Aqra bil-Malti

A number of Air Malta pilots have dropped out of an ongoing court case against Prime Minister Robert Abela days ahead of the airline’s final flight, indicating out-of-court settlements have been reached to settle the dispute.

The Airline Pilots’ Association (ALPA) brought the case against Abela in 2020 following mass layoffs at the beleaguered airline. The association cited a controversial 2018 government agreement that guaranteed them jobs.

Air Malta will make its final flight on 30 March. The newly created KM Malta Airlines, announced last October, will take off the next day with a government capital injection of at least €350 million.

In the court minutes for ALPA’s case against Abela, published last Thursday, the court deputy registrar noted that “a long series of cessation notes” had been presented. As a result, the court excluded those presenting the notes from the suit, effectively dropping out of ALPA’s case.

Efforts to contact ALPA president George Frank Mizzi have proved unsuccessful.

Legal experts have confirmed to The Shift that the ‘cessation notes’ either indicate the case’s abandonment or out-of-court settlements for the pilots concerned.

Court minutes published on Thursday noted a large number of ‘cessation notes’ were filed in the case.

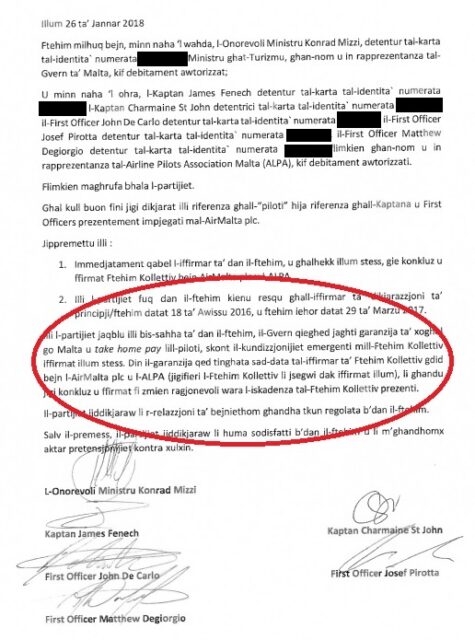

A secret side agreement signed by the pilots in 2018 was a sticking point in the case. The agreement granted the pilots ‘job guarantees’ by the government under the same conditions they enjoyed at the time.

The side agreement was signed by disgraced former minister Konrad Mizzi and drafted and negotiated by Robert Abela when he was a practising lawyer.

In 2021, The Shift revealed how some of the Air Malta pilots laid-off were covertly placed on the government payroll for Mizzi’s deal to be honoured.

Early retirement schemes and side agreements

Mizzi and Abela’s 2018 side agreement was separate from the early retirement schemes for Air Malta pilots in successive collective agreements since at least 2007.

When the new airline was announced last year, Finance Minister Clyde Caruana said some €90 million would be spent if all the early retirement schemes were used.

The collective agreement guaranteed early retirement schemes, which would see the airline pay two-thirds the salary of pilots 55 years of age and older who have 25 years of service until retirement age.

Konrad Mizzi’s 2018 side agreement with the pilots’ association, ALPA.

Caruana did not explain how the government would handle Mizzi’s side agreements. Unlike the early retirement scheme, which forms part of the pilots’ collective agreement with Air Malta, the side agreement was signed with the government.

This means Mizzi and Abela’s agreement continues to apply, binding the government to honour it even after Air Malta’s closure.

Recent court developments indicate the government is settling individual cases with more taxpayer money, but the details are still unclear.

The Shift has reported how outgoing Air Malta pilots have also been offered internal promotions and training ahead of the airline’s replacement.

The Shift’s questions to Prime Minister Abela, Minister Caruana, and the pilots’ association ALPA have remained unanswered at the time of publishing.

This investigation was supported by The Daphne Caruana Galizia Foundation

So when there is no money left this government will ensure they lose an election, until then its a full on raid on public money

Meanwhile, you may note that Malta’s economy keeps growing from strength to strength.

As an economist, I try to explain it better. The debt-to-GDP percentage is a ratio that is simply an indicator of the current economic situation and fluctuates depending on the GDP. The national debt is, however, an absolute value. The cost of paying interest on the national debt and refinancing the debt is not dependent on the GDP but on the base interest rate set by the ECB. The latter is rising; therefore, the cost of the national debt and its refinancing is increasing. At the same time, the GDP of Malta is declining.

So here is how it works:

70% of GDP during Gonzi, with a 4.3 billion national debt at a 3.5% interest rate by the ECB, meant a Euro150 million annual debt financing cost.

58% of GDP today, with a national debt of 10 + billion at an interest rate of 5.5%, and rising(!) means a Euro 630 million annual debt financing cost.

If you also consider that since 2012 the interest rate for Malta has already been falling and the GDP is rising, today the interest rate is rising steeply. The GDP is declining; you may understand why the situation today is much worse than it was between 2008 and 2013.

But the Super One school needs to teach you that.

Well explained, but it is a waste of time. Gahan doesn’t understand economics. I have tried to explain the same so many times that I got blisters on my fingers.

That must be why the national debt doubled!

Hallina tridd!

A government which is akin to a shopaholic all the time borrowing to keep spending. When will it stop!

You should check what the new company offered its pilots as part of the golden handshake package….. money buys silence 🤫

ALPA cannot hold the moral high ground which should be based on flight safety anymore, it just showed it was only after the money…..