A Maltese Judge has sanctioned the release of €1.5 million to a Dubai company owned by Yvette Debono, whose husband Gordon Debono has assets frozen in relation to charges he is facing on fuel smuggling from Libya to Italy.

Court documents show that a Dubai company called International Properties and Investments Limited argued that it was due money – €1.5 million plus 3.5% interest – for a loan granted to a company in Belize called Oil and Ship Consultancy Limited.

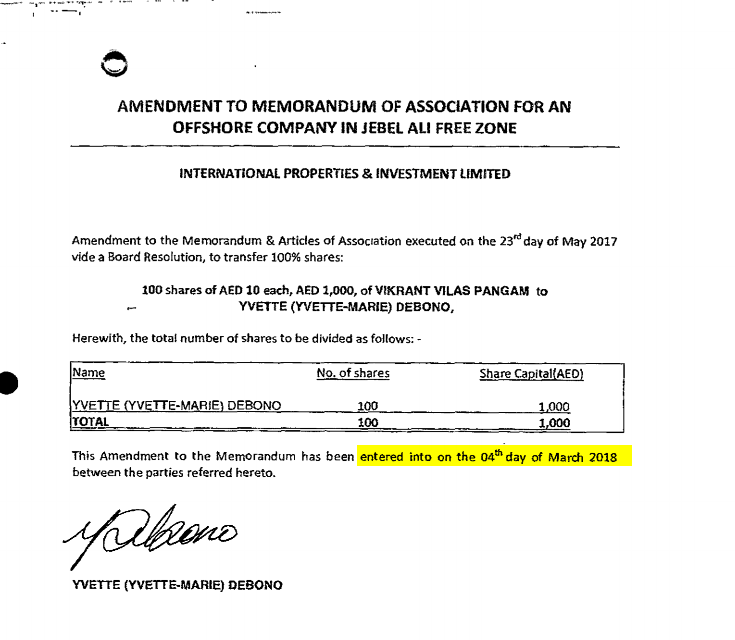

Documents submitted in relation to the case show that the Dubai company was acquired by Yvette Debono from a corporate service provider, as a shell company.

Court documents filed include evidence that the Dubai company is solely owned by Yvette Debono, Gordon Debono’s wife.

The date of the €1.5 million loan purportedly given to the company in Belize is listed on court documents as having occurred a month before the arrest of her husband, Gordon, together with Darren Debono in Italy.

Darren and Gordon Debono (no relation) are both accused of smuggling fuel from Libya to Italy. They are facing charges in Italy, and their assets are frozen as both are subject to sanctions by the Office of Foreign Assets Control, the financial intelligence and enforcement agency of the US Treasury Department.

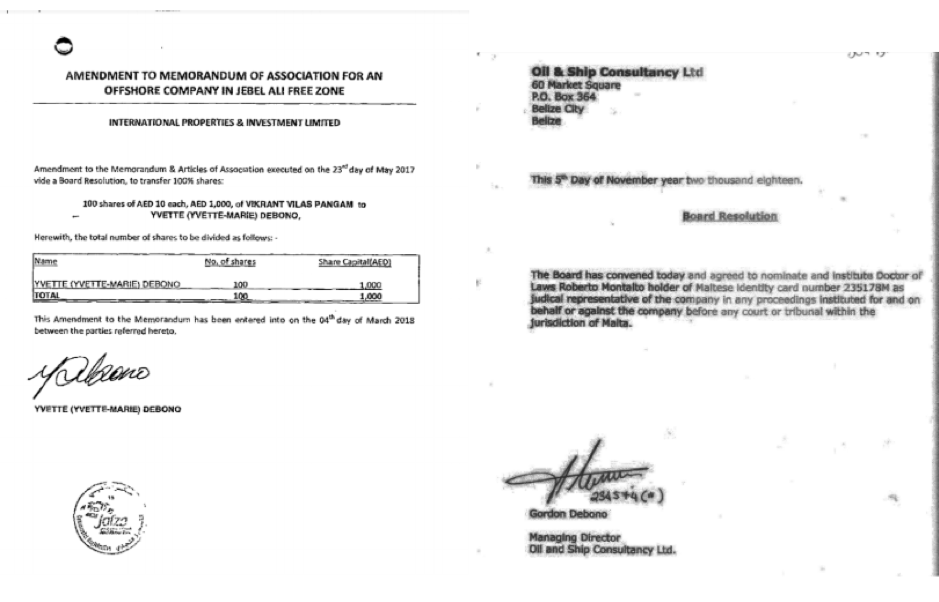

The managing director of the company in Belize (with an office in the British Virgin Islands) that Yvette Debono’s company is claiming owes it money happens to be none other than her husband, Gordon.

In real terms, this is about the release of €1.5 million from a company controlled by Gordon (whose assets are meant to be frozen and the subject of sanctions) to another company in Dubai owned by his wife.

Court documents include evidence showing that the applicant and defendant are respectively controlled by the wife on one hand and the husband on the other.

Legal practitioners consulted by The Shift described this as a seemingly “devious way” to get assets frozen out of the country and “cleaning dirty money” in the process.

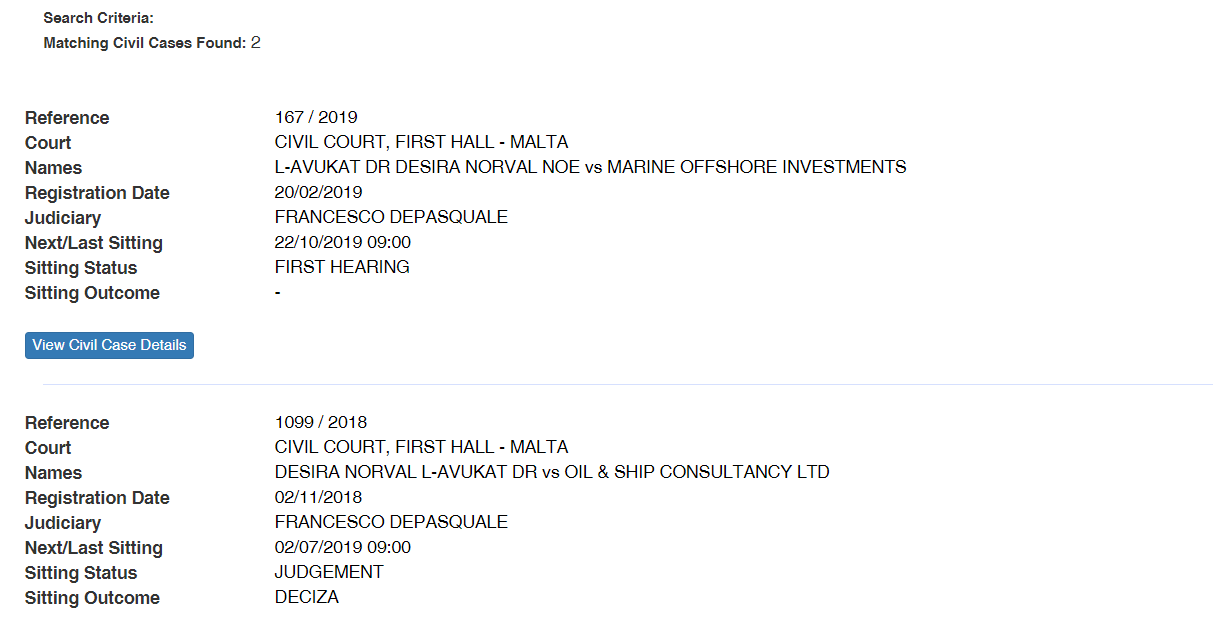

On 2 July, newly-appointed Judge Francesco Depasquale handed down judgment sanctioning the release of the funds. And there is another case before the same Judge by the same Dubai company for the release of another €1.3 million plus interest due to be heard later this month.

How did they do it?

Against a backdrop of lack of action and poor enforcement, the Debonos have been busy filing court cases against banks, including HSBC and BOV, to release bank balances or proceeds of insurance policies. They are also claiming damages for being denied their money.

The Dubai company owned by Yvette Debono filed a case before a district court in a tourist town in Cyprus (Paphos).

It is unclear why a Cypriot court even accepted to hear a case involving a Dubai company against a Belize company with assets and beneficial owners in Malta. But the Cypriot court ruled in 2018 that the parties agreed to settle the payment of the €1.5 million loan (plus interest).

Yvette Debono’s Dubai company then filed an application in Court in Malta for the recognition and enforcement of the judgment by the Cypriot court, requesting the release of the money held in Maltese banks (assets frozen due to charges her husband faced).

The court documents submitted clearly show the family links in the two companies ‘contesting’ the loan and the individuals involved in a case that has drawn international attention.

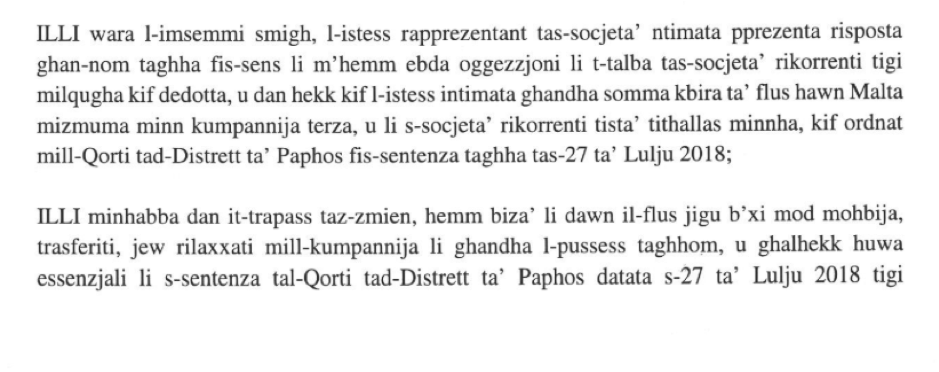

As if the money laundering red flags were not already alarming, not only did the ‘defendant’ Belize company not contest the recognition and enforcement of the judgment in Malta saying it had to pay €1.5 million, but six months into the case both companies even filed a joint request to the court that the case be dealt with “expeditiously”.

Excerpt from the joint request asking that the court deal with the case ‘expeditiously’ .

The reason for this unusual joint declaration states that the Belize company of which Gordon Debono is Managing Director has “a large amount of money in Malta held by third parties” and since the case is taking long the parties are scared that the money would “be hidden, transferred or released by the third party that holds them”.

In April 2019, the Dubai company also sought and obtained a garnishee order (pending judgment) against the Belize company serving it on Satabank (among others) and a Maltese oil trading company.

Confirming balances are held on deposit at Satabank, the MFSA successfully contested the garnishee order in relation to Satabank (but not other garnishees) noting that any money released by this bank should be vetted first by its competent person. The Dubai company is now appealing this judgment.

Judge Depasquale’s ruling to sanction the release of the funds occurred three months later.

The Court did not address the fact that the company Oil and Ship Consultancy Limited, that was meant to pay the loan and linked to Gordon Debono, had been struck off the register in Belize in February 2019.

The engine is still running

Legal practitioners consulted by The Shift noted that a court judgment of this type awarded the Dubai company an executive title which permits enforcement of the claim (and potentially release of money held by a bank or third party) under the sanctioning of the Courts.

It is not clear whether OFAC sanctions would be breached by such a ruling. Legal sources noted that given the claim was in euro and the claimant was a Dubai company, this may have been designed to pass under the radar.

While recognition of judgments handed down by a court in an EU member state may only be refused on limited grounds, practitioners queried the reason why a Cypriot court even accepted to hear a case involving a Dubai company against a Belize company with assets and beneficial owners in Malta. Further and more pointedly, why no one, least of all the Cypriot or Maltese Courts, raised any red flags.

Meanwhile, The Shift is informed that there is a similar case pending before the same Court and the same Judge due to be heard this month.

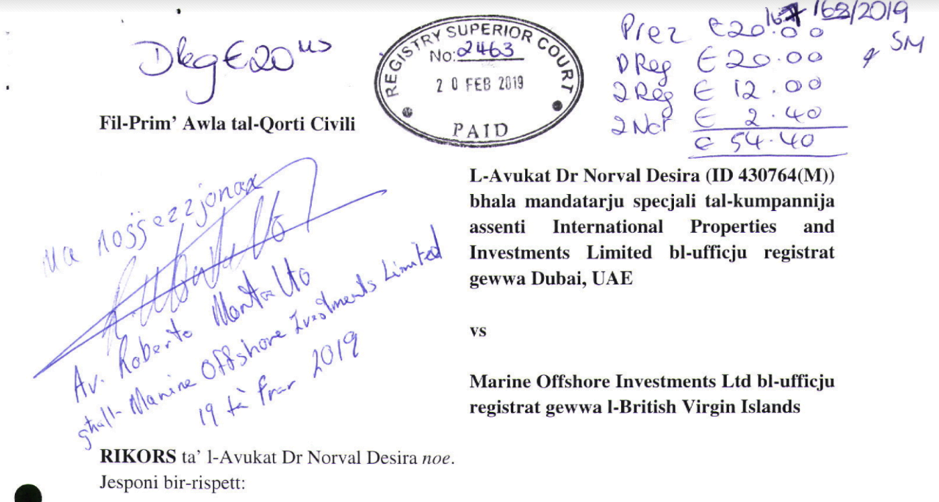

The case is also for recognition of a judgment by the same Cypriot court in favour of the same Dubai company regarding a similar loan, but this time against a company in the British Virgin Islands called Marine Offshore Investments Limited for €1.3 million plus interest. The underlying loans also have the same date – 4 September 2017.

Sources indicate that not only is this company also linked to Gordon Debono but also potentially to the vessel MT Turu. The lawyer representing this company is the same lawyer that acted for Gordon Debono’s Oil and Ship Consulting Limited in the first case. Again, the ‘defence’ lawyer signed off this application asking for over a million euro from a Dubai company with “no objection”.