An op-ed by a leading financial analyst in Malta.

Bank of Valletta Chairman Gordon Cordina is reported to have said (Businessnow, 8 May) that the market’s response to the settlement announcement regarding the Deiulemar court case was very positive with the market reacting immediately and strongly “as the bank saw its share price soar by 26%”.

There is no economic rationale deriving from the company announcement that should cause the price to go higher than the pre-announcement level – the settlement of €182 million will have caused a further hit to the shareholders’ funds of the Bank of a further €100 million to the provision already made of €80 million.

No lessons appear to have been learnt by BOV, which is insisting that it has acted correctly all along from 2009. Once the Bank has agreed to pay this exorbitant amount when it is saying that it was not due, it cannot set the minds of shareholders at rest that such a similar “blameless” bolt from the blue could not occur again at any time.

As of close of business of the 3 May, immediately before the publication of the BOV Company Announcement announcing the Bank’s capitulation of its legal dispute with Deiulemar’s liquidators – when all along the past seven years the Bank had insisted it had a solid claim and no need to make a provision for the case lost earlier in the year – the stock price was €0.78c5.

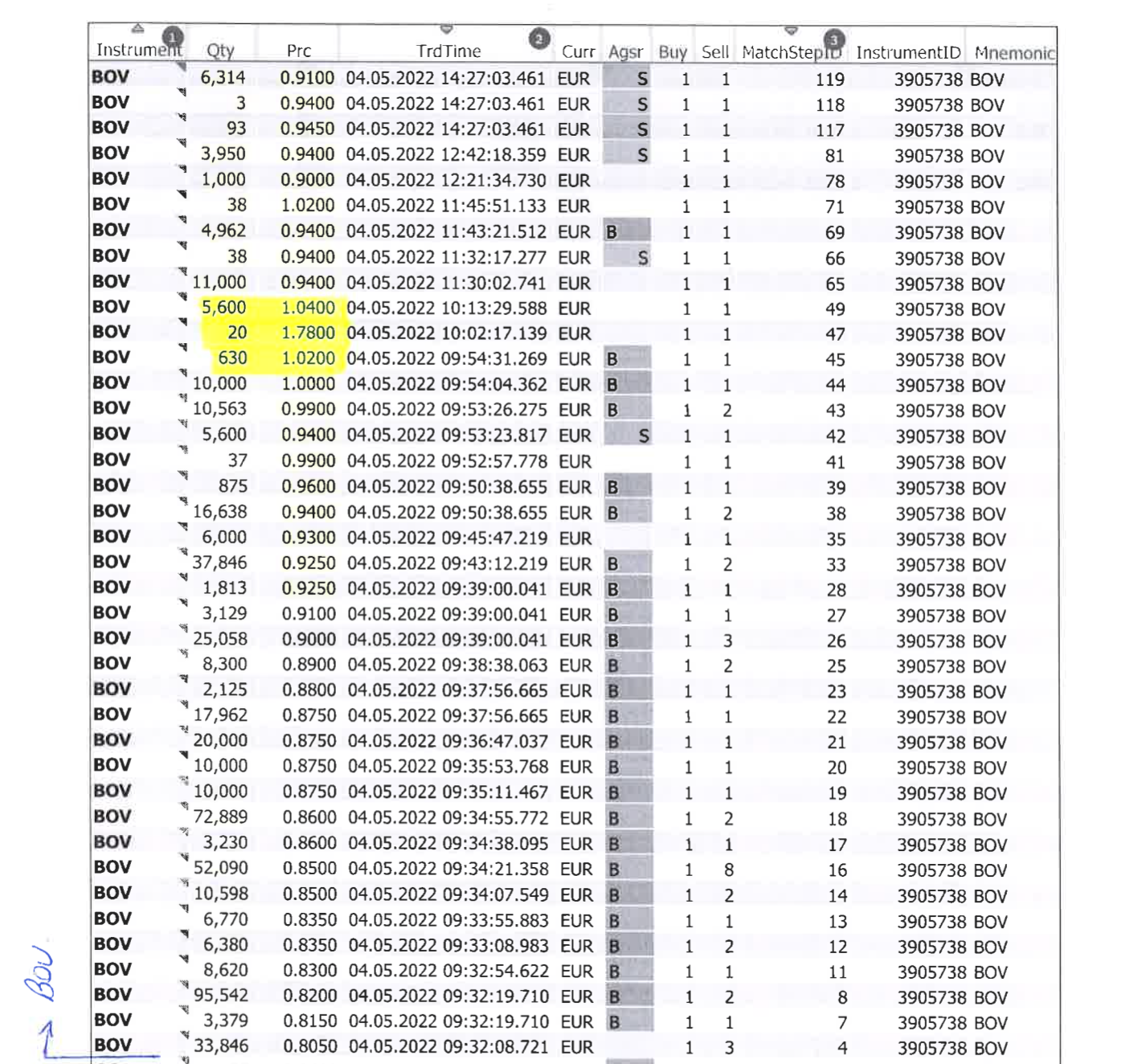

Immediately after the announcement was made, substantial purchase orders started flowing on the Malta Stock Exchange. By 09:54am the price had reached €1.02.

What happened next is very interesting. At 10:02, some participant in the market seems to have made a manifest attempt to manipulate the price of BOV by placing a purchase order of 20 shares at €1.78. If the market had closed at that point in time, the closing price of BOV would have ended at €1.78, an increase of 226%.

The intention of the perpetrator seems intended to force an artificial increase in the market price. The rationale behind such buying positions is usually solely to shift the price of this financial instrument to an artificial level to generate interest from other investors.

A document downloaded from the MSE server showing a list of transactions that took place over the MSE on 4 May is being published below. The identity of the stockbroker involved and the identity of the ultimate purchaser are not known, or rather known only by the parties involved – the Malta Stock Exchange and Bank of Valletta.

In response to questitons from The Shift, both MSE as well as BOV cite confidentiality provisions and disclose no information. The Bank did say that The transactions executed on 4 May at 10.02am were alerted by our automated trade surveillance system and investigated accordingly on 5 and 6 May.

The trade completed at €1.78 did not trigger any genuine business at this manifestly artificially inflated price. The price of €1.78 lasted only until 10:13, when the price reverted to €1.04. Effectively, the share price ended that day’s trading at €0.91.

It has since continued to thread lower since then, ending yesterday 14 June at €0.85, an increase of less than 9% on the previous price of €0.78.5 rather than statistician Gordon Cordina’s claim of 26%.

The MFSA is the competent authority charged by the Prevention of Financial Markets Abuse Act to administer strict EU legislation in the form of the Market Abuse Regulation and the Market Abuse Directive on criminal sanctions for market abuse to prevent, suppress, identify and prosecute illegal market practice. What sort of investigations have been made?

What has the Authority done to ensure the integrity of financial markets and to enhance investor confidence in the operation of our only regulated market, the Malta Stock Exchange? And what has the Malta Stock Exchange itself done in connection with this? And the Economic Crimes Unit of the Police?

Who placed this order? Was it an attempt by a solitary investor, or was it part of a wider net, perhaps a retail investment fund, which would have benefited from such manipulation? What economic rationale did the purchaser have to cause an increase of 226% by the mere purchasing power of a 20 share purchase order?

Was there any indirect connection between the purchaser and any Connected or Restricted Person of the Bank? How on earth could this have constituted legitimate behaviour?

Are the authorities even aware of what happened? Or has everything been relegated to be swept under the table in the belief that this unsuccessful attempt will not have been noticed by the public and that therefore it does not make sense to ruffle the feathers?

Editorial note: The Shift has put the questions raised in the opinion piece to the relevant authorities. Below are their answers of Bank of Valletta, MFSA and Malta Stock Exchange in full. The police did not reply to questions.

BOV

“The transactions executed on 4 May at 10.02am were alerted by our automated trade surveillance system and investigated accordingly on 5 and 6 May. In line with our client confidentiality obligations, we cannot divulge details of the broker who placed the order. Following the investigation by our trade surveillance team, no further action is deemed necessary.

Furthermore, with reference to your statement “just a few minutes after the BOV made an important company announcement”, kindly be notified that the Bank issued the company announcement to inform the market about the out-of-court settlement of the Deiulemar litigation on 3 May at 7:18:59 pm. This can be evidenced from the Malta Stock Exchange (MSE) website which contains a date and time stamp. It was also uploaded on the bank’s website within a few minutes from publication of such company announcement on the MSE website.”

MFSA

“Any ongoing supervision and investigations are carried out by the MFSA with full respect to confidentiality requirements. In terms of law, enforcement actions imposed by the Authority are published on our website and thus are in the public domain.”

Malta Stock Exchange

“You may wish to note that the Malta Stock Exchange is a licensed entity and in terms of law is authorized to conduct the business of a regulated market by the MFSA. As part of the business of operating a regulated market the Exchange, on a continuous basis, monitors for any suspicious orders and trades. In this regards the Exchange is answerable to the Regulator and would, in terms of the said licence provide all the necessary/requisite information to the Regulator, for any appropriate action to be taken should any form of market manipulation be detected. Otherwise, we have no further comments to make.”

Ma tieta tafda l-hadd fuq din il-gzira mmexxija mill-MAFIA. flus l-onest immanupilati mill-korrotti.

Nixtieq naf ghaliex il bov ma ghamilx rixrki mehtiega, meta ghamel ix

xirja ta Deiulemar, hu min sa jihu ir responsabilta,ta euro 182.5 miljun,

is Share Holders? jew min ghamel dan in nigozju?.

Verissmu, hekk Hu.

Share holders pay for others blame, what a shame bov how treating the share holders.

Dan lahhar snin fejn qatt ma qasmu divedents bi skuza ta Delmar, allura dawl IL flus li warbu fejn marru???? Ghax kienu ghejdlu li liispijza ta Delmar diga imwarba, ha ha ha u xorta is share holders baqaw B,xiber imnieher. Ghara Vera mhux ta minn jafdakhom.