A £20 million London home linked to British businesswoman and lifetime Conservative peer Michelle Mone is being linked back to two Malta-based tax avoidance schemes that His Majesty’s Revenue and Customs warned about as recently as two months ago.

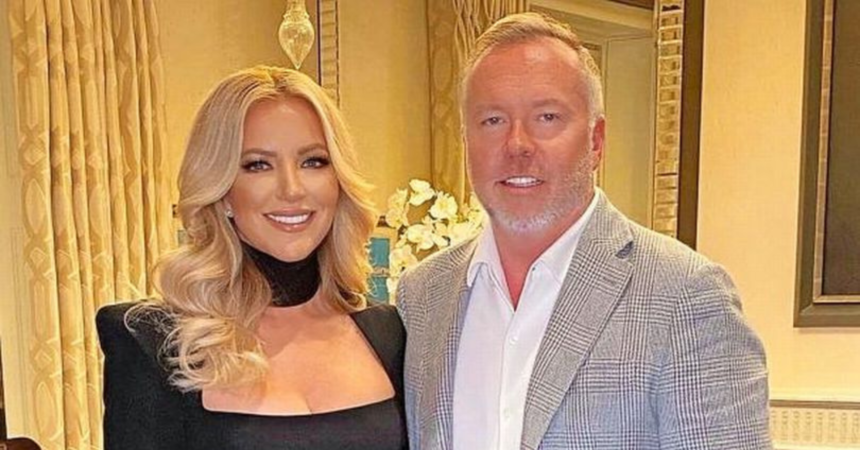

A west London property used by Baroness Mone, her husband Doug Barrowman and children has been put on the market for £20 million.

But the newfound fact that the home is owned by two offshore companies owned by her husband which, in turn, owns two tax avoidance schemes based in Malta, is causing a stir.

The UK government recently published proposals clamping down on tax avoidance and non-compliant umbrella companies.

The measures give HMRC the power to close down companies involved in promoting tax avoidance and help taxpayers to identify and steer clear of avoidance schemes by naming companies, including umbrella companies, which it describes those in Malta as being, that are under investigation by HMRC and controlled by promoters.

The Baroness, Ultimo lingerie’s founder, has denied owning the property but she has not identified who is behind two British Virgin Islands companies that own the companies on behalf of an offshore trust.

The Belgravia property is owned by Perree (PTC) Limited and Soldaldo (PTC) Limited, which are registered to her husband’s Knox Group in the Isle of Man.

Soldaldo (PTC) in turn, owns two tax avoidance schemes in Malta that were highlighted by the HMRC as late as last November. Both have found innovative ways for clients to get around paying their tax dues.

How the tax-dodging schemes work

The first Malta-based firm, Gateway Outsource Solutions Ltd, was named by the HMRC last August. Its clients enter an “employment agreement” with the Tigne Point-registered company.

A UK company known as GOS UK provides support to Gateway Outsource Solutions Malta by facilitating engagements with end clients and recruitment agencies.

The scheme’s users undertake work for the end client and submit timesheets either directly to GOS UK or indirectly through the user’s agency.

GOS UK invoices the end client for the user’s work and receives payment from the end client.

They then, according to the HMRC, receive “two salary payments, one paid at national minimum wage and a second as a loan or advance, which is not taxed”.

The second company, Integra Resourcing Ltd, meanwhile, sees users entering employment contracts with Charteris Management Ltd (CML), and providing their services to end clients through CML or sometimes through an agency.

CML will invoice the end client or agency for the work and, after deducting a fee, pay a salary at, or just above the national minimum wage. It then pays the remaining funds to the second party.

HRMC explains this second payment “is disguised as an ‘introducer fee’, as CML claims the second party introduced the scheme user to CML”.

The second party, after deducting a fee, then makes a larger payment to the scheme’s user, “which may be labelled as a ‘loan’, ‘option’, or something else”. Neither tax nor National Insurance contributions are paid on the second payment.

Both firms are registered doors away from each other in a block at Tigne Point. Both are owned by Soldaldo (PTC) Limited of the British Virgin Islands.

The London house in question had been raided by the National Crime Agency in April 2022 as part of an investigation into PPE Medpro, which won more than £200 million in government contracts after lobbying by Baroness Mone.

Love it, crooks galore, just another day in Mafia land.

It amazes me how Malta ever got off the “grey list”. Corruption and dirty business where ever one looks.

it left the gray list precisely to allow money to be taken to another tax haven country, we will see what will remain of Malta after this year

When life gives you lemons 🤣 trade them lol