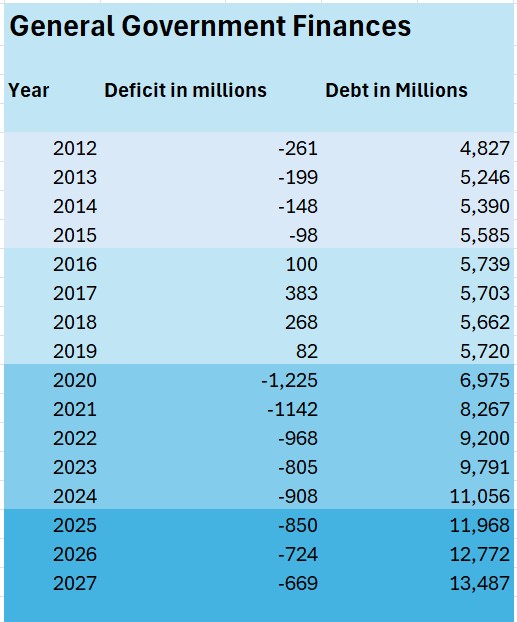

Finance Minister Clyde Caruana plans to increase the island’s surging debt by another €2.4 billion over the next three years, reaching a record €13.4 billion by the end of 2027, excluding any significant and unpredicted economic hiccups.

While no budget adverts or billboards highlight this negative aspect of Malta’s public finances and its leadership, tables in the budget estimates show how Labour continues to base its fiscal policy on heavy lending requirements, which are used primarily to pump out short-term sweeteners that have no real impact on the economy and little on people’s pockets.

Buried in the 112-page budget speech, the finance minister presents a dark forecast.

While the Maltese economy remained resilient, backed by a 130,000-strong cheap labour foreign workforce pumping hundreds of millions of taxes into state coffers, the government continued to increase its loans instead of taking the opportunity to make robust savings and reduce its overall debt.

The staggering evolution of Malta’s debt mountain and Clyde Caruana’s estimates for the next three years

According to the estimates, in 2024, the government will borrow a further €1.7 billion, partly to cover its annual deficit of almost €1 billion.

At the same time, the estimates show that over the coming three years, Clyde Caruana is already planning to borrow a further €4.7 billion as he continues to dish out sweeteners in the form of tax cuts, subsidies and other forms of political favours from money the government doesn’t have and needs to borrow.

While the government’s debt will surpass €11 billion for the first time in history by the end of this year, Caruana is planning to continue on this dangerous trajectory, hitting €13.4 billion by 2027.

At the same time, Caruana boasted in his recent speech that the general government deficit, compared to the Gross Domestic Product, is on a downward trend, thanks to a growing economy.

While predicting economic growth of 4.3% more in 2024, Caruana still planned his budget on a deficit of almost €900 million in 2025, which he will need to borrow and increase the debt further.

To sustain the spending of unnecessary funds, particularly hundreds of millions in all forms of giveaways, Malta will pay €312 million in interest on its €11 billion debt next year.

In an unchanged interest rates scenario – impossible to forecast – taxpayers will be spending €400 million in interest rates by 2027.

Bail out will be next. It is a matter of when not if.

Paraphrasing all economists, government debt increases are fine as long as accompanied by an increase in the magic letters GDP. This obviously would hold as long as the economy is based on stable ‘Product’.

My angst comes to visit when I remember that the party in government is, let us be kind and say, quite comfortable with fibbing. Anyone knows where the Maltese GDP growth is coming from? I know what textbooks say, so my question is can someone provide the datasets so that I could calculate the GDP figure myself.

Malta, another Greece in the making

We have seen in some countries, such as Greece, how the future of young people can be destroyed.

The fact that Malta has not learnt from this is, in my view, almost self-evident, because they don‘t want, because they love to stay in power and because there are to many brown envelopes for so many.

I am not the only one who realises that in a few years’ time, the youth will look down on us and ask us: how could you allow a party of corruption with mafia-like structures to be in power for so long?

How could you build the destruction of our future to your shabby advantage?

obviously the more money there is in circulation the more money comes into your pocket… and when the time comes we will go to Dubai

Good news – they’re not planning on a billion a year as they have been doing thus far

The thing that baffles me is that in the last survey, its mentioned that people trust more PL in finances than PN. The problem in this country is that people are not aware of whats going on, or else, forgot how PN really was good in public finances. People should wake up and understand how this government is ruining the country from every single aspect