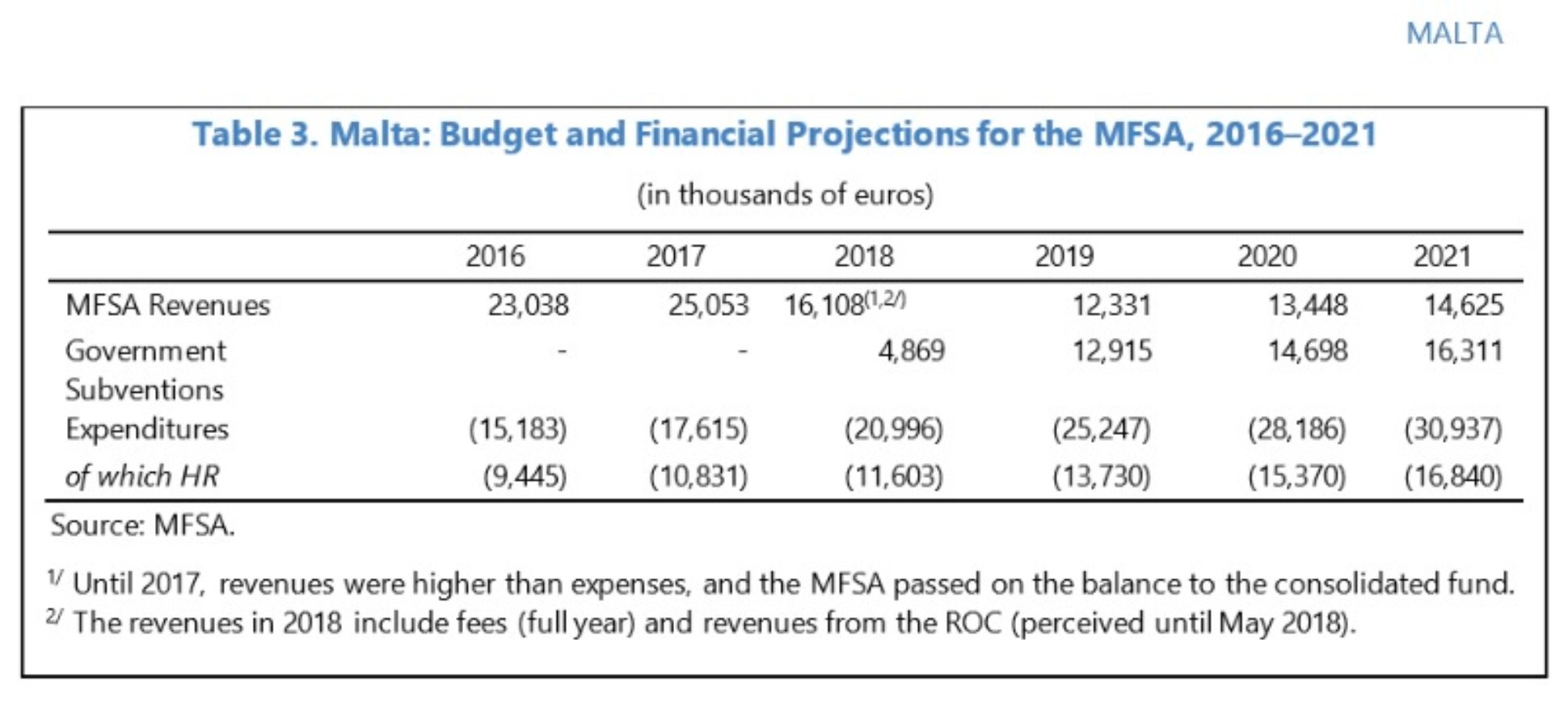

An analysis of the 2019 accounts of the Malta Financial Services Authority shows a staggering €25 million was needed from the government to keep the Authority afloat, as it overshot its own financial plans by 40%.

While estimates for 2019 submitted by the MFSA budgeted just over €25 million in operating expenses, the actual costs skyrocketed to €35.2 million – an overrun of more than 40%, according to the Authority’s report.

The MFSA budget submitted to the IMF.

The IMF last year drew attention to the issue of the regulator’s reliance on State funds.

One of the main contributors to the increase in expenditure was the recruitment of new managers, including top aides who used to work with CEO Joseph Cuschieri in other organisations.

The MFSA paid almost €2 million in an ad hoc early redundancy scheme, targeting some of the most experienced managers and replacing them with new recruits. Employee costs increased by €3 million in one year, from €12.5 to €15.4 million.

In 2019, the Authority also spent lavishly on flashy communications and events, with costs reaching almost €700,000.

As the Maltese financial services industry is under an increasingly dark light over many money laundering scandals, the Authority has been put under intense pressure to pull up its socks.

Facing the prospect of Malta being blacklisted, with the likes of Panama, by the Financial Action Task Force on money laundering as well as rebukes by European Super Regulators, the MFSA is in a race against time to show that it is changing.

The international pressure, caused by years of neglect by the same Authority, also had an adverse effect on spending.

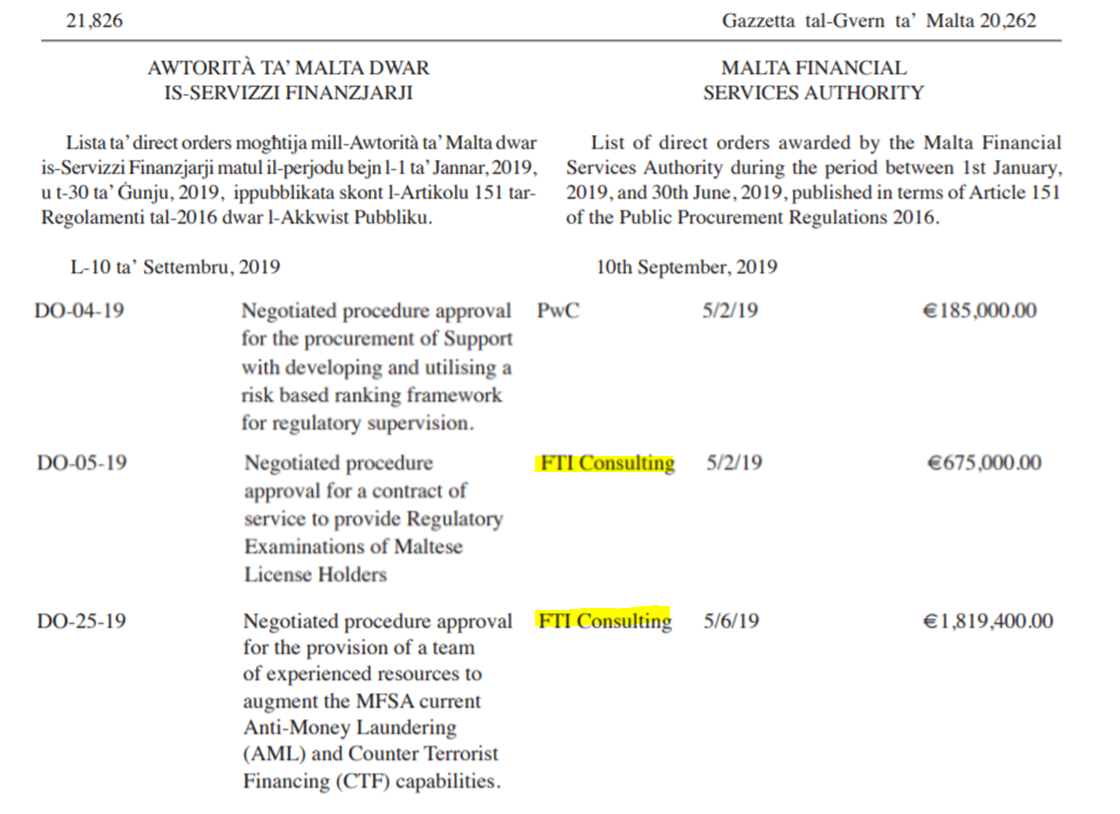

MFSA’s expenditure on consultancy fees, including anti-money laundering support, reached €13.5 million last year according to its published accounts. These expenses, which include contracts given through direct orders, are broken down in the accounts as:

- €2.4 million in unlisted professional fees, an increase of more than €1 million from 2018,

- €2.3 million in again unlisted “regulatory support fees”, a new line-item since 2018, which also increased by over €1 million from last year, and

- €8.8 million in nondescript “enforcement and compliance fees”, another new line-item since 2018 and which ballooned by a staggering €5 million since last year.

Despite the international focus on Malta’s financial services, the watchdog was still embroiled in a serious of negative headlines during the past months, particularly over the lack of good governance and accusations of abuse of public funds by the CEO.

Extract from Direct Orders awarded by MFSA in 2019. Source: Government Gazette (pdf)

A swing of €15 million

Yet, increased expenditure in anti-money laundering efforts does not explain the full picture, according to financial experts consulted by The Shift. “Since its inception, the MFSA had always made a profit…until 2018, when a change at the helm led to an explosion in expenditure and the Authority registered a loss of €7.9 million.”

The MFSA passed on profits to the government annually. In the two years prior to Cuschieri’s appointment, the MFSA registered a profit of €8 million in 2016 and €7.5 million in 2017. The following year, the Authority registered a swing of over €15 million, turning its registered profit into a loss.

Operational costs increased from €17 million in 2017 to €24 million in 2018 and €35 million in 2019.

While the fight against money laundering is used to justify the increase in expenditure, the IMF has recently said the relevant authorities are not equipped with adequate resources to be effective.

In a public clash last year, a senior member of the MFSA’s Board and former Labour Justice Minister, Joe Brincat, accused Cuschieri of running the watchdog like a personal fiefdom.

Brincat claimed that in order to get rid of the Authority’s Chief Operating Officer, Cuschieri offered him a golden handshake – paid by taxpayers and without the Authority of the Board. Although the COO, Reuben Fenech, did not take up Cuschieri’s offer, he was still sacked and replaced by a former colleague of Cuschieri at a private firm.

Another MFSA official, George Spiteri, was paid over €150,000 to retire, only to be recruited once again in the same job at an offshoot of the MFSA.

These cases are being investigated by the National Audit Office.

The MFSA recruited Cuschieri to head the Authority on the direct order of the Office of the Prime Minister in Joseph Muscat’s time. Known for his close relationship with former OPM chief of staff Keith Schembri, Cuschieri was immediately installed as Head of the Malta Gaming Authority, shortly after Labour was returned to power.

Cuschieri’s time at MGA was characterised by claims of lavish overspending including suspect interior design contracts. Some of Cuschieri’s closest aides at the MGA are now working at the MFSA.