The FIAU has fined shuttered money-launderette Pilatus Bank €4.9 million. The penalty is the very definition of the expression ‘too little, too late’ – the bank was finally shut down by the European Central Bank – after Malta failed to act – in 2018 after its CEO was arrested in the US, despite myriad reports of wrongdoing from assassinated journalist Daphne Caruana Galizia starting from at least 2016.

Reading about the FIAU report on its investigation into the bank, in which it says it identified wrongdoing in a whopping 97% of the bank’s operations, with suspicious transactions being allowed through without scrutiny in 86% of cases, was a stark reminder of what Caruana Galizia was up against as she sought to open people’s eyes about the reality behind the false smiles and fake bonhomie of the PL government.

It’s also a stark reminder that we’re still there, still stuck in that world of inside-out, upside-down reality fostered by the lies, gaslighting and obfuscation of the coven of crooks squatting in Castille. The same people who partied at the Pilatus Bank CEO’s wedding, who celebrated the inauguration of what has been proven to be nothing but a sordid, ill-intentioned criminal scheme, still at large, still spared having to face justice.

Despite the conclusions of the public inquiry into Caruana Galizia’s murder, which laid the blame for the brutal killing squarely at the feet of the men and women who, for their own nefarious ends, turned Malta into a criminal enterprise, squandering the nation’s resources on massive capital projects designed purely as a source of siphoned-off funds for themselves.

That culture of impunity they created in order to do that, and that led to Caruana Galizia’s assassination, hasn’t even been dented. Corrupt and scandalous contracts, jobs-for-chums and secret deals with hidden hands have simply gone on being doled out to political cronies, trolls attack journalists calling out politicians or exposing wrongdoing and engage in smear campaigns, some insidious and underhand, others open and obvious, though no less distressing.

The economy is about to fall off a cliff, and yet ministers dole out illegal gifts, jobs and direct order contracts to selected supporters and donors to the tune of many millions of euros in each ministry. The institutions are as hamstrung as they’ve ever been, the police as incompetent and unwilling to do their duty as they’ve been for the past eight years.

And now, like some dismissive crumb tossed to a wayside cur, the FIAU has, far too late to make any difference to anything, decided to issue a paltry fine to a company that no longer exists.

Pilatus Bank was granted a licence in 2014 by the MFSA under then-chairman Joe Bannister and former finance minister Edward Scicluna. The permit was issued in breach of all proper regulatory standards: Pilatus chairman and owner Ali Sadr Hasheminejad was already known to be under investigation in the US for serious financial crimes and he had no experience in banking. Calls from Opposition MEP David Casa, among others, were ignored, and the laundromat was allowed to continuing functioning until the ECB stepped in.

The FIAU is years too late with its fine – which, given the extent of criminality and magnitude of the sums exposed by the agency’s report – is minute. In terms of penalising the bank, it falls far short. But even more importantly, in terms of warning other institutions of what they face if they’re ever tempted to go down the same route, it’s miserable.

Indeed, it’s more of an encouragement than a warning. Five million euros to institutions holding and managing billions for shady customers is nothing: almost like an extra licence fee. Five million euros for four years of criminality equates to a dirty business pass of €1.25 million a year.

How do other jurisdictions deal with banks that break major rules such as failing to apply anti-money laundering or counter-terrorism financing rules, or participating in, or enabling corruption? There’ve been a number of very high profile cases over the last five years,

In March this year, the UK Financial Conduct Authority (FCA) started criminal proceedings against NatWest for having failed to monitor and scrutinise a bank account into which £365 million was deposited, two-thirds of it in cash, over a five-year period. This is the first time the UK has brought criminal charges against a bank for failing to apply stringent enough money laundering checks, a clear signal that the consequences for wayward lenders are going to get harsher.

More commonly, banks found in breach of the regulations designed to stop criminals from being able to legitimise the proceeds of crime, have been slammed by mega fines, sometimes reaching into the billions of dollars.

Last year, Goldman Sachs was hit by two record fines, one from the US and the other from Malaysia, on charges of money laundering, bribery and misuse of funds, in a massive scandal involving the latter country’s sovereign wealth fund, 1MDB. The lender paid $2.9 billion in fines in the US, and a further $2.5 billion dollars in Malaysia.

Also in 2020, Wespac Bank in Australia was fined $920 million over AML and CTF violations, which is reportedly the largest civil fine ever in that country. In the same year, SEB in Sweden was fined $150 million for allowing money laundering activity in its Baltic branches.

In January this year, the US fined Deutsche Bank more than $124 million on similar charges, though the bank has actually been slapped with a much bigger fine in the past: it had to pay $600 million in 2017 in a Russian money laundering case.

Fining Pilatus Bank, a bank that allowed hundreds of millions of euros worth of suspect transactions to be channelled through its accounts, a paltry €4.9 million is a joke.

Clearly, the natural next step should be for the police to immediately act to arrest anyone who was involved in this criminal enterprise, or in helping the owner and his directors evade justice: Edward Scicluna, unbelievably still skulking in the Central Bank as its supposed governor, Lawrence Cutajar, the spineless former police commissioner who allowed Hasheminejad to flee the country with bulging bags while he sat idly at a restaurant in Mgarr, and any of the former or current ministers or MPs who had accounts at Pilatus Bank.

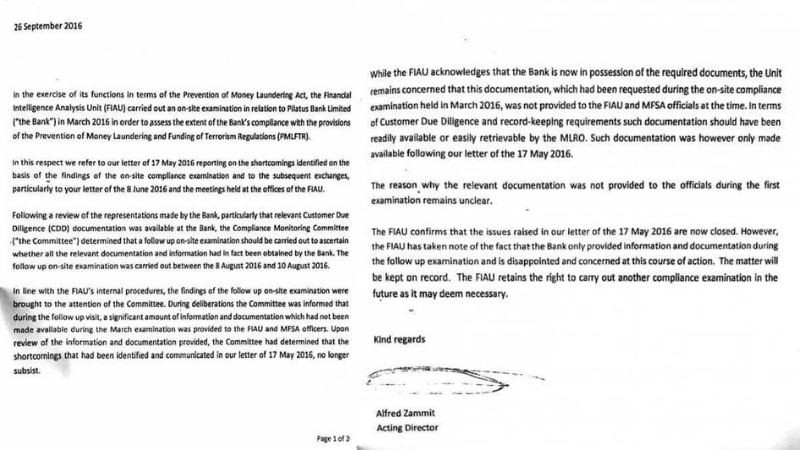

In September 2016, after an FIAU inspection earlier that year had highlighted a series of shortcomings in the bank’s operations, the FIAU’s acting director, Alfred Zammit, wrote a letter claiming the issues highlighted in the unit’s May letter had been closed.

Letter signed by FIAU Acting Director Alfred Zammit giving Pilatus Bank the all-clear after the FIAU’s own report had flagged irregularities in the bank’s operations.

Thus closed a crucial window of opportunity for Malta. Zammit, too, must be questioned about why he made the statement that effectively shut down all investigations into Pilatus Bank’s illegal activities for the next several years.

Money laundering is a serious crime, carrying some of the heaviest penalties in legal systems across the western world. Yet here in Malta, an institution that has been found to have allowed irregularities and wrongdoing in almost all of its accounts, is fined a paltry sum, after it’s been shut down and effectively no longer exists.

They’ve left everything far too late for anyone to be able to feel confident that this is any kind of breakthrough. And if it fails to convince us, they can be quite sure this latest exercise in window dressing won’t fool the FATF either.

Featured photo credit: Daniel Cilia

Alfred Zammit is still working at FIAU. He is the deputy director, for which he is paid tens of thousands of euro per year. He has the power to dish out fines to whoever he wants and not to fine whoever who wants. He must be investigated and prosecuted.

Another incisive and cogent article by Blanche exposing all the usual suspects with the usual whitewashed excuses from the proper authorities and institutions.

Too little and too late indeed!

This is just a bluff by the FIAU to pretend that disciplinary action against Pilatus Bank was taken.

U niftakar lil ex Kummisarju tal pulizja ma jaghmel xejn u baqa immexmex il fenek ma shabu l İmgarr. Niftakar lil propjtarju hiereg ma dik is sinjorina rasa baxutta nizlin dak it tarag fis satra tal lejl. Niftakar lil Konrad hiereg min pilatus bank u gie imwaqqaf biex jaghmlulu intervista tan NET

Dr Sant Fournier ghadni kif qrajt l ittra li ir russa tat lil Manwel Delia fid Dicembru tat 2017 li kienet indirizzata lilek. Erga ghaqra u indemm. İttra profetika. Min lawrja f universita ghal akkuzi Kriminali. Ghandek wicc tohrog barra.

Sur Borrg. Tista taghtini hjiel fejn nista naqra l’ittra. Tks