More light is being shed on the shady dealings Binance is suspected of having run through Malta during its year-long stint on ‘Blockchain Island’ when the leading cryptocurrency exchange was loosely, if at all, regulated.

The latest revelation is that Binance had processed close to $346 million in bitcoin for the Bitzlato – a digital currency exchange whose founder was arrested by American authorities last week over allegations the exchange was running a “money laundering engine”.

The US Justice Department charged Bitzlato’s co-founder and majority shareholder Anatoly Legkodymov, a Russian living in China on 18 January with operating an unlicensed money exchange business that “fuelled a high-tech axis of cryptocrime” by processing $700 million in illicit funds.

Binance, which was active in Malta between October 2018 and October 2019, when it left the country once regulations governing cryptocurrencies became more stringent, was among Bitzlato’s top three counterparties by the amount of bitcoin received between May 2018 and September 2022, according to the US Treasury’s Financial Crimes Enforcement Network (FinCEN).

It is not known exactly how many of those funds went through Binance when it operated from Malta between 2018 and 2019.

Binance, however, was the only major crypto exchange among Bitzlato’s top counterparties, FinCEN said. As for Bitzlato’s other counterparties, Binance was in dubious company. These included the Russian-language drugs marketplace Hydra and Finiko – a crypto investment website described as “an alleged crypto Ponzi scheme based in Russia.”

Bitzlato was, however, a “primary money laundering concern” related to Russian illicit finance, FinCEN added.

Bitzlato bragged about its lax background checks on clients, the US Justice Department said, explaining that when the exchange asked users for identification, “it repeatedly allowed them to provide information belonging to ‘straw man’ registrants”.

Binance chief strategy officer Patrick Hillmann recently admitted in an interview with The Washington Post that the world’s largest cryptocurrency exchange that set up shop in Malta in 2018 ‘had shortcomings in its approach to regulatory compliance in the first few years of its rapid expansion’.

Binance, which was launched in 2017, moved to Malta in those same early years, during the Joseph Muscat administration’s ‘Blockchain Island’ fever, after relocating from China and Japan because of their increasingly stringent regulations.

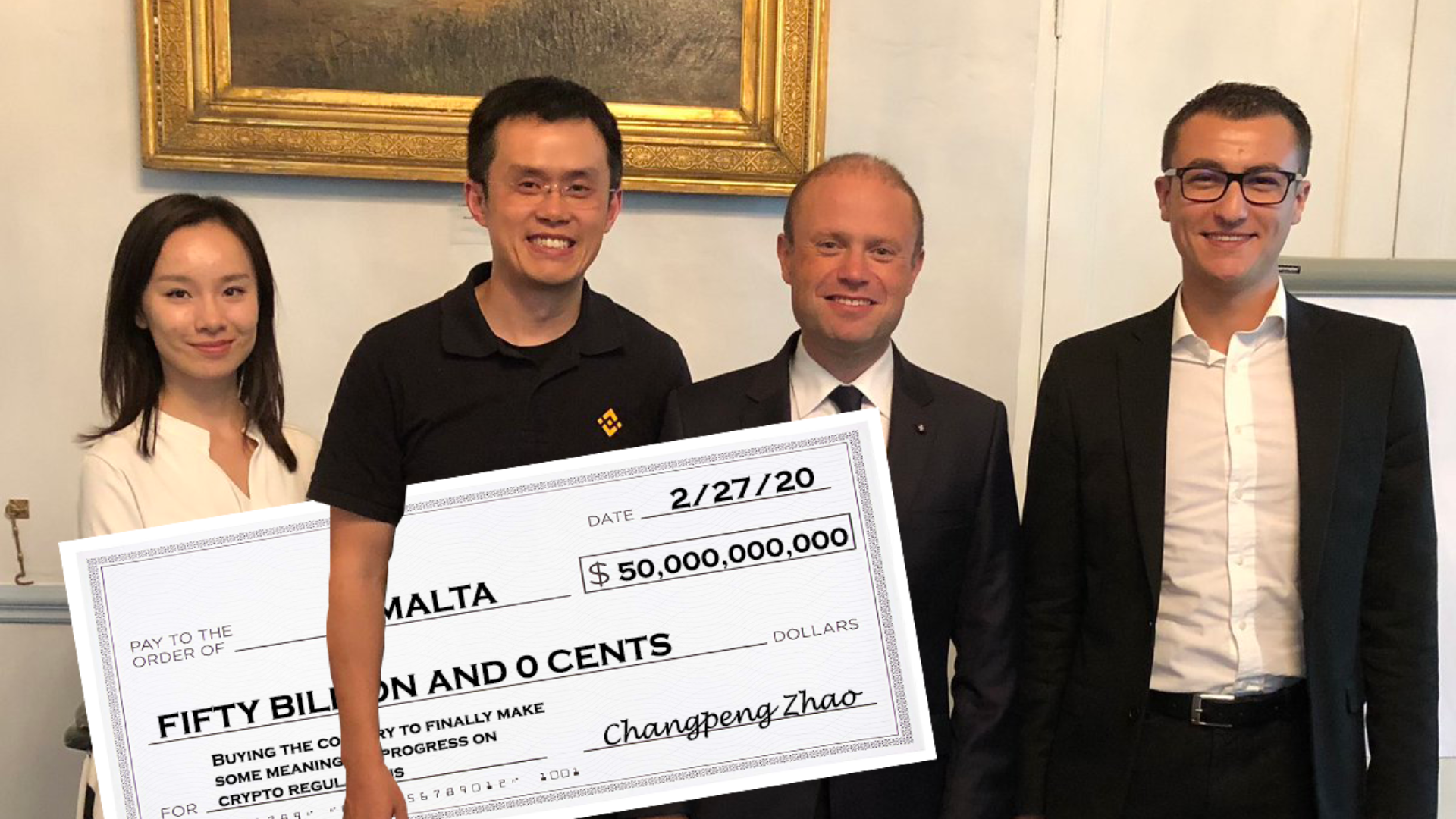

Binance CEO and founder Changpeng Zhao presenting then-Prime Minister Joseph Muscat and Minister Silvio Schembri a $50 billion novelty cheque to ‘purchase’ Malta – ‘Blockchain Island’.

According to Hillman, the company has now changed its ways and is attempting to make a clean break from its early days of shaky regulatory compliance.

As he told The Washington Post, “Over the last two years [i.e. since 2020], the company has completely changed its posture. Now that we have those resources, we are easily one of the most proactive parties to identify, freeze and get back funds” that were laundered.

Binance said it was to set up shop in Malta in March 2018, and in October 2018 Malta passed its blockchain law that allowed crypto companies to apply for licenses to operate from the country.

Binance was operational in Malta between October 2018 and October 2019, when companies in the cryptocurrency space, particularly exchanges that shifted to Malta and before the October 2018 start date of the new law had one year – until October 2019 – to seek authorisation by becoming compliant with regulations.

Until that “grandfathering period” elapsed and their applications were processed, companies such as Binance were essentially exempt from the need for authorisation or even the need to comply with anti-money laundering laws.

This largely explains the rush of big companies, including Binance, in the sector registering their interest in setting up in Malta at a time when other governments were focusing on regulating the sector.

It was just before that concession period elapsed that Binance informed the Malta Financial Services Authority that it had abandoned its plan to base itself in Malta.

An investigation by Reuters has shown how a torrent of illicit funds flowed through Binance between 2017 and 2021. It found that over that period Binance processed transactions totalling at least $2.35 billion from predicate crimes such as hacks, investment fraud and contraband drug sales. Binance’s period in Malta falls right in the middle of that.

Reuters made the calculations by examining court records, statements by law enforcement and blockchain data that was compiled for the news agency by two blockchain analysis firms.

And it would appear that the Hong Kong-registered Bitzlato used Binance’s services when the latter was operating under the cover of Malta’s Blockchain Island.

It is believed that Binance’s status as one of Bizlato’s top counterparties will lead the US Justice Department and Treasury to focus on Binance’s compliance checks with Bitzlato, which quite possibly involved Binance’s dubious stint in Malta.

Reuters this week reported how Binance moved over 20,000 bitcoin, worth $345.8 million, across some 205,000 transactions for Bitzlato between May 2018 and its closure last week.

The figures were compiled by US blockchain researcher Chainalysis and were seen by Reuters.

The US steps against Bitzlato are being taken as the Justice Department investigates Binance for possible money laundering and sanctions violations. Some federal prosecutors have concluded that the evidence collected justifies filing charges against executives including founder and CEO Changpeng Zhao, Reuters reported in December.

Binance has processed at least $10 billion in payments for criminals and companies evading American sanctions, Reuters found in a series of articles last year based on blockchain data, court and company records.

That criminal investigation is reported to have begun in 2018, just as Binance landed on ‘Blockchain Island’. Those investigations are focused on Binance’s compliance with US anti-money laundering laws and sanctions.

But despite its departure from Malta at the end of the interim, loosely-regulated ‘grandfathering’ period, Binance kept exploiting the coverage it received in Malta to inform its users around the world that it was “governed under the laws of Malta”.

This led the MFSA, on two occasions, once in February 2020 – after the departure of Joseph Muscat, Keith Schembri and Konrad Mizzi from government – and again in July 2021 to clarify that Binance is not authorised to operate under Maltese law.

“Binance is not licensed nor authorised by the MFSA to conduct any VFA related activities in or from Malta and therefore falls outside the MFSA’s regulatory oversight,” the regulator said.

Although Binance had all but vanished from Malta, it left behind two companies that are still active: Binance Marketing Services Limited and Binance Europe Services Limited.

Both were set up in April 2018, are directed by Guangying Chen and are owned by Binance founder and CEO Changpeng Zhao.

Governance at it’s worst. Now what would be interesting is who was even remotely involved when these fraudsters were allowed to operate in Malta, without the necessary investigative constraints and appropriate legislation in place.

It seems that Binance made quite a lot of hay while the sun was shining in Malta.

But all that they made seems to have gone rotten and grown moldy because of a good showering by the USA justice system!

Maybe Sai introduced this company as she did Huawei to earn her €13500 per month salary as she did say we don’t know what she brings to malta as she works behind the scenes?

I am sure that FUAU will enlighten the general public and shed light on all the grave concerns raised by Shift. FIAU is so meticulous and conscientious about all the necessary rubber stamps of financial services practitioners that they surely would not be embarrassed by the jungle of illegalities and money laundering instigated by the government regime in the relevant years.

Be ware of Sharks