Bank of Valletta and HSBC Malta may have allowed the cashing of cheques by individuals on behalf of a third party despite bans on the practice since 2019, leading to an elderly shopkeeper being charged with money laundering in court last week.

The 67-year-old pensioner pleaded not guilty to charges of money laundering, running an unlicensed banking service and making false tax declarations related to the cashing of over €2 million in third-party cheques between 2014 and 2020.

Commenting generally about Malta’s enforcement against money laundering cases, financial experts who spoke to The Shift said they were struck by the “selective” manner in which anti-money laundering and police authorities acted.

Following questions by The Shift, a Bank of Valletta spokesperson confirmed the practice of depositing third-party cheques had been banned by the bank since May 2019, raising questions on how the accused pensioner was able to deposit some of the third-party cheques on behalf of customers.

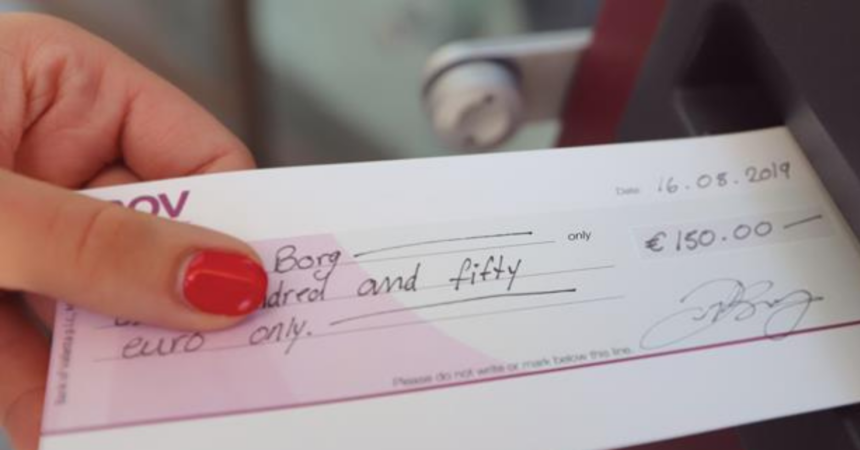

“As of May 2019, BOV adopted a procedure by which newly issued cheques are marked as ‘only’, meaning that they can only be deposited to an account in the name of the person to whom the cheque is addressed (the payee) or paid in cash to the named payee. The bank has no longer issued ‘or order’ cheques’,” he said.

An HSBC Bank Malta spokesperson said the bank “prohibits any activity which is not in line with applicable laws and regulations” when asked about when bans on the practice were implemented.

The spokespersons for both banks claimed the policy change was introduced to protect their customers but have not explained how the accused pensioner deposited the third-party cheques despite the bans.

Last Tuesday, the court heard how the pensioner, Carmela Borg, who used to sell animal feed from her home and garage, would cash cheques for her customers for an average fee of €7.50.

She deposited €1,243,951 through 2,060 cheques at BOV and €722,270 through 2,403 cheques at HSBC Malta between 2014 and 2020.

Defence lawyer José Herrera argued it was “an old village practice” where she would “spare [customers] going to the bank” in return for “a couple of euros”.

Presiding Magistrate Donatella Frendo Dimech questioned whether the banks allowed the practice to go on for years, arguing that “we cannot pick and choose” who gets charged.

Anti-money laundering done in ‘selective manner’

Speaking generally about the issue in comments to The Shift, Financial Advisor Paul Bonello said that while the habitual cashing of cheques “may constitute an activity which is reserved for licensed financial institutions” and may be a criminal offence, this does not necessarily constitute money laundering.

Money laundering “will depend on whether the activity of cashing such cheques was generating any illicit funds and whether the accused was in any way trying to conceal or disguise the origin and nature of such funds,” he said.

Bonello said he was struck by “the selective manner in which the anti-money laundering and police authorities appear to be proceeding with, where the emphasis is to enforce the law in the strictest possible manner with small harmless microbusinesses and self-employed individuals,” arguing such individuals may not even be aware such practices are prohibited.

Conversely, “high profile big cases that constitute serious white collar crime, including flagrant criminal activity, money laundering and organised crime, are allowed to be perpetuated by big business or persons associated with the political class in power,” he said.

Bonello said, “The lack of proportion with which the law enforcement authorities approach this matter is glaring and fails all standards of justice, conscientiousness and proportionality.”

Doesn’t sound like money laundering (designed to hide the origins of funds) to me, but the average fee reportedly charged does sound usurious. They could at least get the charge sheet right. Once again, strong with the weak and melting putty with the strong. Ingavia dirige nos.

In fact. It is not money laundering at all. Although failure to declare her commission is tax evasion and that falls under the same umbrella of money laundering under the wide encompassing rules. Having the odd money laundering conviction helps statistically. And in the meantime, the real money launderers are laughing their way to the bank!

Jaqbdu maz-zghir biex imbad Gafa joqghod jiftahar bl istatistika!

What defines money laundering? Depositing fully traceable cheques into a traceable account is NOT Laundering, by any definition.

These are goverment issued cheques deposited into a local bank , not in Panama.

Have the police brains been cooked?

Even the magistrate was correct in stating and in asking how the banks allowed such practice. Now following the reply of the Bov speaker who adamantly stated that such practice was discontinued in May 2019 than it is time that the magistrate orders an FIAU investigation at Bov to check who the Bov speaker was and how come “fra il dire e il fare ce dimezzo il mare” One will definitely be surprised if such an investigation is carried out as this will certainly link to other interesting articles that this journal has published. Hopefully the speaker was not the Chairman of the Compliance committee as this would certainly add up to the grey areas that have arisen in view of her reach within Bov, her conflicting role as well as indefinite employment with the bank’s external lawyer. 2.3 million fine and no appeal should ring a bell. Trust us more will be divulged very soon for the interest of shareholders.

Pick and choose Justice. To be credible the Police should also prosecute those politicians big fish who have repeatedly stolen from taxpayer’s money not only harmless small fish that are not even aware this is against the law.

Will the Magistrate order an FIAU inspection at the banks that are involved particularly Bov since these have even commented that they had changed their policy in May 2019. So what happened after. Possibly the Chair of the Compliance Committee can give us an explanation and if also nothing is in the wrong she should also be called to testify in this ongoing court case. However she should be given a waiver if requested to explain why the 2.3 million fine that the FIAU had imposed on the bank on another breach was not appealed. It is important also to check who was the Chair of the Compliance committee when such fine was imposed and one would start seeing the jigsaw puzzle being easily sorted out.