In collaboration with Nina Fargahi and Sylke Gruhnwald for Swiss digital magazine Republik.

Ali Sadr Hasheminejad had approached Henley & Partners – the private concessionaires for Malta’s cash-for-passport programme – after he acquired a licence for Pilatus Bank in Malta because he wanted to partner on financing transactions related to the scheme, according to Henley & Partners.

The firm told The Shift News that Henley & Partners had rejected Ali Sadr’s proposal: “[Ali] Sadr approached Henley & Partners after establishing the bank in Malta and in connection with financing transactions relating to the Individual Investor Programme (IIP). Henley & Partners ultimately decided not to work with Pilatus bank”.

Ali Sadr is now charged with funnelling more than $115 million paid under a Venezuelan construction contract through the US financial system. If convicted, Ali Sadr could face a sentence of up to 125 years in prison.

Ali Sadr received a banking license for Pilatus Bank in January 2014. Henley & Partners was also contracted in 2014 to design and implement Malta’s cash-for-passports programme.

“It is to be expected that the set-up of a government programme such as the IIP in Malta will attract the attention of many other companies, including banks and other financial services providers. The issuing of banking licences is not something we can comment on, but any such license would have been the result of a preceding due diligence and approval process which is entirely outside of our scope of operations. Equally importantly, any related timing similarities would be purely coincidental,” the firm said.

Henley & Partners denied that a personal relationship existed between the group chairman of Henley & Partners, Christian Kälin, and Ali Sadr or his father Mohammad Sadr Hashemi. Kälin did admit to inviting the bank’s owner to his 20th anniversary wedding, a fact revealed by assassinated journalist Daphne Caruana Galizia.

“As a matter of courtesy… [Ali] Sadr was indeed invited to Kälin’s wedding anniversary event, which was one of many social events that Kälin regularly hosts, and to which a large number of people are invited, including current and former clients… [Ali] Sadr did not attend this event,” the company said.

MEP David Casa, who forms part of the European Parliament’s committee investigating the rule of law in Malta said, “in a recent meeting with MEPs, Kälin confirmed he had a personal relationship with Ali Sadr. He stated that this relationship was the result of his having been a client… Recent revelations that have uncovered links between these entities are indicative of something very sinister. And Henley & Partners’ attempts to conceal these links further exacerbate justified concerns”.

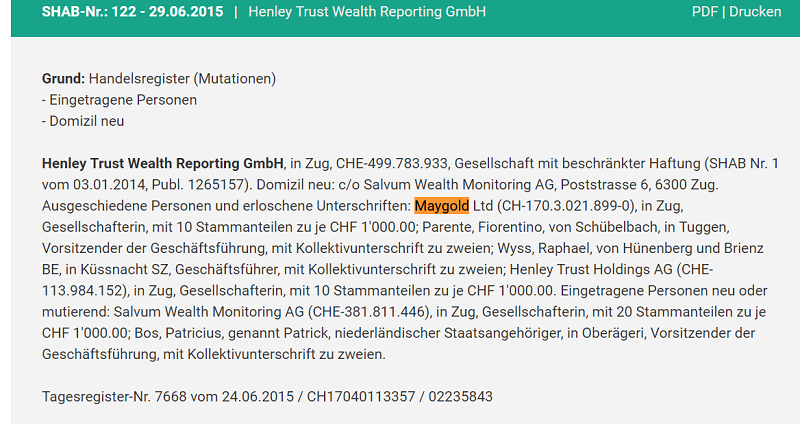

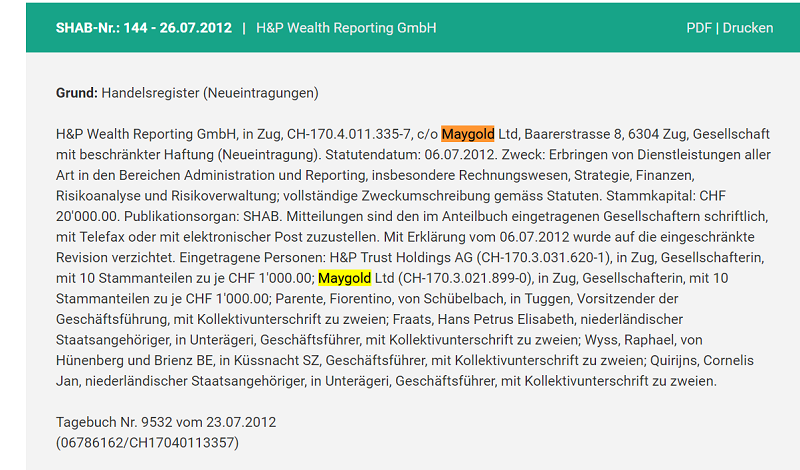

On Thursday, The Shift News in collaboration with Swiss digital magazine Republik, revealed that Pilatus Bank owner Ali Sadr had used companies in Switzerland hidden behind an international trustee called Maygold whose managing director, Raphael Wyss, also served as managing director at Henley Trust.

Henley & Partners also denied that Henley Trust, now Athos Group, was part of the corporate group, saying it was “never part of Henley & Partners Group” and that it was separate from management to operations.

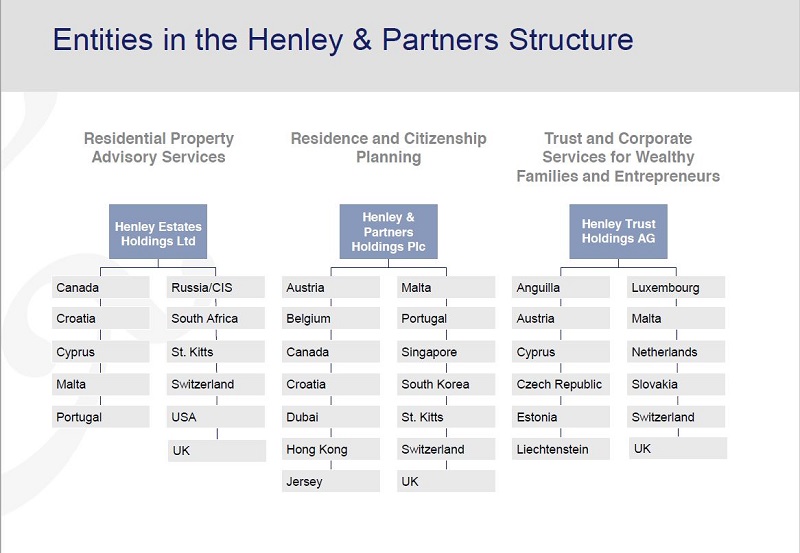

The image shows the organogram outlined by Henley & Partners in a presentation uploaded to the web site of the Arab Bankers Association in the UK.

Athos, with offices at Whitehall Mansions in Ta’ Xbiex (where Pilatus Bank offices are also located) carried the Henley & Partners logo in its listing on Finance Malta until last week.

Since The Shift News published the article, the logo was replaced.

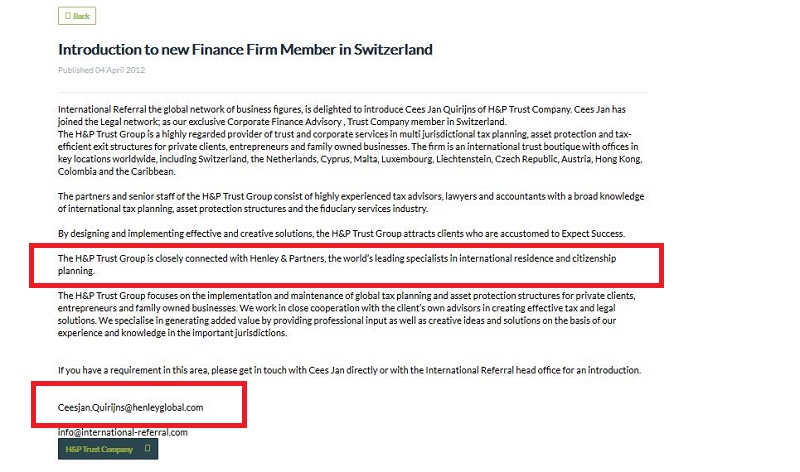

An introductory article by RGlobal published in 2012 also stated: “The Henley & Partners Trust Group is closely connected with Henley & Partners, the world’s leading specialists in international residence and citizenship planning”.

Ceesjan Quirijns of Henley Trust, now renamed Athos Group, promoted an email address of Henley Global group using an email for Henley Global.

When pressed by The Shift News to clarify the separation of the two companies when efforts were made to link operations in promotional initiatives, Henley & Partners said:

“The email setup for Quirijns served this joint marketing purpose and is indeed a practice that is applied in many industries where professionals work together in networks. This, however, does not change the fact that there was, and is, no legal connection between Henley Trust and Henley & Partners, as both operated entirely independently and within completely separate structures, as they do now.”

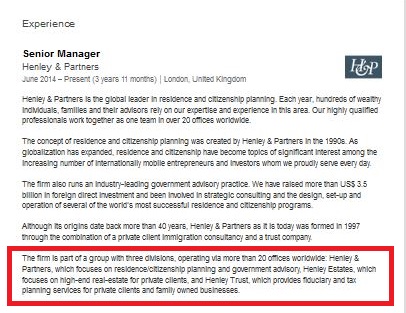

The LinkedIn profile of a senior manager at Henley & Partners states “the firm is part of a group with three divisions… Henley & Partners, which focuses on residence/citizenship planning and government advisory; Henley Estates, which focuses on high-end real-estate for private clients; and Henley Trust, which provides fiduciary and tax planning services for private clients and family owned businesses”.

Henley & Partners said this was incorrect and there was “no legal connection” to Henley Trust.

Kälin was vice chairman of Henley Trust until 2013 but the company insists, “Kälin does not know Wyss of Maygold and has never met with him…Neither Kälin, nor Henley & Partners, have ever had any dealings with Maygold. We have also confirmed with Henley Trust / Athos Group that not even they had any actual business links with Maygold”.

Henley & Partners said: “The former Henley Trust – which changed its name several years ago to Athos Family and Business Services – used the Henley name under a franchise arrangement for the purpose of marketing towards a similar clientele… Kälin was, and is, on the board of companies where, from time to time, such arrangements are mutually beneficial,” the company said.