Henley & Partners earned €9.7 million from Malta’s cash-for-passport scheme between July 2017 and June 2018, taking the company’s earnings up to €28.8 million since the controversial programme was launched in 2014.

Figures released in the Fifth Annual Report on the Individual Investor Programme (IIP) show that a total of €162.4 million were paid in contributions by 330 applicants between July 2017 and June 2018.

Of these, €159 million went to the National Development and Social Fund, €68 million to the Consolidated Fund and €11.8 million to Identity Malta.

Since the programme’s inception, a grand total of €672 million have been raised in contributions, of which Henley & Partners has taken over 4%.

The lucrative business of selling passports has seen the number of accredited agents swell up to 159. These include 67 financial fiduciary and trust firms, 51 legal firms, 27 management and consultancy firms and 13 property agents.

Recently, the European Commission said that tougher guidelines will be published to regulate golden passports as the European Commission was “extremely concerned” with the issue. Malta and Cyprus were among the countries of concern highlighted by Justice Commissioner Věra Jourová.

In October, Malta’s passport scheme was slammed by an international report, which highlighted the need for the island to adequately address the programme’s reputational and money-laundering risks.

‘European getaway: Inside the murky world of golden visas’ published by Transparency International and Global Witness 2018 highlighted the flaws and loopholes in such schemes, stressing that “insufficient due diligence, wide discretionary powers and conflicts of interest” could open Europe’s door to the corrupt.

Applications down over previous period

In total, 330 applications were submitted between July 2017 and June 2018, 47 applications less than the previous twelve months. 223 applications were approved while 75 were turned down.

This takes the total applications since the programme’s inception up to 1431. Of these, 961 have been approved, taking the the amount of unapproved applications to 19.5%.

The number of dependants included in the 330 applications submitted between July 2017 and June 2018 amounted to 818 of which 243 were spouses, 398 were minor dependants and 177 were adult dependants (either adult children or parents/grandparents).

On average the number of dependants per application was 2.47 which is slightly down from the average recorded in previous years.

As in previous years, the largest number of main applicants originated from Europe (141), even though a slight decrease of 1.9% was noted when compared with last year’s figures.

Data released by Eurostat earlier this years shows that around 500 Russians received a Maltese passport in 2016, with that country’s citizens making up 33% of the 1,495 people granted citizenship by the Maltese government that year. The figure also includes naturalisations.

The second most popular region was, once again, Asia which witnessed a significant increase (+10.9%) of applications from last year.

Africa surpassed the Middle East in third place with the latter region experiencing a 5.6% drop during the past twelve months.

26 applicants originate from the Middle East while another 4 applicants were submitted from the Gulf.

A further 4 applications were submitted from Oceania, 14 from North America, 3 from South America and 1 from the Caribbean.

The absolute majority of main applicants (309 out of 330, i.e. 94%) only had one previous citizenship, meaning that the Maltese Citizenship would be their second. On the other hand, 21 main applicants had two previous different citizenships. During the period in question there were no applicants previously holding three citizenships or more.

Only 25 properties purchased

Main applicants are obliged to invest in a residential property in Malta, either by acquiring and holding one having a minimum value of €350,000 or by taking one on lease for a minimum annual rent of €16,000.

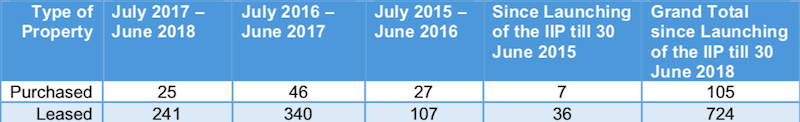

Between July 2017 and June 2018, 266 properties were either purchased or leased. The vast majority of property (91%) was leased while the remaining 9% was purchased.

Compared the previous 12 months, there was an increase of 3 percentage points in the number of applicants who preferred to lease rather than to purchase.

Sliema topped the list of localities in which property was purchased, closely followed by the previous favourite spot St Julians.

Both localities enjoy a dominant position with regards to purchased property, with 72% of all purchased properties situated in these two localities.

Property leasing was spread over 26 different localities and once again the most popular localities were Sliema (35%) and St Julians (21%) totalling 56% of all leased properties. The third most popular locality was Swieqi (10%). Interestingly, 2.5% of the properties were leased in Gozo.

Between July 2017 and June 2018 the value of the 25 purchased properties amounted to €29,600,500, averaging €1,184,020 per property. Taking into consideration all the properties purchased since the launch of the IIP the value of all purchased property (115) totals €110,302,233.31 (averaging €959,149.85 per property).

On the other hand the value of leased properties between July 2017 and June 2018 averaged at €19,139.16 per year, significantly higher than the minimum threshold of €16,000.

Globally 718 leased properties were leased since 2014 with an annual average rental value of €19,668.54.

Investments

IIP applicant must also make a minimum investment of €150,000 in Malta Government Stocks. In this regard, the amount invested in such Stocks between July 2017 and June 2018 totalled €39.9 million. Taking into consideration all investments made since the launch of the programme the total amount adds up to €126 million.