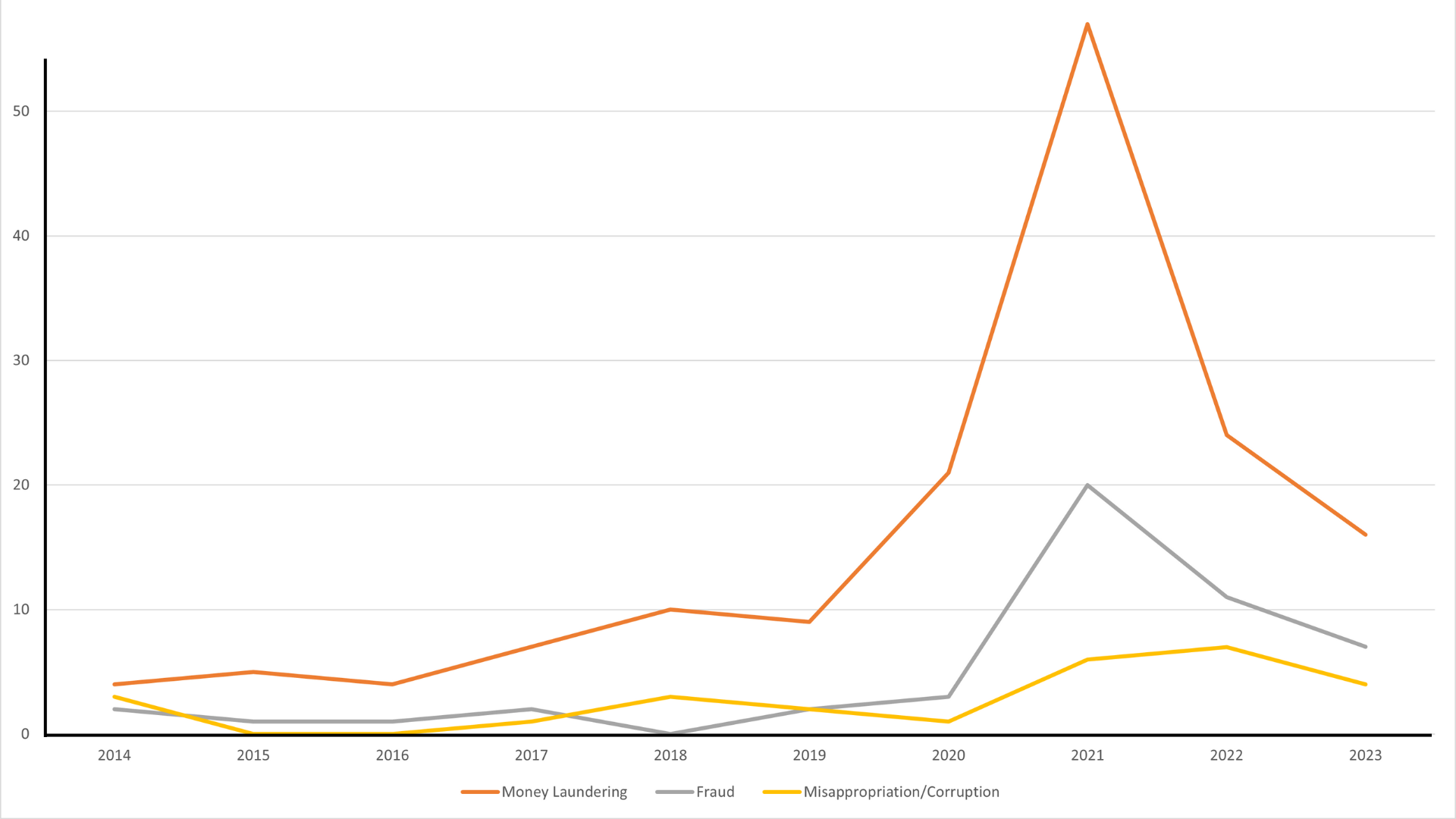

Maltese courts saw a surge of money laundering and fraud cases in the wake of Malta’s greylisting by the watchdog Financial Action Task Force (FATF) between 2021 and 2022, new figures tabled in parliament show.

The figures show a substantial increase in the number of charges issued against companies in the time leading up to and during the greylisting, only for them to dip in subsequent years.

The figures were tabled in parliament by Home Affairs Minister Byron Camilleri in response to a parliamentary question by opposition MP Jerome Caruana Cilia.

Organised by year and the suspected crime in each case, the data shows a noticeable spike in money laundering, fraud, corruption and tax evasion charges leading up to 2021.

The number of cases then decreased again in 2022 and 2023.

Malta was greylisted by the FATF between June 2021 and June 2022.

In the three years leading up to and during the greylisting, more than 100 money laundering court cases were launched. The preceding three years had 26 such cases.

Money laundering and related offences over the years show a noticeable spike in the wake of the FATF’s greylisting in 2021.

During the same period, both the Financial Intelligence Analysis Unit and the Malta Financial Services Authority (MFSA) spent hundreds of thousands of euro on public relations, marketing and advertising in an attempt to manage their public image during the period in which they were subject to increased scrutiny.

The Shift has also reported how dozens of administrative fines to financial institutions issued for their failure to adhere to anti-money laundering regulations, are now being challenged on constitutional grounds.

While separate from the criminal cases listed in parliament, many of the administrative fines now being challenged were levied during the same period.

The government was so far unwilling to update legislation governing the FIAU, despite a string of court cases that nullified their enforcement actions due to constitutional issues.

Experts who spoke to The Shift noted the “zealous attempt to show the unit’s effectiveness” during the period. They said this came in the form of “targeting small fry while ignoring politicians or cabinet members.”

Financial experts have told The Shift that given the administrative fines were being dismissed based on the way they were issued, rather than the merits of the suspected offences, any actual offences by the companies charged will remain unenforced.

Finally Labour being transparent.

FIAU CEO moved to MFSA, while conveniently keeping his chair on the FIAU board, when FIAU started loosing in courts. Still, it is not their fault. Now they are scrutinized for finally doing their job?

FIAU investigates but rarely concludes the process, which tallys for years. Perhaps legislation should change. Perhaps courts should learn how to properly assess money laundering cases to make an informed decision instead of undermining the efforts of the designated AML institution in Malta.

Never underestimate the lobbying power of the financial firms and their rich owners and directors. Check the integrity of the judges who annuled FIAU fines, regardless of the judgement rationals. Check their competence as well.

Otherwise, Malta will loose again. Who will take the blame next time?