An international payments company, set up in Malta in 2016 by foreign investors, has announced that Malta’s grey-listing by the FATF has made working on the island impossible.

The firm said it will be closing its operations here, as it becomes the latest victim of Malta’s international grey-listing, citing ‘bullying tactics’ by the MFSA and the FIAU.

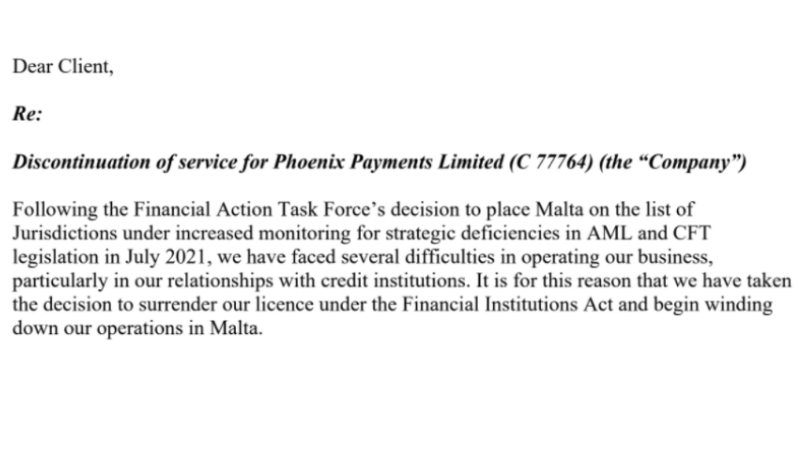

The Shift is informed that Phoenix Payments Limited last week told its clients that it intends to surrender the operating licence it was issued by the Maltese financial services regulator, and will move elsewhere in the EU.

Contacted to explain the reasons for this decision – one of tens of similar moves taken by international companies since Malta’s grey-listing by the FATF (Financial Action Task Force) – the company’s founder, Marco Lavanna, hit out at the local authorities for effectively sending the message that Malta has become “impossible to work in”.

Memo from Phoenix Payments Limited to its clients, informing them of the decision to close down their operations in Malta.

The clearly frustrated businessman did not mince his words.

“The short comment is that the MFSA and the FIAU are now trying to flex their muscles to look good and try to impress the FATF. They are doing this by slapping international businesses with fines and other administrative penalties without even addressing the core issues,” Lavanna claimed.

“It is also interesting to note, but I am sure it’s just an innocent coincidence, how the recent wave of penalties and fines is hitting almost exclusively institutions owned by non-Maltese businessmen. Elections are coming and I am sure they don’t want to upset voters,” Lavanna said.

Asked whether his company’s decision to leave Malta’s jurisdiction and set up shop elsewhere is a direct result of Malta’s grey-listing, Lavanna confirmed this was correct. He insisted that the way the MFSA and the FIAU are handling the situation, after years of inaction, is making other financial institutions, particularly banks, very uncomfortable to do business with companies located in Malta.

Only last month Lavanna’s company was slapped with a €435,000 fine for alleged money-laundering breaches linked to cryptocurrency. The company is appealing this decision in court and insists that the MFSA’s conclusions are unfounded.

According to Lavanna, it’s not the fine that is worrying but the publishing of claims.

“The publication of the penalty, even though still under appeal and not final, effectively puts any business on a global blacklist,” Lavanna explained.

“As a result, several of our local providers terminated their agreements with us, our SEPA (Single European Payments Area) was also terminated and our banking relationship with German bank Handelsbank was also cut off while several other banks in Switzerland, Lithuania and Romania have all rejected our applications because of the fact that we posed a high compliance risk as a consequence of being fined and coming from a grey-listed jurisdiction”.

“This made us realise that our life in Malta has become complicated and decided to leave,” he said.

Lavanna also complained over ‘discrimination’ stating that in some cases, the MFSA and the FIAU has come up with ‘secret’ arrangements with some institutions also claimed to be in breach of rules, to settle the issues quietly without any publication.

The Shift reported these ‘deals’ a few weeks ago. No one in the industry knows what protocol is followed by the MFSA and the FIAU to decide on these deals.

A flood of business leaving Malta

Since Malta’s grey-listing by the FATF, last June, tens of companies in the financial services industry have either already left Malta or are in the process of doing so.

Up to last week, some 45 companies have already surrendered their licence, and more are in the process of doing so.

The latest blow to Malta’s future as a serious financial centre arrived from Citco, an international hedge fund administrator which oversees around $1.5 trillion in assets worldwide, which has decided to surrender its operating licence.

In September alone, some 21 companies had followed suit.

Inclusion in the grey list, which has put Malta’s jurisdiction under the spotlight, has been a looming threat for years as Malta, particularly since 2013, has opened its doors to a series of ‘dodgy’ businessmen who used the island to launder millions of euros while the government controlled FIAU and MFSA looked the other way.

Licences were also issued for ‘problematic’ banks to set up with scant supervision, resulting in corrupt politicians and businessmen moving millions through Malta. One such example was Pilatus Bank, described in court as a money-laundering machine.

This came soon after disgraced Prime Minister Joseph Muscat started selling Maltese passports immediately after Labour was returned to power in 2013, attracting even more shady millionaires to the island.

In the meantime, the reputation of the sector’s regulators, particularly the MFSA and the FIAU, was severely damaged with scandals involving the former CEO Joseph Cuschieri and his associate, General Counsel Edwina Licari.

The latter has kept her position at the MFSA, on a €100,000 financial package, despite the scandals in which she was allegedly involved.

It was today revealed in Parliament that advertising and promotion of “blockchain island” cost taxpayers 3.5 million euro. The MFSA official Christopher P. Buttigieg, who was the brains and main promoter of “blockchain island”, is still enjoying his hefty salary at MFSA.

He still gets to decide whom to award license or not. He is in good company, with disgraced Edwina Licari.

Both are not fit and proper to work in the private industry or to set up their own business. Hence, the taxpayer has to made good for such incompetent people.

SHAME ON ALL THESE CROOKS who have taken the bad example of Malta’s most corrupt ex pm and who’s now hiding until the hammer at the law courts strikes (if ever).

When will Joseph Gavin,the new Chief Executive Officer at the MFSA,make an appearance and a statement. When he does, will he just echo Mamo’s famous words, to excuse the continual failings of the MFSA in their pathetic attempts to combat fraud ,money laundering and tax evasion?

Gobektourrkuntry, mela and leave us alone trapping finches, we will show the world the result of our research. We don’t need Finco, we want finches. Euro sucker rubber jolly.

The Maltese response to Greylisting

I am Canadian. The other day some Maltese told me foxx il-Ingletterra tieghek while spitting and foaming at the mouth with hatred. It was a driving incident. I opened my mouth and spoke a few words of English and he started going off like a volcano of rancid hate.

Sounds bizarre but I am deeply happy. Hope the Maltese will face hunger and all the bad in the world. they truly deserve it!

Issa jigi xi hadd jghidli missek tisthi tghid hekk fuq pajjizek. Iva pajjizi zibel!

LE pajjizi GHAMLUH ZIBEL min meta erba’ hallelin w assassini f’kastilja ghaddew il-poplu biz-zmien.

Yes, but why everyone? All the bad in the world to innocent people?

There are those that are deserving, not only on the tiny city island of Malta but globally!

uwejja bro! Jien ukoll ha nehel mal-hazin! Ara tispiccax tiekol noodles tal-pakkett kuljum int ukoll kink.

This is the price we have to pay for the protection that prime minister Robert Abela is giving to the crooks.

Lavanna’s remark about the watchdogs being held on a tight lead from approaching Maltese-owned companies is telling.

Don’t they give Booby’s war chest a sweetener in return?

Ahjar nergghu nibdew l- industrija tal- kappar u bebbux ghax ser nieklu lill- xulxin…..

BOV Chairman doesn’t agree with you-

https://www.maltatoday.com.mt/business/business_news/113059/greylisting_left_no_impact_on_real_economy_bov_chairman_says#.YYJZQ57MKUk

lol