placed into liquidation are the “operational” companies (below in red) leaving just the three holding companies (in purple) at the top. The documentation placing the companies into liquidation are dated 25 April (but filed on 14 May). They are signed by Sri Ram Tumuluri as director, among others.

The Shift News had revealed that while the ownership of VGH in Malta remained unchanged on paper, the economic benefit of the VGH concession secretly shifted to other beneficiaries through a mix of loan agreements, share options and other contracts.

The public faces of VGH (Ram Tumuluri and Mark Edward Pawley) along with their previously hidden partners (including Shaukat Ali Abdul Ghafoor) also secretly set up a series of companies in Jersey and proceeded to sign a series of intercompany agreements between the Maltese companies and the hidden Jersey companies.

Each intercompany agreement considered the payment of commissions and other fees from the Maltese concessionaire to these Jersey companies, effectively siphoning off income. Even the Maltese ‘management company’ effectively transferred various of its management functions to Jersey and procurement and key contracts with suppliers were also shifted to the Jersey companies – VGH Malta became a client of VGH Jersey.

The Shift News has also shown that VGH was pitching to other governments even as it sought, and got, a bailout in Malta. In short, the previously secret owners of VGH were using the fact that they got a concession in Malta as a selling point to other governments. Worse, they were quietly using Maltese taxpayer funds to create a ‘platform’ in Jersey to expand internationally.

Although they received over €50 million from the Maltese government, they left a reported €55 million in debt showing that rather than delivering on the Maltese concession their priorities were on milking the concession and expanding to other countries at Maltese taxpayers’ expense.

The Shift News has also shown how these Jersey companies were used to finance the takeover of key suppliers including Technoline Ltd (medical and pharmaceutical supplies) and Mtrace plc (radiopharmaceuticals) and then proceeded to award them exclusive distributorship agreements.

The deal is the subject of a request for a magisterial inquiry by NGO Repubblika.