-

Shares in Vitals Global Healthcare, the holder of the Malta hospitals concession, transferred to Steward Healthcare after investor withdraws legal action.

-

The new arrangement means that the men behind the secret deal with the government will continue to profit from supply contracts for years to come.

-

The company was giving presentations to other governments even as it knew it could not deliver in Malta after receiving over €50 million from taxpayers.

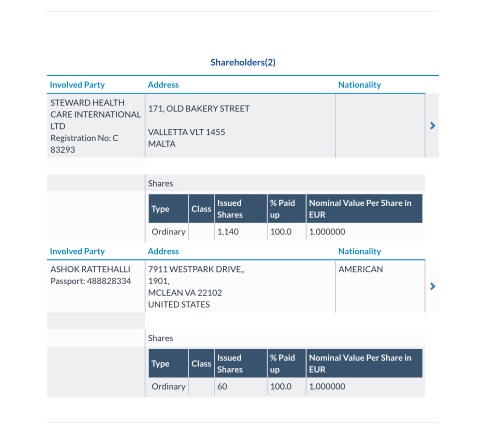

The Malta hospitals concession awarded to Vitals Global Healthcare less than two years ago was effectively transferred to Steward Healthcare this week after one of the initial investors – Ashok Rattehalli – withdrew legal action, MFSA documents show.

The transfer of shares registered at the Registry of Companies came into effect on 16 February, the day after Rattehalli informed the Court he would not be pursuing further legal action to stop the deal.

MFSA documents reveal that Rattehalli got his 5% cut (60 shares) after turning to the Maltese courts to stop the transfer because he had not been given what he was promised in the original agreement among the hidden investors.

Last week, he withdrew the warrant of prohibitory injunction he had filed a second time, indicating an agreement had been reached.

Sri Ram Tumuluri and Mark Edward Pawley are now out of the picture in terms of acting as a front for the deal in Malta, and Armin Ernst (former CEO of VGH and President of Steward Healthcare) is now a director of VGH Malta together with Michael Callum.

Ernst and Callum were also appointed as directors on VGH Malta’s three subsidiaries.

The net effect of the share transfers is that the concession remains with VGH Malta and, more importantly for the existing investors, the lucrative contracts with suppliers and others negotiated by VGH Malta while it held the concession will remain intact.

In sum, the men behind the secret deal negotiated by Minister Konrad Mizzi now get to walk away pocketing over €50 million in taxpayers’ money since 2016, paid out as salaries, consultancies and other expenses. while failing to deliver on commitments. In addition, they and others will continue to profit from supply contracts for years to come.

The government continues to defend the deal, and Mizzi was again involved in negotiations with the Prime Minister’s Chief of Staff Keith Schembri and VGH representatives to enable the new arrangement with Steward Healthcare.

The Shift News has revealed how VGH were still negotiating new contracts with other countries even when it was clear they would be unable to deliver in Malta. The company was already in discussions with Steward Healthcare when it was using the Malta platform to pitch a new deal in Macedonia.

READ MORE:

Vitals busy negotiating international contracts while seeking bailout in Malta

The new Memorandum and Articles of Association for VGH Malta lays the road for a much-needed capital increase. It became clear that the hidden investors never had the needed capital to see the project through and attempts to raise the capital failed.

The Shift News also revealed that financial trouble hit Pawley’s company in the British Virgin Islands last summer, a company that was key to the VGH Malta chain of ownership. The company faced bankruptcy charges in the summer of 2017 after it could not repay money borrowed.

To comment on this story or anything else you have seen on The Shift News, please head over to our Facebook page or message us on Twitter.