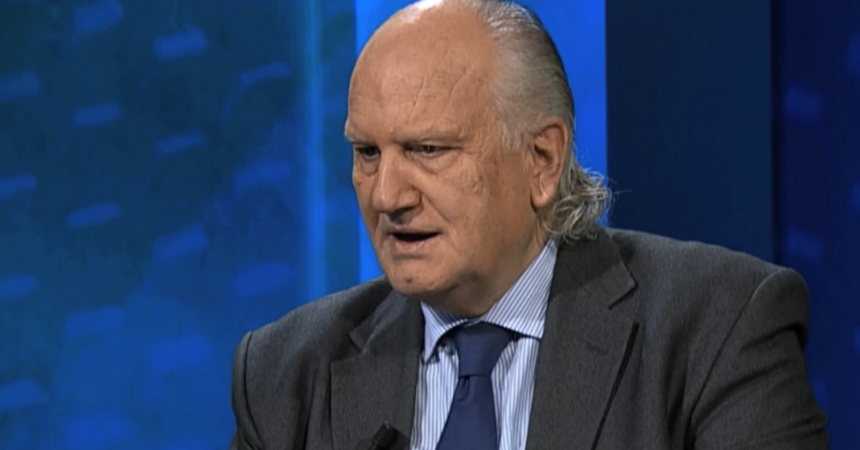

Labour stalwart Alfred Mifsud was this week appointed as the arbiter for financial services even though his predecessors in the position had found him guilty in no less than 66 cases, research undertaken by The Shift shows.

Several court appeals on those rulings have also harshly reprimanded Mifsud for misselling complicated financial products, failing to inform clients that their investments were doing poorly and increasing clients’ risk appetites without their approval.

Mifsud will now be tasked with handing down judgement on financial services operators when he has quite possibly been found guilty of the very same breaches.

Mifsud sold his private business, Crystal Finance, in 2015 in the wake of the debacle. After that, he was appointed as deputy governor at the Central Bank of Malta during the Joseph Muscat administration. Muscat used to work for Mifsud at Crystal Finance.

The Muscat administration found ways to overlook Mifsud’s notorious past with Crystal Finance and appointed him to the second-highest position at the central bank.

But the Abela administration this week went a step further and made him the very same arbiter, of financial services, that found him guilty of 66 breaches during his time at Crystal Finance.

Many of those cases went to the appeals court.

In one such case, the Court of Appeal presided over by Mr Justice Anthony Ellul found it could “not understand how the client, an old woman who can’t even read and write, could ever understand all those things [she was being sold].

“For the court, it was obvious that that was not a suitable product for her and her husband, no matter what [investment advisor] Michelle Stanmore and Alfred Mifsud say.”

The woman had been sold a financial product with a CCC- rating that had been classified as medium risk although, according to the court, a CCC- rating “gives a clear picture of high risk”.

In a scathing judgement, the court found, “From the evidence it does not appear that the client had any knowledge and experience in the field of bonds in relation to that specific product.

The court also had “no doubt” that Crystal Finance, under Mifsud, breached the client’s trust when it spent “a whole year watching the value of the investment drop and did not speak to her”.

In another case, a client sued Crystal Finance for failing to inform him in time that the stock portfolio it created for him was failing miserably.

The same judge found it was clear that the investor depended upon information from Crystal Finance to make his portfolio decisions. But, the court found, “When the crucial time came, Crystal Finance decided to not inform the client in a timely manner about the situation.”

Moreover, the court found that it could not understand how “after a suitability test was carried out that established a medium risk appetite for the client, Crystal Finance advised him to buy into a high-risk investment.”

In another case, in which Crystal Finance lost an appeal against a woman who sued the company for selling her junk bonds, the Court of Appeal found the bond she had been sold was clearly of a high risk given its CCC- rating.

“The court does not understand how, based on the information that Crystal Finance was supposed to have about the client’s knowledge and experience, it could propose such an investment.”

The arbiter had previously found, “The investments offered to the complainants were not in their best interests. They were not adapted to their circumstances and reasonable and legitimate expectations.

“The clients were advised to invest in risky products rather than in products matching their actual risk appetite, which led to the losses they have suffered.”

The appeals court then found Crystal Finance responsible for failing to have given the clients the correct information it was obliged to have given when advising on an investment portfolio.

Despite the complexity of the investment, the court found, there was no “evidence that the clients used to trade on a regular basis in those kinds of local investments, nor does it appear they were asked what losses they were willing to accept on the investment.”

A long-time piece of the furniture at the Labour Party, Mifsud also chaired the party’s media arm, One Productions, between 1999 and 2001. Before that, between 1996 and 1998, he was chairman of Mid-Med Bank before it was sold to HSBC.

Mifsud was appointed as a non-executive director at Bank of Valletta in January 2020 and resigned this week in tandem with the new appointment.

So he sold his business to Calamatta Cuschieri. He is now meant to decide cases launched against Calamatta Cuschieri on mis-selling of investments. Yet another clear of conflict of interest.

So we have disgraced Edwina Licari at MFSA’s helm, Pilatus’clean bill of health issuer Alfred Zammit at FIAU’s helm and incompetent Alfred Mifsud as Financial Arbiter. It really augurs well for the industry.

With the current Attorney General in place and Gafa appointed as Commissioner of Police by the Prime Minister too, I think it is safe to presume that every single case of financial misconduct by “ friends” of the government or indeed current and past members of the government have now been well and truly headed off at the pass.

We have to hope that the European Justice Commissioner learns of this latest outrageous snub by the PM to ensuring the rule of law is being upheld.

Mr. Mifsud the first time you go to your new office make sure you take with you a brand new heavy duty paper shredder.

I am sure there is a lot of evidence, against your past Crystal Finance sordid deeds, which you must be so eager to destroy !

A match made in heaven. His expertise is second to none.

When one applies for a job or at times even to do charitable work a police certificate of good conduct is asked for. But it seems this is only for us not for the chosen who they keep recycling from one job to another

That’s what one calls ‘the irony of history’!!

Dan nahseb li se jirrizenja qabel ma jidhol. The shift news tatna CV eccellenti dwaru.Prosit Ministru Caruana li nahseb int kont li appuntajtu. Ministru caruana ghara li l istima li ghandek min hafna ma tkunx inti li tintefa l ABİSS. Mhux forsi l artiklu li kiteb dan l ahhar kien xi RİKATT HUX.

Please , this is not a case of ” It takes a thief to catch a thief” but a case of ” A friend in need is a friend indeed” , in need of being protected from the law.

The joke of the century. Pity his appointment was not dated 1st April.

This appointment should be produced in textbooks to give an example of the meaning ‘not fit and proper’.

Perhaps the MFSA should also include it in their induction course for new employees in their lectures on ‘due diligence’.

Another incompetent failure rewarded by the MLP.

Criminal. Financial arbiter

Some time ago I met him at a demonstration and he was all out against this Mafia administration- hope he was not there to spy on people. Change of heart again or greed?

The only suitable persons capable of running government entities are “tal partit”. What is the purpose of spending years buried in books? When the main qualification is one’s STAUNCH (by furnishing donations) allegiance towards the incumbent party. The only hope left is a thousand foot tsunami…….!

Xih ghakka, fadallu zmien. Apparti revolving doors..

Fantozzi

The island is a laughing stock. Poacher turned Game Keeper, doesn’t stop him being a Poacher, he just knows how not to get caught.

This guy reminds me of the Ghost Busters Film. Plenty of shit around too.