Malta’s anti-money laundering agency flagged concerns on documents perceived as forged that were related to offshore companies held by tourism minister Konrad Mizzi and the Prime Minister’s chief of staff Keith Schembri, according to a recently leaked report.

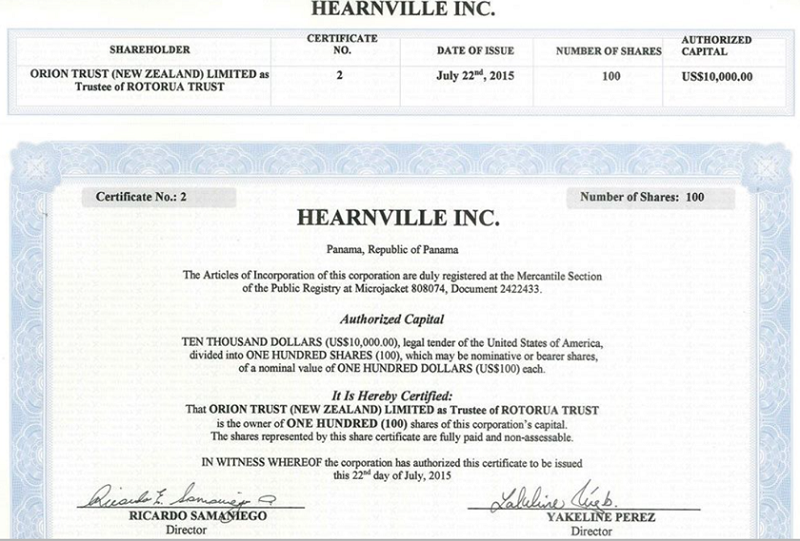

The agency’s investigation then showed that Mizzi and Schembri’s companies – Hearnville Inc. and Tillgate Inc. – were worth much more than €92, as Mizzi had repeatedly claimed. They were worth US$10,000 (€9,200 as per exchange rate in 2016).

The latest twist in the saga that has unfolded since the Panama Papers exposed ownership of companies in secretive jurisdictions by Malta’s Tourism Minister (then Energy Minister) and the Prime Minister’s Chief of Staff, raises concerns on whether Nexia BT and Mossack Fonseca were instructed to forge documentation.

The recently-leaked report by the Financial Intelligence Analysis Unit (FIAU) was handed to a magistrate by PN MEP David Casa. It found that Nexia BT – the financial intermediaries who opened companies in Panama for Mizzi and Schembri – may have backdated documents to cover their tracks following the Panama Papers leak in April 2016.

The FIAU report refers specifically to a share certificate and a board meeting declaration drawn up and backdated to 21 July, 2015 to replace a previous one.

“The ease with which documentation was amended and backdated is considered to be suspicious,” according to the leaked report by Malta’s anti-money laundering agency. It is a “highly irregular” practice referred to as ‘backdating’.

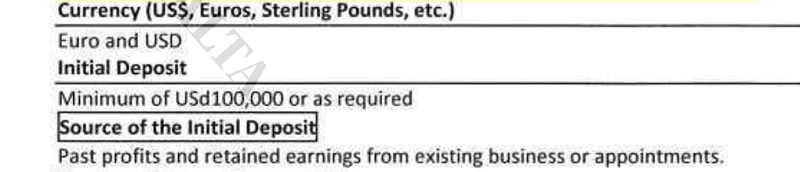

The FIAU report also refers to an engagement letter dated 5 May, 2015 between Nexia BT and Mizzi.

“This document may have been fabricated to coincide and substantiate requests and claims made following the revelations of the Panama Papers,” according to the FIAU, which adds that Mizzi had actually been using the services of Nexia BT for well over two years prior to the engagement letter.

Prime Minister Joseph Muscat officially inaugurated Brian Tonna’s (left) Nexia BT offices in June 2013. Photo: DOI / Omar Camilleri

Previously unseen documentation reveals that, faced with these revelations and media scrutiny, transactions appear to have been reversed.

Legal sources who spoke to The Shift News noted that the practice of backdating is “highly irregular” and could, especially if gains are made or matters concealed, be deemed fraudulent.

The Panama Papers had exposed Mossack Fonseca as engaging in such irregular practices for clients with alarming frequency.

Mossack Fonseca had even set a charge: “US$8.75 (€7) for each month farther back in time a document is backdated”. Nexia BT represented Mossack Fonseca in Malta.

Financial services practitioners also noted that the “highly suspect practice of backdating” corporate documentation could call into question the validity of audit opinions, because such retrospective changes may not have been disclosed to auditors.

Practitioners added that auditors caught engaging in backdating of corporate documentation have in the past been sanctioned and barred from the profession.

How it happened

July 2015 was an active month in Malta, Panama, Dubai and New Zealand.

Mizzi seems to have been jet-setting between Istanbul, Montenegro and Shanghai and regularly eating at restaurants.

Schembri continued to lurk quietly but, unknown to others, there was a great deal of activity in the background.

Orion Engineering Group was attempting to wire $200,000 to 17 Black Ltd’s bank account at Noor Islamic Bank.

Its first transfer was flagged and refused by Deutsche Bank’s regulatory investigations team. The second attempt through Bank of America succeeded.

Meanwhile, Nexia BT was busy compiling documentation to open bank accounts for Hearnville Inc. and Tillgate Inc. – these companies showed 17 Black Ltd (and Macbridge Ltd) as their clients and source of income.

They were each ready to place a $100,000 initial deposit.

On 21 July 2015, the directors decided to increase the share capital of the company: from one share of $100, to 100 shares worth $10,000. They also decided to transfer these to the Trust.

A new share certificate was issued showing the increased share capital. It stated the $10,000 required was fully paid up (meaning it was received by the company from its shareholders).

Seven months later, assassinated journalist Daphne Caruana Galizia exposed Mizzi and Schembri having established these companies in Panama while in office, along with their related New Zealand trusts.

Following these revelations, the activity came to a sudden stop. And transactions appear to have been reversed.

The long chain of emails shows that frantic attempts with at least eight banks to open accounts for the companies ended abruptly when Caruana Galizia uploaded a cryptic photo of a Panama hat and a New Zealand lamb on her blog on 22 February, 2016.

The photo of a Panama Hat published by Daphne Caruana Galizia on her blog Running Commentary on 22 February, 2016.

Hounded by the media at a time when the FIAU concluded its first preliminary report, Mizzi decided to close the company. The FIAU sent its first report to the police, dated 7 April, 2016.

In an email dated 1 April, 2016, Mossack Fonseca’s Juan Carlos Martinez informed Karl Cini of Nexia BT that the resolutions and share certificates increasing the companies’ share capital were replaced, retrospectively.

The new board resolution and share certificate were hurriedly drawn up and dated a year earlier – 21 July, 2015 and 22 July, 2015.

These made it look like it was still a dormant company with one token share.

These latest revelations (as well as the ease with which documentation was tampered with and transactions reversed) beg the question: how reliable are the audits?