Latest News

Prime minister's contractor of choice emerges as key operator in secretive Marsaskala promenade works

Elbros Group, the same major contractors hired by the prime minister to work on his Żejtun villa, have emerged as the s..View More

Rule of Law, by plat du jour

I used the line “quis custodiet ipsos custodes?” as the epigraph to my doctoral thesis in 1979. It was abou..View More

Planning Ministry installs solar farm illegally – applies for permit following The Shift's questions

The Planning and Gozo Ministry, entrusted with the oversight and enforcement of planning laws in Malta, has installed an..View More

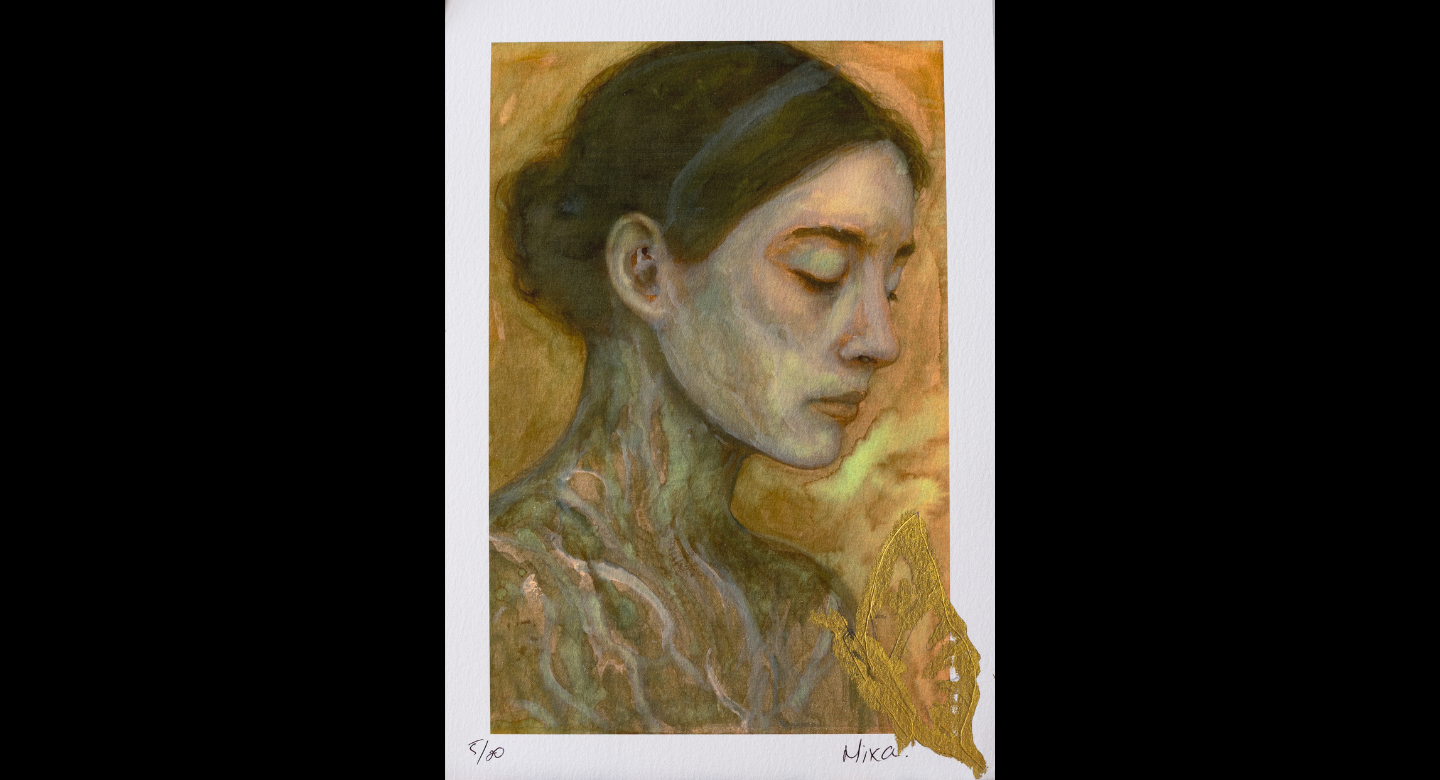

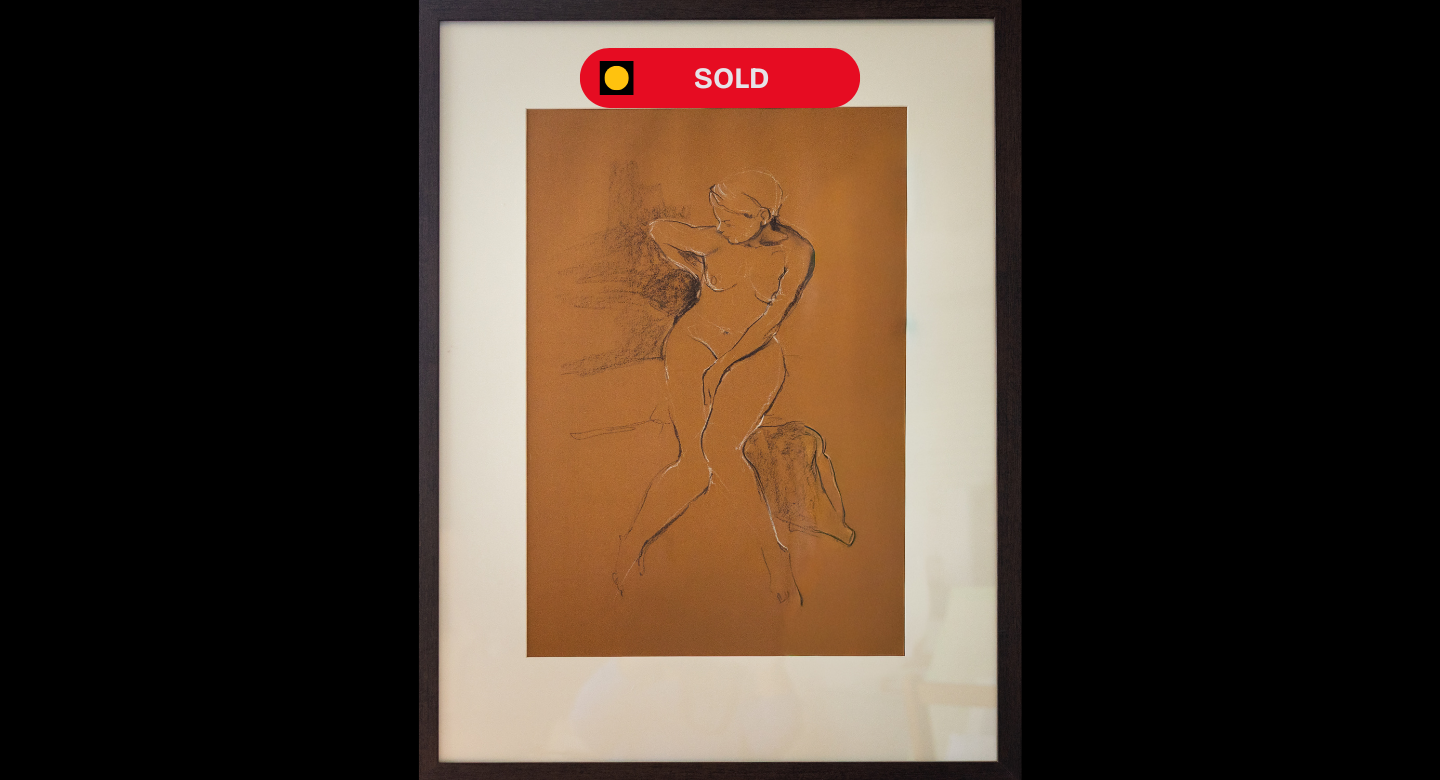

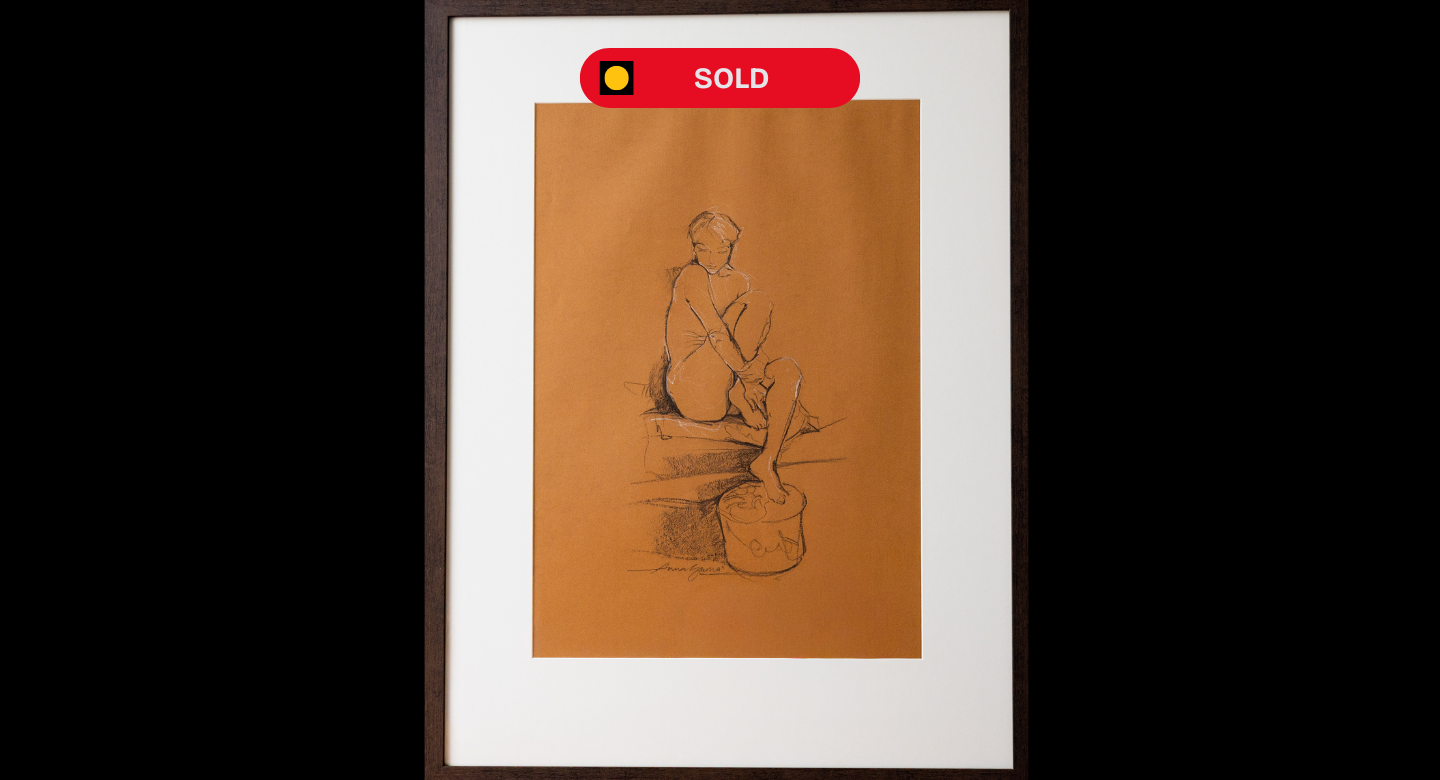

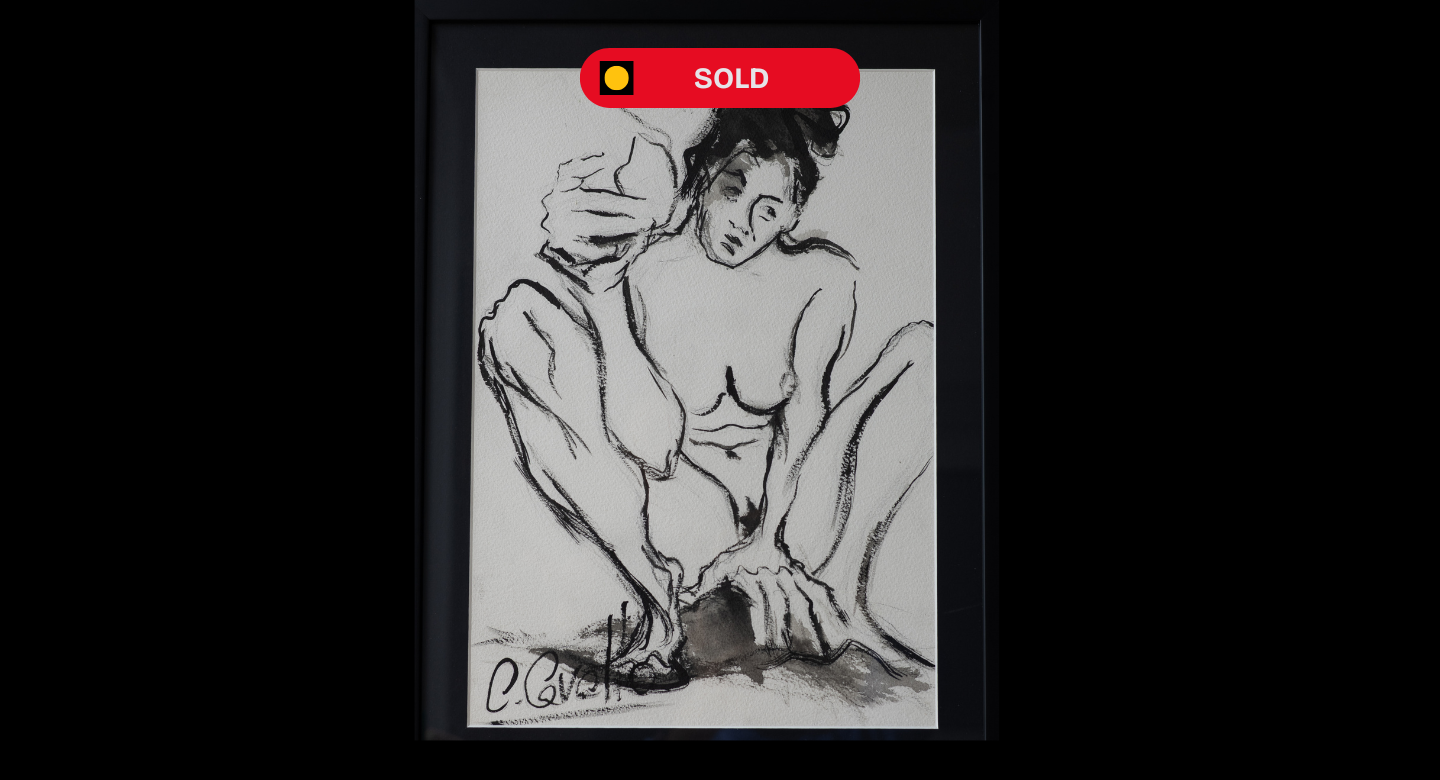

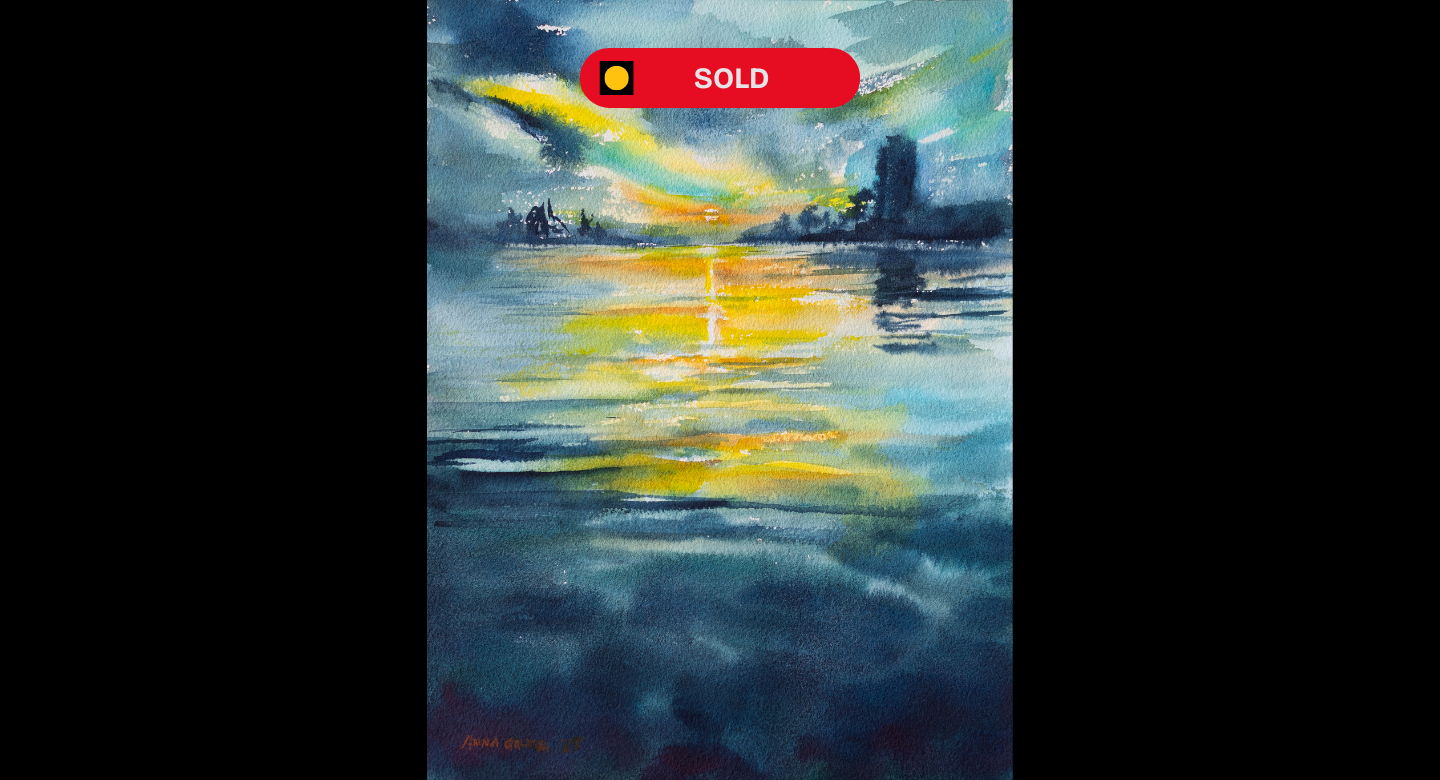

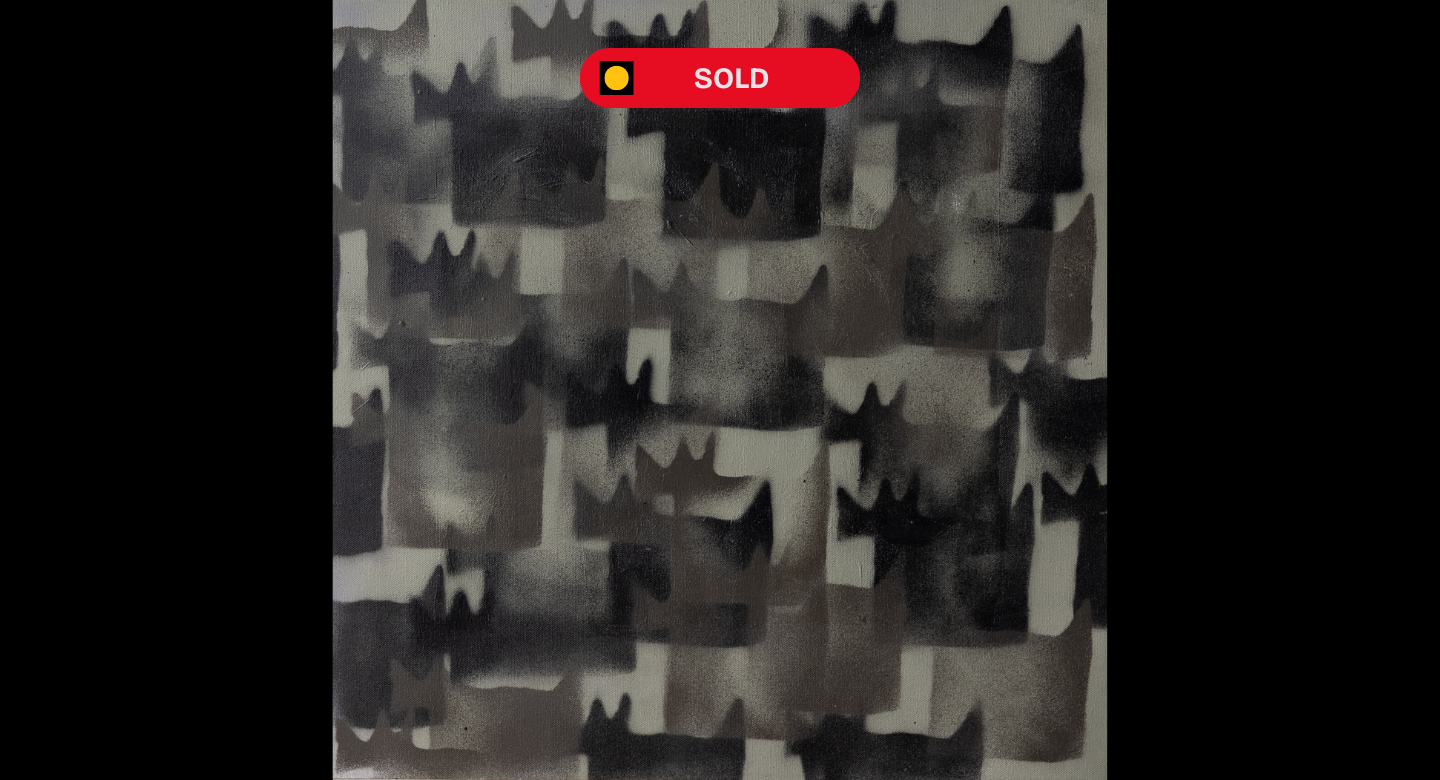

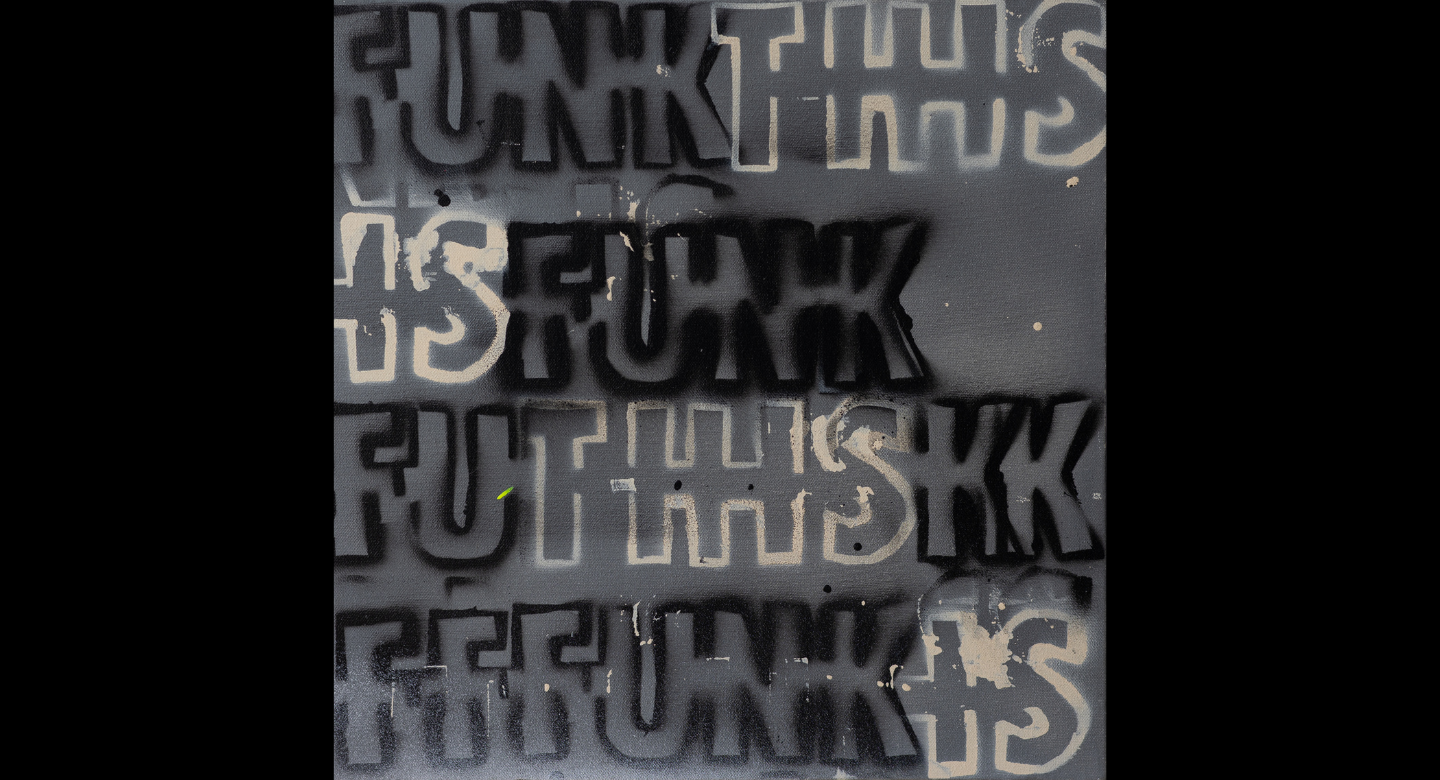

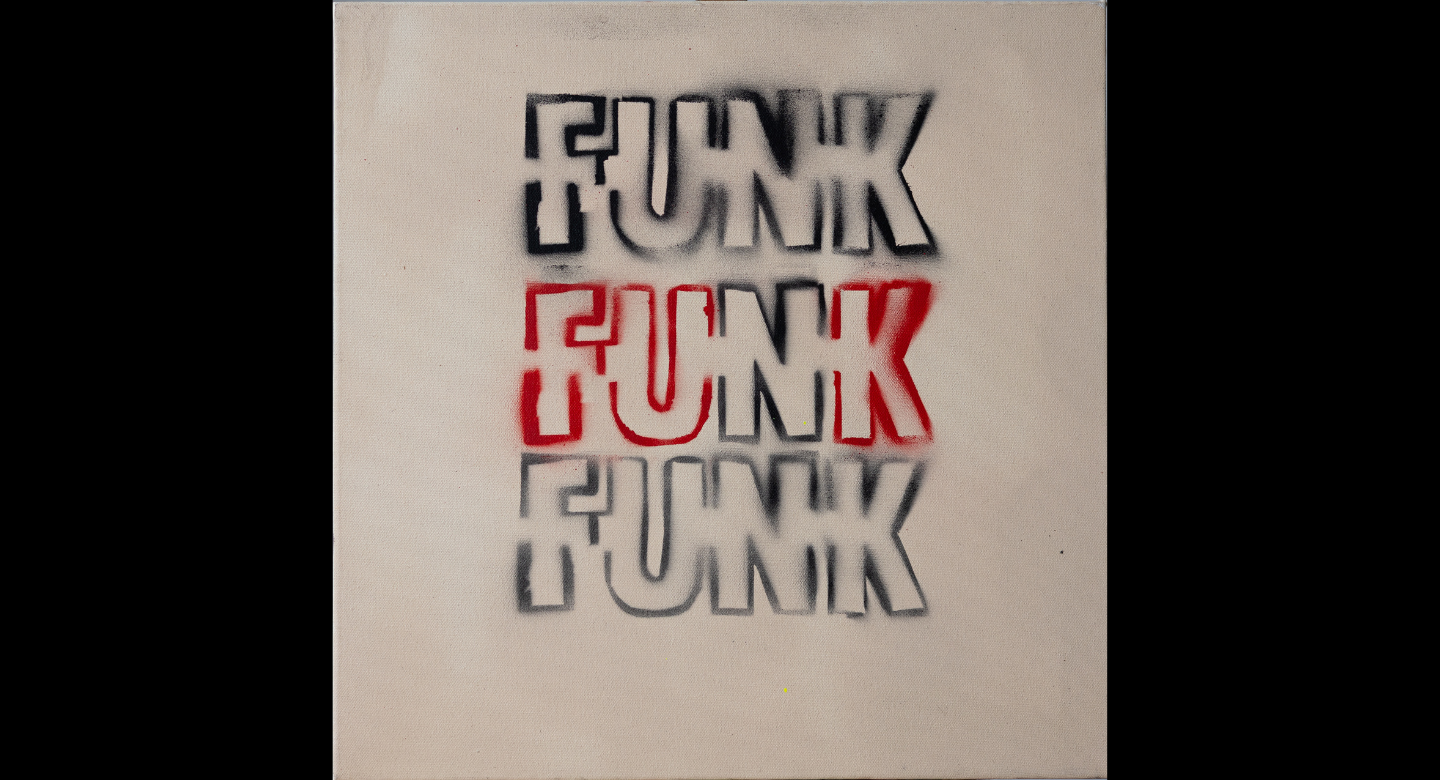

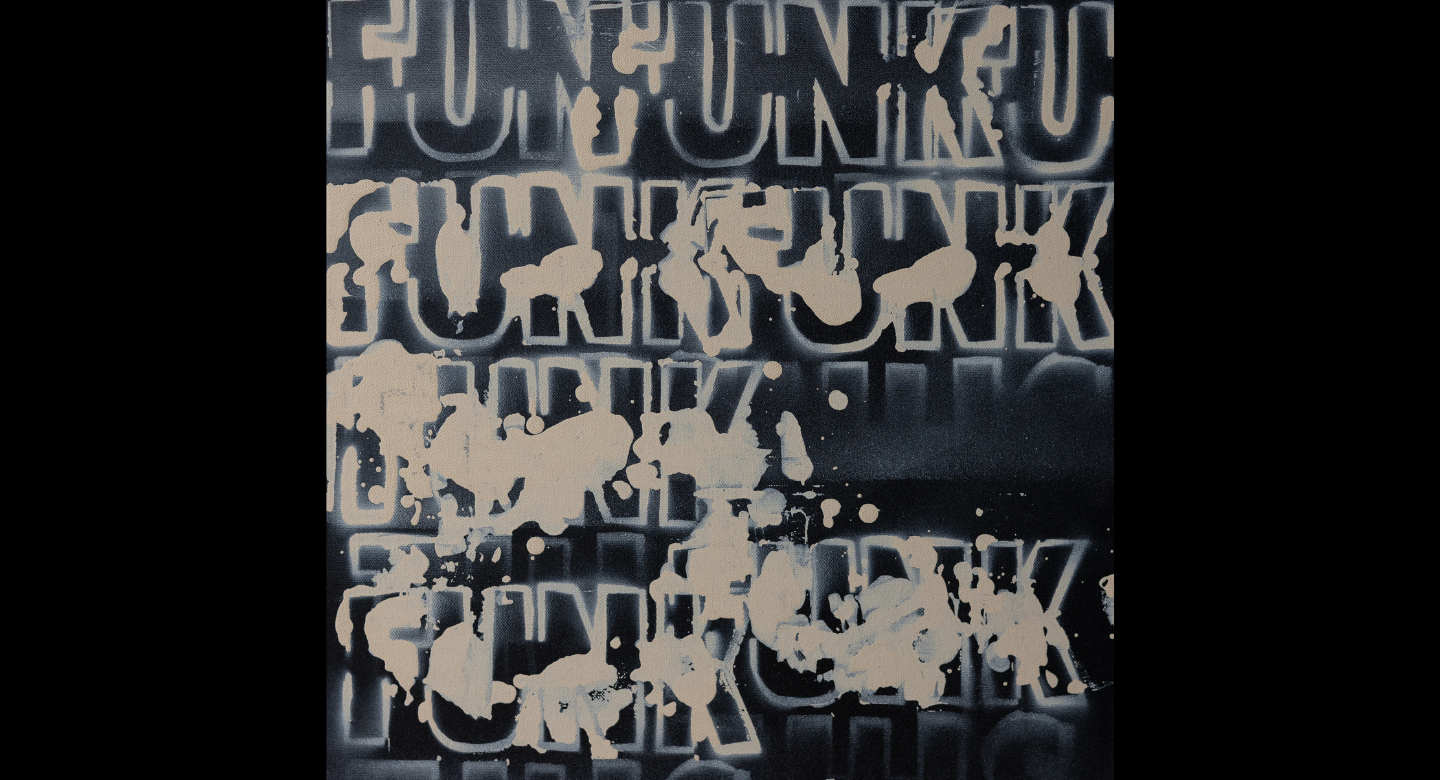

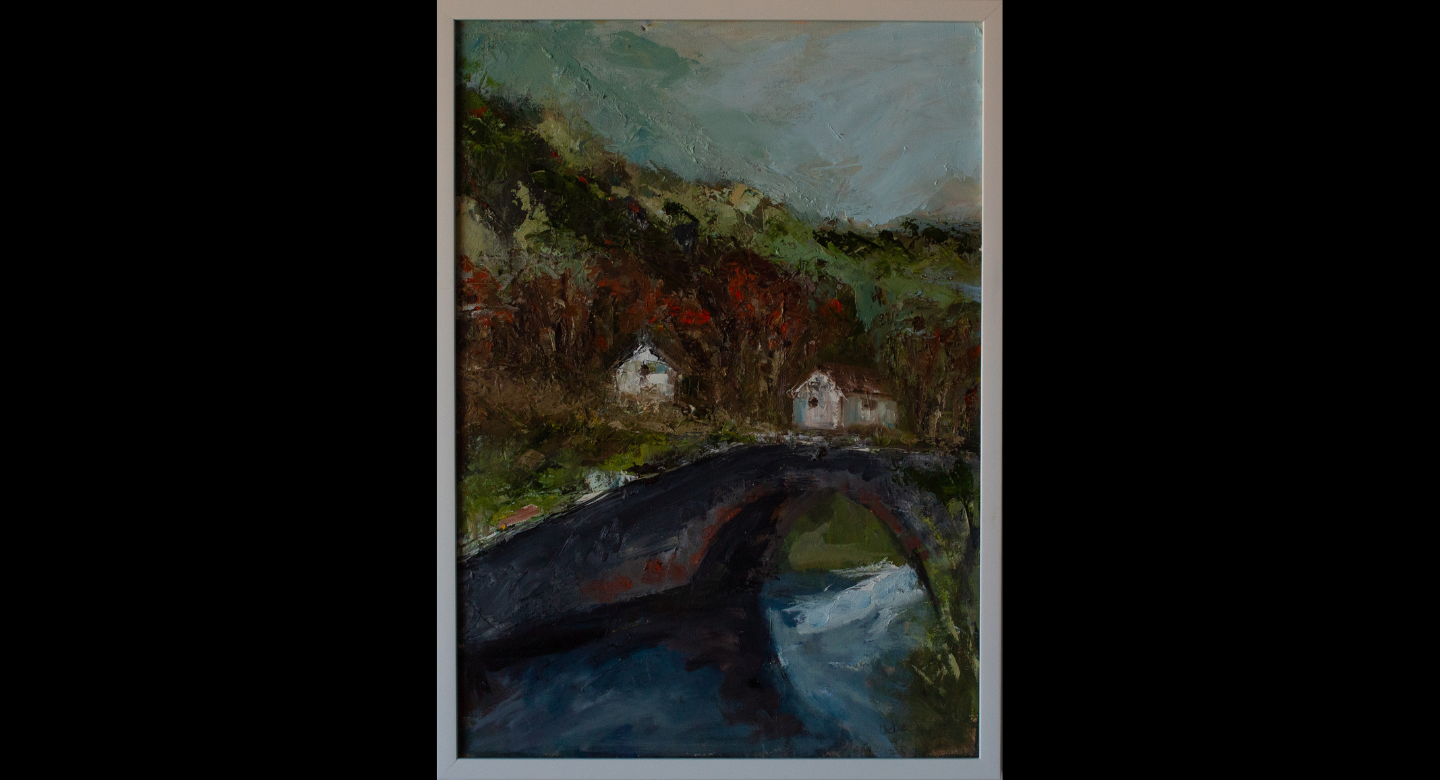

ART FOR THE SHIFT 2025

Top Stories

Investors withdraw from MMH rescue talks as €15 million bond risk deepens

A third attempt to avert a potential default on €15 million in bonds issued by Mediterranean Maritime Hub (MMH) has co..View More

Minister failed to declare discounted penthouse in Cabinet asset declarations

Social Housing Minister Roderick Galdes is facing increasing pressure after it emerged that a penthouse he purchased at ..View More

Owen Bonnici retains aide who admitted to social benefits fraud

Culture Minister Owen Bonnici is employing in his private secretariat a political canvasser who has admitted in court to..View More

Malita chairman quits as governance crisis escalates

Malita Investments plc is facing a deepening governance crisis after its newly appointed executive chairman, Johann Farr..View More

Dalli blocks information on Enemalta's missing €60 million

Energy Minister Miriam Dalli continues to block the release of information linked to a €60 million shortfall in carbon..View More

How to lose a country’s hospitals, blame everyone else, and call it good governance

Let me put the deck on the table: I haven’t read the whole flipping thing; my life probably isn’t long enough. But..View More