Investigations into who owns the other 30% of Vitals Global Healthcare brought to light a name that has long-standing political connections in Malta – Shaukat Ali Abdul Ghafoor (Chaudhry), a Pakistani national originally based in Libya and who has acquired Maltese citizenship and resides in Tigne, Sliema.

Shaukat Ali Abdul Ghafoor is one of the owners in Pivot Holdings Limited, a company set up on 9 October, 2014 just one day before the secret Memorandum of Understanding (MoU) on the Gozo Healthcare / St. Luke’s / Karin Grech hospitals concession was signed with the government, and to which Pivot was a party.

The other owners of Pivot Holdings Limited are:

- Mohammed Shoaib Walajahi, a Pakistani national based in Dubai who describes himself as a PPP consultant and whose Facebook profile picture was a photo of him on the doorsteps of Castille; and

- Asad Ali Shaukat, a Pakistani national originally (according to public records) sharing the same residence in Pakistan as Shaukat Ali Abdul Ghafoor and his wife Aasia and now also a holder of a Maltese ID card and residing in Swieqi. Asad Ali acquired his one-third shareholding in Pivot in the same month that the Projects Malta Request for Proposals was issued, March, 2015.

Shaukat Ali Abdul Ghafoor pops up as far back as 2011, when the meeting he held with former President George Abela was listed in the President’s engagements. Shaukat Ali attended that meeting with Anthony Cassar and Asad Ali Shaukat, according to the announcement.

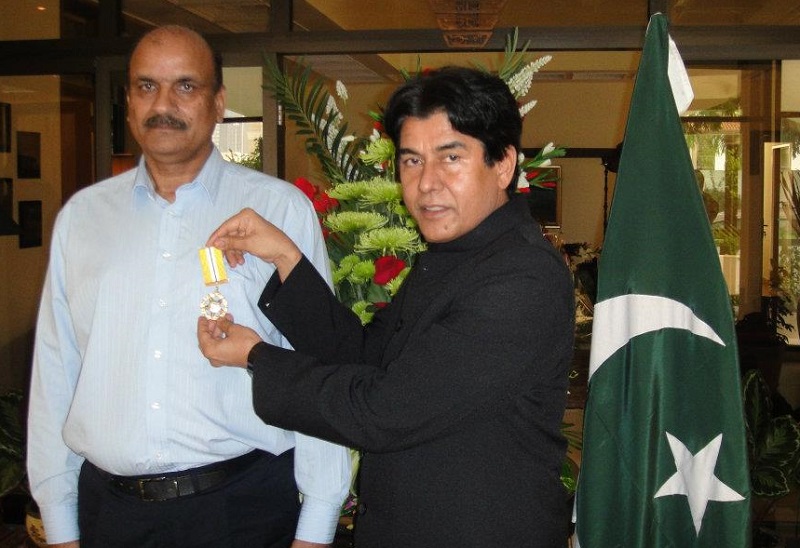

Shaukat Ali Abdul Ghafoor (left).

Shaukat Ali Abdul Ghafoor’s links seem to stretch far and wide. Besides his signing the secret MoU with the government on 10 October, 2014 on behalf of Pivot Holdings Limited, he is a shareholder in Medical Health Management & Consulting Ltd, the company that tried to buy St. James Hospitals. He was also reported as traveling with Ram Tumuluri to sell a stake in a Renewable Energy project in Norway. He also shares the same Tigne Point flat address with a director of Technoline Malta.

Asad Ali Shaukat, who according to public records shared the same residence in Pakistan as Shaukat Ali Abdul Ghafoor and his wife Aasia, was between 2009 and 2011 a major shareholder in Corporate International Consultancy Ltd (C5114), one of John Dalli’s corporate services companies. His Facebook friends list includes John Dalli and his daughter Claire Gauci Borda.

The Shift has already revealed who holds 70% of the equity in VGH, as a result of documents submitted by one of the investors to try to stop the sale of the Malta hospitals concession to Steward Healthcare. The Shift has also shown how interests were hidden. Further investigation of the documents shows how the companies were set up.

How they set up the companies

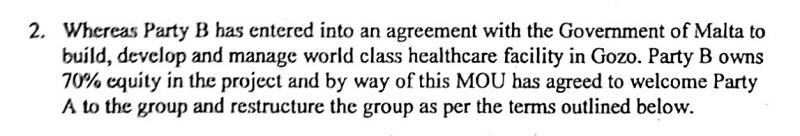

The investors signed a Memorandum of Understanding (MoU) with the government in October 2014, five months before the government issued a Request for Proposals – at this point the public was not even aware of the government’s intention to partner with them on hospitals, and potential bidders for the project had no clue the winner was already sealed.

Konrad Mizzi, who yesterday finally admitted to the existence of the government MoU, described this MOU as relating to “a project the government ultimately rejected”, however, court documents indicate otherwise and point towards a tender designed to be won by Vitals.

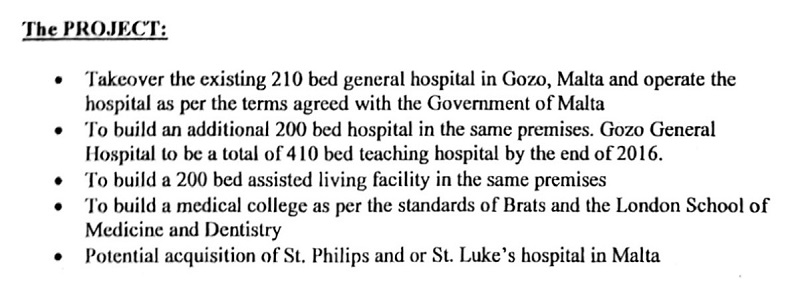

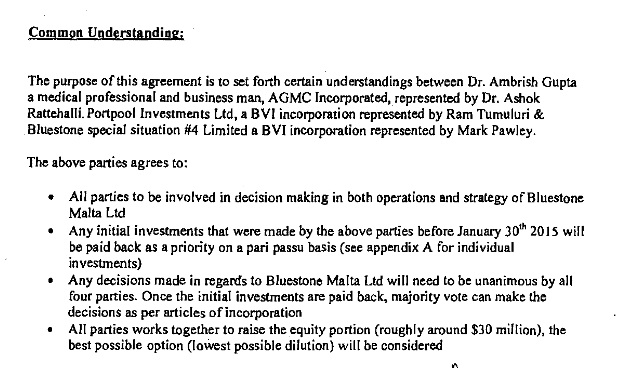

A month after the MoU was signed, the investors signed an agreement among themselves. Court documents submitted by Ashok Rattehalli, who was trying to protect his interests by stopping the sale of the hospitals concession to Steward Healthcare, show that on 23 November 2014 he signed an agreement with Ram Tumuluri and Mark Edward Pawley. It details terms that are uncannily similar to the Request for Proposals later issued by the government, proving they knew exactly what they were getting.

In that secret agreement, Rattehalli, Tumuluri and Pawley, each through their respective companies, warrant that they “own 70% of the equity” in the Malta project.

The MoU with the Government of Malta was signed on 10 October, 2014 between the government (represented by Minister Chris Cardona) and Rattehalli (representing his company, AGMC Inc), Pawley (representing Bluestone Special Situation #4 Limited (BVI)) and Mohammed Shoaib Walajahi and Shaukat Ali Abdul Ghafoor (Chaudhry) (representing Pivot Holdings Ltd).

The MoU between the investors contemplate the establishment of Maltese companies to operate the concession and acquire the hospitals which would be held as to 70% by Dr. Ambrish Gupta, Rattehalli, Pawley and Tumuluri.

Just 16 days later, a new company was established, Bluestone Investments Malta Limited (C67975) in Malta, with Tumuluri and Pawley as directors. It is owned by Pawley’s Bluestone Special Situation #4 Limited in the British Virgin Islands. The Investors’ MoU, as amended in January, 2015 notes that this was to be the company into which they would originally invest.

Bluestone Special Situations #4 Ltd is in turn owned by another BVI company (Asia Harimau Investments Ltd) which, again, is owned by Pawley.

Three days later, Crossrange Holdings Limited (C68092) was established in Malta, 70% owned by Bluestone and 30% owned by Pivot Holdings Limited (C67020) with directors Pawley and Mohammed Shoaid Walajahi.

Crossrange, in turn, established two further companies being the companies specifically named in the agreement between the investors (Gozo Global Healthcare Ltd (C68092) and Gozo International Medicare Ltd (C68094)).

Gozo International Medicare Ltd was intended to hold the hospital’s projects assets while Gozo International Healthcare Ltd was created for the company’s operations.

The 70% / 30% split referred to in the MoU between the investors is therefore reflected in Crossrange’s shareholding with the 30% held by Pivot Holding Ltd, or 10% for each of Shaukat Ali Abdul Ghafoor, Asad Ali Shaukat and Shoaib Walajahi.

While the requirement to issue an RfP (no matter how questionable), likely meant that this pre-tender structure needed to be abandoned and new structures created, court documents filed by Rattehalli show continuity between the pre-tender and post-tender arrangements. They also show how it is possible to replicate ownership interests contractually without ever appearing on the public register.