Aqra dan l-artiklu bil-Malti.

Changpeng Zhao, the CEO of the world’s largest cryptocurrency exchange, Binance, has pled guilty to money laundering offences, resigned, and agreed to pay more than $4.3 billion to settle a case with the US Treasury Department.

Binance, based out of Malta for 18 months while not paying a single cent in tax, is accused of operating as an unregistered securities exchange, violating US securities laws, and failing to meet anti-money laundering obligations, amongst others offences.

Zhao, head of the company since day one, also pleaded guilty to a felony related to his failure to prevent money laundering through the platform. He also admitted to violating the Bank Secrecy Act and violating sanctions programmes, including implementing reporting and monitoring of suspicious transactions.

In a statement, Binance admitted that it made “misguided decisions” and acknowledged “responsibility for historical, criminal compliance violations.

US authorities said Binance allowed more than 1.5 million virtual currency trades that violated US sanctions to the benefit of Hamas, al-Qaeda and other criminals, as well as others that supported “activities from child sex abuse, to illegal narcotics, to terrorism, across more than 100,000 transactions.”

Despite the shocking dossier of illegalities, Binance did not file a single suspicious activity report on any of the transactions.

The magistrate was clear that Zhao “knew you did not have controls in place,” to which the now-former CEO answered, “Yes, your Honour.”

Zhao, who has previously faced allegations of illegally diverting customer funds, took to X to address his decision to step down but did not mention his admission of guilt.

“Today, I stepped down as CEO of Binance. Admittedly, it was not easy to let go emotionally. But I know it is the right thing to do. I made mistakes, and I must take responsibility. This is best for our community, for Binance, and for myself,” he wrote.

The former CEO added that “Binance will continue to grow and excel with the deep bench it has” before announcing that former global head of regional markets, Richard Teng, would take over.

Referring to the case with the US government as “resolutions with the US agencies”, he said they did not allege Binance misappropriated user funds or engaged in market manipulation.

As well as the large fines, Binance has agreed to third-party monitoring by the US Treasury’s Financial Crimes Enforcement Network to ensure compliance with federal laws.

Binance in Malta

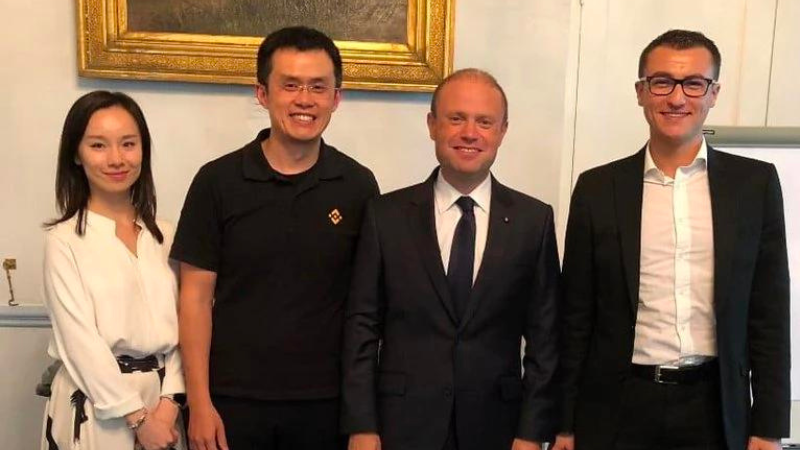

Binance relocated to Malta in 2018 amid the administration of disgraced former prime minister Joseph Muscat’s push to position the country as a “Blockchain Island”.

The government pushed through three laws designed to regulate cryptocurrency and related activities but offered businesses a transition period during which regulatory enforcement would be ‘hands-off’’.

Binance stayed for 18 months with billions of euros passing through its structures, but it left as soon as the regulations came into force, along with most of the other exchanges that set up in Malta simultaneously.

During the company’s time in Malta, it did not pay any tax as it reported losses to the Commissioner for Inland Revenue.

€5 if you spot the criminal in the picture!

C’mon, it’s not that hard!

That will cost you 15, at least, Vanni!

Is that another picture taken at the Office of the Crime Minister?

Silvio Schembri the JOKE of the century