Strong collaboration between countries was closing the net on organised crime and tax evasion, but “steer clear of Malta” was the message delivered by offshore tax haven specialist David Marchant during an international conference in London last week on international financial crime enforcement.

The OffshoreAlert Conference is a Financial Intelligence & Investigations Event held annually drawing experts from over 20 jurisdictions. It covers “the full spectrum of issues” that affect individuals and corporations conducting business in or through offshore financial centres.

Biznews.com founder Alec Hogg reported that hundreds of delegates attending the conference “with a speaker’s list that reads like a who’s who of international financial crime enforcement” got a clear message to stay away from “shady” Malta.

“We got a clear message to steer clear of Liechtenstein – and its shady successor Malta, where a journalist was recently blown up by a Mafia-style car bomb,” during a conference in London.

“Scary world this,” he adds.

Delegates attending the annual event, which included financial advisers, bankers and government officials from around the world, also heard how Bitcoin was the currency of choice for criminals.

They said criminals are behind 97% of all Bitcoin transactions, while crypto crime specialists said that “conservatively” 80% of Initial Coin Offerings (ICOs) are fraudulent, Hogg reported.

Last February, Europol said criminals in Europe are using cryptocurrencies to launder as much as $5.5 billion in illegal money.

The main problem with cryptocurrency is the lack of transparency in the provenance of the money, together with the lack of information about the people behind the transactions.

A recent study held among 25 different cryptocurrency exchanges across Europe and the US revealed that only 32% perform full identity checks on their users.

The dangers of cryptocurrencies were strongly emphasised in Malta’s National Risk Assessment:

“Cryptocurrencies may be exposed to money laundering as they involve encrypted data, instantaneous settling of transactions and higher levels of anonymity compared to traditional bank transactions… virtual currencies is one of the key emerging risks to money laundering, terrorist financing, tax evasion and fraud.”

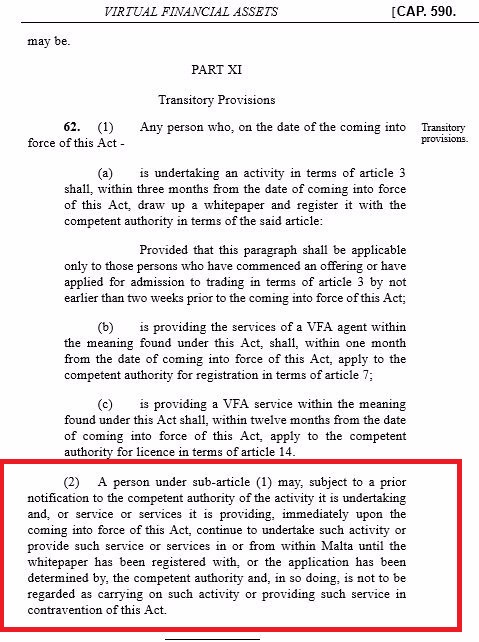

Crypto exchanges that filed a notification to MFSA before 11 November are exempt from licensing until the lapse of the one year transition period. Until they apply for authorisation they are not “licence holders” under the Virtual Financial Assets Act.

Only exchanges that are licensed are deemed to be subject persons and accordingly subject to anti-money laundering obligations.

While on paper there is an expectation that exchanges operating during this unlicensed “transitional period” aim to comply with applicable rules on a “best efforts” basis, it also means that compliance is neither mandatory nor enforced in practice.