Legal action taken last summer against one of the key companies in the British Virgin Islands holding the ownership of Vital Global Healthcare in Malta could have spelt disaster to the multi million-euro hospitals deal and risked bringing the whole edifice down, with possible severe repercussions for Malta’s national health service, documents show.

Further investigation of documents submitted in court by panicked investor Ashok Rattehalli to try to stop the transfer of the Malta hospitals concession to Steward Healthcare, lead to a trail in the British Virgin Islands and the discovery of court documents showing the investors were in serious trouble.

READ MORE:

Vitals investor tried to stop sale of Malta hospitals concession to Steward Healthcare

Names of hidden investors in Vitals Global Healthcare revealed

Vitals: A lesson in how to hide commissions

Vitals ownership: Untangling the web

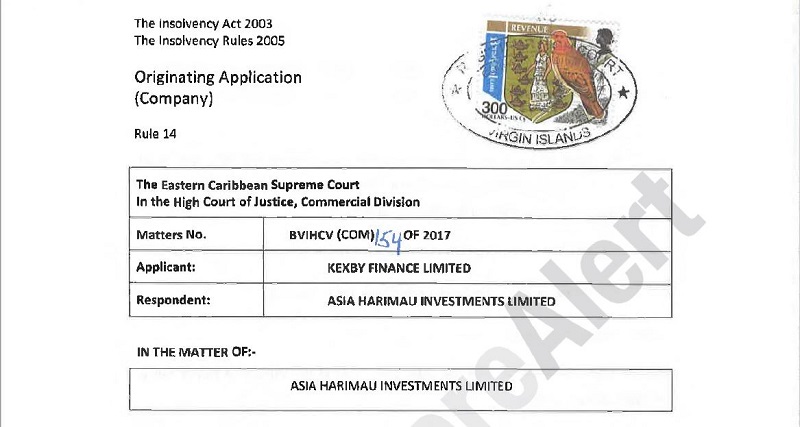

On 31 August 2017, a finance company asked a court in the British Virgin Islands to declare Asia Harimau Investments insolvent (bankrupt). But Asia Harimau Investments is a key company in the complex web of companies set up to hide the investors and beneficiaries behind VGH in Malta.

On paper, the Vitals structure in Malta remained owned by Bluestone Special Situations #4 Limited (BVI), which in turn is owned by another BVI company Asia Harimau Investments. This is owned by Mark Edward Pawley of Oxley fame, a structure and faces that Vitals (and the government) were keen to flaunt.

Pawley and Ram Tumuluri are directors in Bluestone Investments Malta Limited in Malta, which is also owned by Pawley’s BVI company. So Asia Harimau Investments sits at the top of the chain of companies that ultimately controls VGH.

If Asia Harimau Investments is declared bankrupt, the whole edifice may come tumbling down. A great deal of money stands to be lost.

It may trigger nightmare scenarios for Malta’s national health service if insolvency clauses in agreements were triggered. It could affect the control of the entire structure if, for example, a liquidator would be appointed, financial and corporate lawyers have told The Shift.

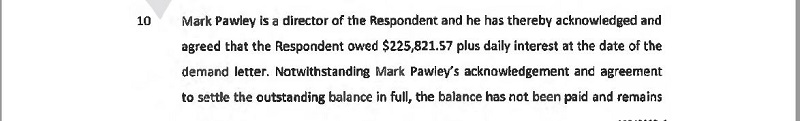

The case against Asia Harimau Investments carried great risk for the Malta deal and the hospital service. It was triggered because Pawley through this company had, among other things, borrowed money from a financing company called Kexby Finance Limited in April, 2016. By July of the following year, he was struggling to meet its interest and repayment obligations and blamed delays on “issues with the banking system”.

By 31 August, 2017, Kexby Finance Limited had clearly had enough. Kexby Finance Limited asked a BVI court to declare Asia Harimau Investments Limited, on paper, the vehicle through which the alleged owner of Vitals held his entire ownership of Vitals, insolvent (bankrupt). The application was filed before the Eastern Caribbean Supreme Court.

Health Minister Chris Fearne had said discussions to sell Vitals to Steward started the following month.

Rattehalli’s move to try to stop the deal through the Maltese courts has shed light on the hidden investors behind the deal in a 70 / 30 split, and confirmed they had a secret agreement with the government five months before the call for proposals was made.

It is abundantly clear from the Rattehalli documents that the initial investors who approached the government with their idea for a public private partnership project involving the Gozo Hospital did not have deep pockets.

The investors appear not to have had sufficient capital to cover the pre-commencement costs for the project ($500,000, the bulk of which being “consultancy” costs). They raised further money through loans from investors such as Dr. Ambrish Gupta who lent Bluestone Special Situations #4 Limited $150,000 and likely lent a further $275,000 – all towards his 17.5%. The investors then agreed to work together to raise “roughly around $30m,” court documents show.

At this point, less than two years since they ‘won’ the hospitals concession, and with insolvency problems looming on the horizon, the men behind the shady deal seem to have decided it is time to cash out.

The looming Fourth Money Laundering Directive has been the focus of reasons for the sudden announcement of the Vitals’ sale. Yet, even with the new regulations it would be unlikely the interests involved needed to be declared, the experts added. The Shift already reported how investors’ interests such as Rattehalli’s were hidden through a share option agreement granting them rights to percentages of shares in Vitals without ever appearing on the public record.

This is not the first time that the lead “investor” in a project awarded by Projects Malta has, despite assurances that due diligence is being carried out, been found to have less than sound finances.