The Malta Financial Services Authority (MFSA) has filed an appeal in Court against a decision of the Financial Services Tribunal, that ruled the executive committee took enforcement decisions and issued fines in violation of the law.

According to the MFSA, the decision taken by the tribunal was completely wrong, yet it has failed to bring any new arguments to the table.

Last week, The Shift revealed that the Financial Services Tribunal struck down a decision by the MFSA in which a €160,000 fine was imposed in 2021 on MC Trustees Ltd – a retirement scheme administrator – for a claimed breach of financial service regulations.

After MC Trustees challenged the decision, the tribunal declared that the committee’s decision was illegal. This set a precedent for all decisions made similarly since 2019.

As a result, all decisions made in the past four years may be declared void, and the MFSA could be held accountable for repaying all the fines paid during this period, amounting to millions of euro.

In 2019, the law was changed, and the MFSA had to appoint an independent Enforcement Decisions Committee (EDC) to decide on and execute decisions. This was meant to ensure a distinction between those filing charges (the executive committee) and those deciding on the outcome. Yet the MFSA never appointed the committee, allowing decisions and execution to be made by the same unit.

The Shift contacted the MFSA for comment on the ruling, and a spokesperson said the Authority would contest the tribunal’s decision through an appeal.

Submitting the same arguments already dealt with at the tribunal stage, the MFSA said its enforcement role is primarily vested in the executive committee.

“As a sub-committee, the EDC is a subordinate committee to the executive committee and subject to the Board of Governors appointing its members, the EDC acts and decides by the remit and rules of procedure established by the executive committee.”

“The MFSA did not ignore the law,” the spokesperson said, while not addressing the point that the EDC does not even exist at this stage.

Asked to state why the MFSA has never implemented the law and set up the EDC since 2019, the spokesperson said it was discussed on several occasions by the executive committee and the board of governors: “Several practical, methodological and procedural challenges have been considered”.

“The matter has been recently further complicated by legal and constitutional considerations which put into question the effectiveness of the EDC in its current form as an enforcement decision maker.”

The spokesperson did not address the question of what would happen and who would be held responsible if the MFSA loses the appeal.

Separate from the tribunal’s conclusions, the MFSA’s enforcement procedure is already being subjected to constitutional challenges by different parties.

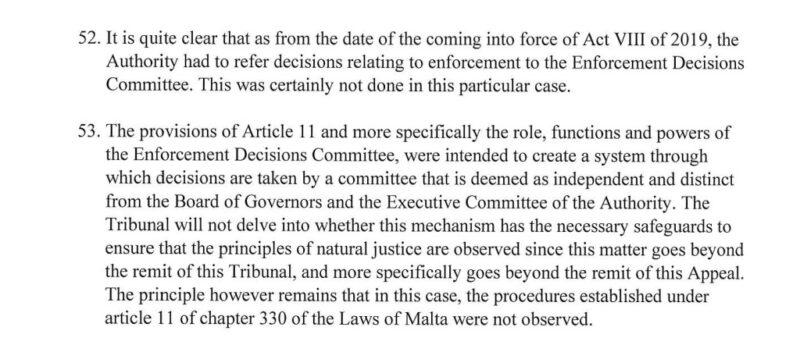

An excerpt from the recent tribunal decision.

Executive committee members are paid high salaries, reaching €150,000 each, due to the sensitivity of their role.

Edwina Licari, embroiled in an MFSA scandal involving disgraced former CEO Joseph Cuschieri, is the chief legal officer at the financial services regulator.

MFSA appears to be disputing a glaringly obvious decision; the fault appears to be fully attributable to its intransigence and inertia in implementing the safeguards of natural justice before it can impose punitive administrative decisions, albeit they may also be insufficient against best standards of independence and impartiality. It ought to have admitted mea culpa resulting from its legal office’s arrogance incompetence and negligence and dedicate its energy in complying with the law itself before accusing others.

The report is excellent as are your comments.

Not only has the legal office at the MFSA displayed “ arrogance, incompetence and negligence “ the outsourced legal team(s) assisting the MFSA – and there is plenty of evidence to show this is common practice- will have displayed those same failings.

What a waste of resources!

The deficiency and breach of the law that occurred in the MFSA’s actions could not have escaped the attention of both legal teams.

The tribunal was quick to notice it!