Aqra bil-Malti

Deo Scerri, the former BOV chairman who last year took on an advisory role at a private company that controversially bought a multi-million-euro portfolio of non-performing loans (NPLs) from Bank of Valletta, has resigned.

Scerri, 67, downplayed speculation over his departure, stating that it was just a personal decision to slow down.

“I can assure you that there is nothing untoward with my resignation. It’s just a personal decision to slow down. I am no longer young and decided it is the right time to take it easier,” Scerri told The Shift.

Underlining that his role was advisory and that he had nothing to do with the day-to-day running of the financial vehicle, he said his resignation had absolutely nothing to do with the company’s business practices.

“I did not have any disagreements with the company, and neither do I know of any legal disputes it might have with debtors. My move was just a personal reason to slow down,” Scerri insisted.

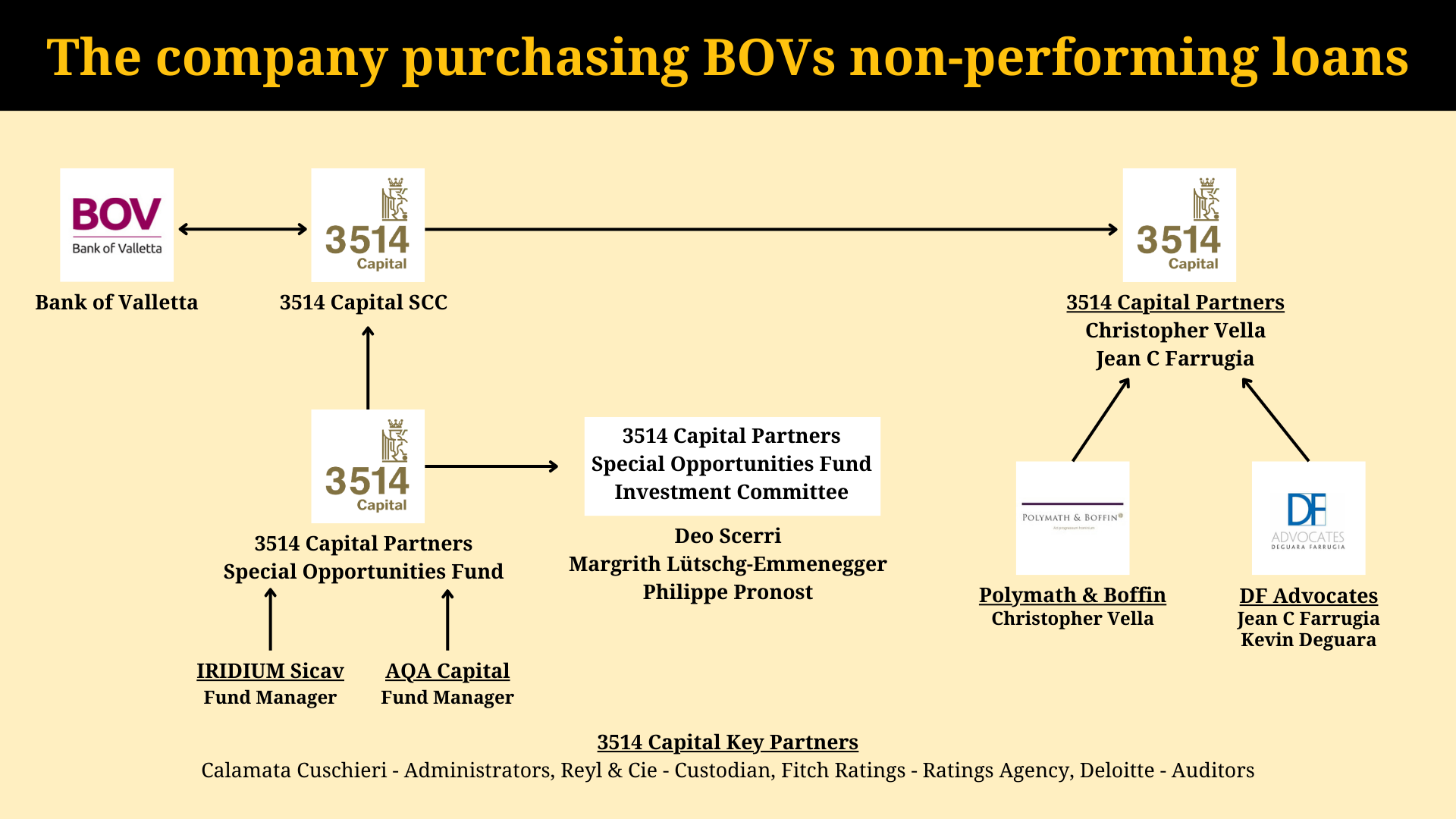

The Shift last year revealed that Bank of Valletta had decided to sell some 700 old loans to 3514 Capital SSC for an estimated quarter of their value, at €26 million.

Scerri was chairman when BOV decided on loans sold to the company he then advised when the deal was sealed. Yet he had dismissed accusations, saying he had nothing to do with the company’s acquisition of the loan portfolio.

The structure behind 3514 Capital

3514 Capital is a partnership directed by DF Advocates’ Jean Carl Farrugia, now facing criminal charges, and Christopher Vella, CEO of business consultancy Polymath & Boffin.

Vella is the sole director of investment advisory Polymath & Boffin, set up in 2011, whose offices in Floriana also serve as those for 3514 Capital.

Farrugia and Kevin Deguara are the founding partners of DF Advocates. This firm made a name for itself by being involved in several controversial deals negotiated by the Labour Party in government, including the rezoning of Smart City for private residences and the hospital scandal.

The Shift is informed that some of the BOV debtors taken over by 3514 Capital are unhappy with the deal and are considering legal action.

BOV never revealed the original value of the NPL’s portfolio it sold, estimated at €100 million, but it defended the sale, stating that it made financial sense and that the process was managed professionally and transparently.

Something is cooking and it doesn’t smell too good!