Key findings:

-

The agreement shows that Steward Healthcare bought Vitals Global Healthcare (VGH), and with it a concession worth millions per year, for only €1. Yet, the real hidden owners behind VGH got paid millions.

-

These payments included €1.4 million to a mysterious Dubai company, and another €1.85 million to a previously undiscovered individual as part of the Steward sale.

-

The real owners – hiding behind companies in Jersey – drained management fees and commissions from the embattled concessionaire VGH before Steward’s takeover.

-

The transfer to Steward is described as satisfying the previous owners’ (of VGH) duty to finance the concession – the €200 million investment the government used to justify the deal in the first place. If they couldn’t raise the funds, why were they given over €50 million in taxpayers’ money?

Steward Healthcare paid the total sum of €1 for all the shares in Vitals Global Healthcare (VGH) and the concession over three public hospitals, but others – the real owners – got paid millions, according to the agreement on the deal being revealed for the first time.

The government has so far refused to provide details of the terms of the Share Purchase Agreement that handed over the operation and management of St Luke’s, Karin Grech and the Gozo Hospitals to Steward Healthcare.

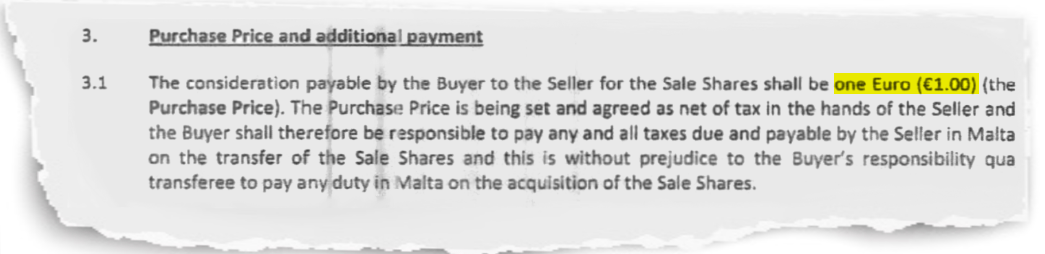

The agreement, signed on 1 February last year after a last minute deal struck in the dead of night at Castille, shows that Steward paid Bluestone only €1 for all the shares in VGH along with the concession.

That is, just €1 for a lucrative contract entitling the owner to €70 million per year, or €188,000 per day from the Maltese government for potentially 99 years – a contract guaranteeing €7 billion in revenue.

Steward needed to take on VGH’s debts and obligation to make the promised investment (€200 million). Yet, the company was still left with a ridiculously lucrative contract.

The agreement being revealed today tells us more than that. It shows the sale price and other arrangements, including payments to other parties listing some old and new names, confirms that Bluestone was only a front, according to corporate lawyers consulted by The Shift News.

The Share Purchase Agreement between Bluestone and Steward for all shares in VGH dated 21 December 2017 (as amended).

A review of the agreement shows that the ‘debts’ burdening VGH included hefty severance payments payable to related parties – these are the real (hidden) owners of VGH who got paid millions as part of the terms of sale of the concession.

These payments included €1.4 million to be paid to a mysterious Dubai company (Mount Everest General Trading LLC) and another €1.85 million to a previously undiscovered individual as part of the Steward sale.

The agreement also notes that it is subject to the government’s consent (which was already in hand) and that such consent would need to note that through this transfer to Steward, the original ‘owners’ of the concession would have satisfied the financing obligation – the promised €200 million investment the government had used to justify the concession to VGH in the first place.

The consideration for all the shares in VGH was just €1.

So how did VGH, which received over €50 million from taxpayers funds to run the concession, reportedly end up €55 million in the red?

The Shift News has already shown that, notwithstanding half truths and outright lies, what was declared to the Maltese public was not the true ownership of VGH.

The public register still showed that Bluestone held the shares in VGH, but a network of private agreements signed before and after the actual granting of the concession meant that other people – people purposely hidden from the public eye – benefited financially from the hospitals concession.

These are the real beneficial owners of the concession (click on nodes for additional information):

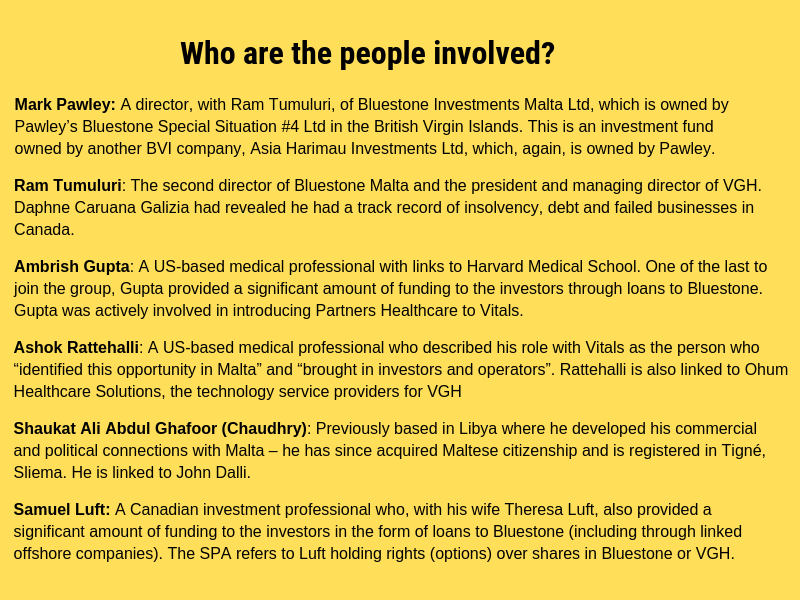

The Shift News has explained how these hidden owners including a politically well connected Pakistani businessman, Shaukat Ali Abdul Ghafoor, and an Indian expat Doctor, Ashok Rattehalli, kept their involvement in the Vitals concession (with full cooperation from the government) hidden from the Maltese public through hidden option agreements and non-arm’s length loans.

The Shift News has also shown that these hidden investors made arrangements to expand, behind the Maltese public’s back, through other sewn up tenders in a number of other countries. VGH was busy negotiating international contracts even as they sought, and got, a bailout in Malta.

They even started setting up parallel structures in Jersey, which Jersey structures are referenced in the sale agreement indicating that not only were these companies active but that they also drained management fees and commissions from the embattled concessionaire VGH before Steward’s takeover.

Key contracts were signed with the Jersey companies that would ensure a stream of revenue from the national healthcare service for years to come, from a project on which they never delivered.

The agreement also shows there were more payoffs, worth more millions, to vested interests while the Maltese public remains in the dark as to what it really got out of yet another shady deal yet again manoeuvred by Minister Konrad Mizzi when he was responsible for the health sector.

The Vitals Steward Share Price Agreement is available here.