Crypto-exchanges moving to Malta before October could operate until 2020 without complying with anti-money laundering (AML) and market manipulation rules.

Malta has adopted the “blockchain island” moniker in a bid to attract companies operating in the Bitcoin and other crypto-currencies space, and earlier this year passed three crypto-related Bills into law to lure companies into setting up in Malta.

On paper, these laws include requirements in relation to prevention of money laundering as well as consumer protection and market integrity (eg against market manipulation). But there’s a catch.

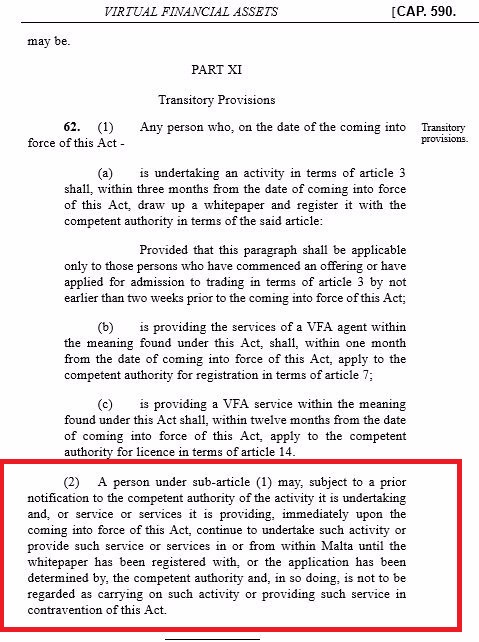

Companies in the crypto-currency space, particularly exchanges that shift to Malta and operate before the October start-date will have up to one year to apply for authorisation (ie until October 2019).

Until this “grandfathering period” lapses and their application is processed, these companies will be exempt from the need of authorisation or even needing to comply with anti-money laundering laws.

This explains the rush of big companies in the sector registering their interest in setting up in Malta at a time when governments are focusing on regulating the sector. Essentially, it will be business as usual for them until 2020 (assuming a two month application review period).

Cryptocurrency is a type of digital currency unregulated by a Central Bank and governments are now making a move to attempt to regulate it. In June, the G20 reiterated its intent to bring the cryptocurrency sector under international anti-money laundering standards by October.

Like other online technologies in their infancy, cryptocurrency is vulnerable to scammers, illicit schemes and money laundering outfits.

Last February, Europol said criminals in Europe are using cryptocurrencies to launder as much as $5.5 billion in illegal money.

The main problem with cryptocurrency is the lack of transparency in the provenance of the money, together with the lack of information about the people behind the transactions.

A recent study held among 25 different cryptocurrency exchanges across Europe and the US revealed that only 32% perform full identity checks on their users.

More than two-thirds of European and US crytocurrency companies failed to comply with Know-Your-Customer (KYC) procedures and could start trading using either a telephone number or email address – two elements that can be easily falsified or provided without identification.

In December 2017, the European Parliament’s Committee on Economic and Monetary Affairs agreed to require cryptocurrency exchanges as well as wallet providers to identify their users – as part of the fifth anti-money laundering directive of the EU, referred to as AMLD5. It is set to come into effect in June 2019.

Exchanges along with online gaming companies accepting cryptocurrency, mixers (companies that jumble cryptocurrency holdings as a service) and anonymous currencies like Monero or Zcash are repeatedly singled out as posing a very high-risk for money laundering.

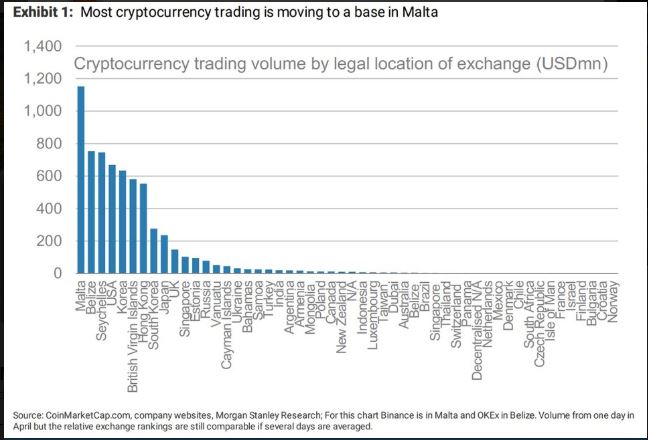

Malta’s accommodating stance on cryptocurrency operators as well as these grandfathering provisions which reward companies that set up shop before October – by allowing exemption from rules until 2020 – has created a veritable gold rush.

The largest cryptocurrency exchange in the world by volume – Binance – chose Malta for their new headquarters after warnings received from Japan, China and Hong Kong over concerns about its operating without a licence or serious AML procedures.

Coinmarketcap data estimates that it has $1.47 billion in trade volume. Soon after, the second largest company OKEX also said it was going to turn to Malta as its base. OKEX has recently been the subject of allegations of reporting fake volumes and illegally trading in China.

Polish cryptocurrency exchange BitBay also announced its move to Malta because it cannot open a bank account in its homeland. Banks, particularly in the US, have traditionally shied away from companies with exposure to cryptocurrencies due to the heightened risks of money laundering.

Binance, which traditionally had banking issues, had also originally declared that it was moving to Malta as a solution to its banking problem. Reportedly, Binance found a willing banking partner in Agribank, a bank set up to focus on lending to British farmers.

In July, Binance announced that it was, along with other partners, setting up its own Maltese bank called ‘The Founders Bank Ltd’.

Next month, the Maltese government is organising the no-expenses-spared Delta Summit, bringing together traders, cryptocurrency CEOs – including those of Binance, OKCOIN – and the founder of Wikipedia as “Malta’s official platform from where to promote this technology and its business opportunities”.