Information on which officials assessed Prime Minister Robert Abela’s tax declaration on his two-tumoli Zejtun farmhouse is not available at the Inland Revenue Department, the tax commissioner has told the information commissioner in response to a complaint by The Shift on a Freedom of Information (FOI) request denied.

In a letter to the information and data protection commissioner (IDPC), the commissioner of Inland Revenue, Joseph Caruana, said he does not have the information sought, even though this must be recorded in his department’s files, according to law.

The Shift filed a complaint with the IDPC after Caruana refused an FOI request on the tax department’s handling of the prime minister’s declaration.

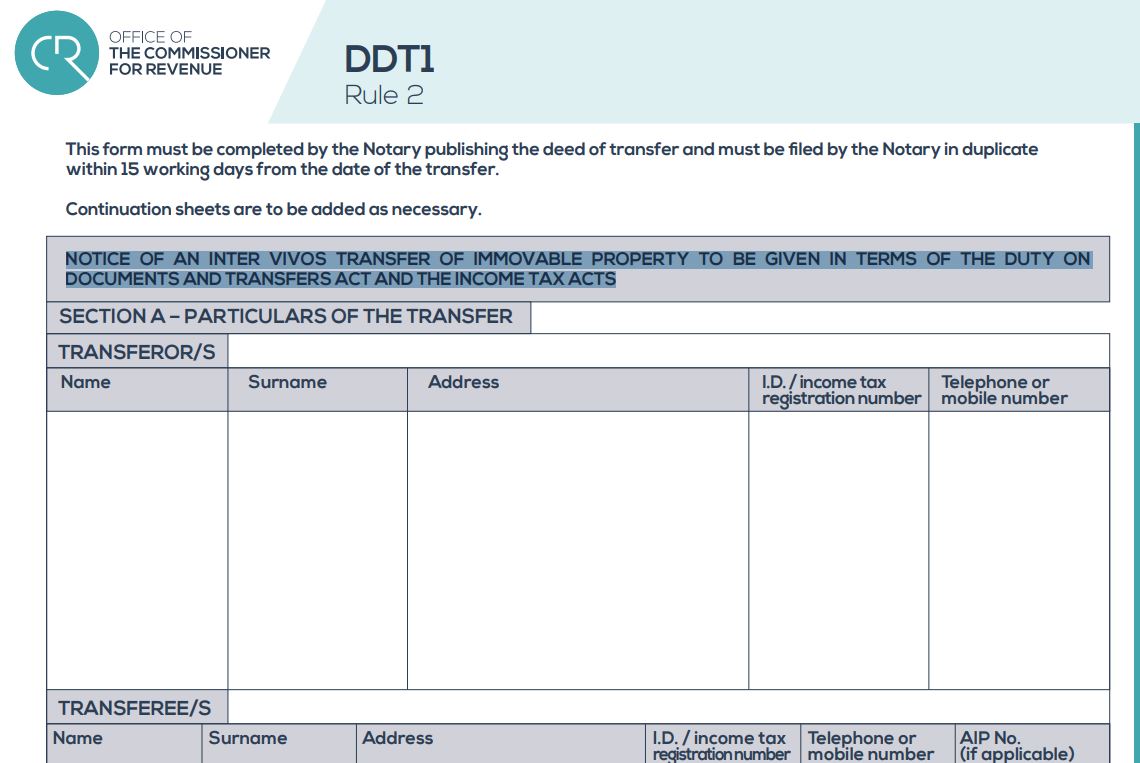

The Shift asked Caruana to provide the minutes of the internal board meeting assessing the prime minister’s DDT1 form declaration, through which Abela’s notary would have informed the department of the value of the purchase and the taxes due.

Sample of the DDT1 form the Abelas were obliged to submit to the Inland Revenue Department.

The ShIft also asked for the names of the officials during this meeting and the date it was held.

The law states that all contracts on the transfer of property and related declarations on stamp duty to be paid are to be assessed by an internal Inland Revenue Board.

Yet, Caruana, appointed to his position by Abela, surprisingly told the IDPC that “the requested information is not available to this (his) office”.

The Commissioner also refused to provide the prime minister’s DDT1 declaration, saying, “the Duty on Documents and Transfers Act prohibits the disclosure of information received during the exercise of the officers ‘duties within the Office of the Commissioner for Revenue’.”

The Shift replied to the IDPC, saying the tax department’s “excuses” cannot be taken seriously because it is impossible not to have any data on a crucial assessment it should have conducted.

The Shift also told the IDPC that the same law quoted by Caruana to prohibit the publication of the information requested has provisions in which the same commissioner can exert his sole discretion.

“The fact that this request concerns the transparency and accountability of the person occupying the highest public office of the country merits the CIR’s discretion to reassure the public that the prime minister was not given any special treatment by a government department,” The Shift argued.

According to a public contract signed on 10 July 2017, published by Notary Dorienne Arapa, Robert and Lydia Abela declared the villa’s value as €600,000.

Yet multiple estate agents consulted by The Shift estimated the actual market value of the property at the time stood at €1.8 million to €2 million.

The prime minister has insisted that he paid stamp duty according to the declared value of the transfer of the property and revealed that the CIR had not even made an assessment on the purchase.

At the time, the tax commissioner was Marvin Gaerty, who was later removed by Abela to appoint Joseph Caruana last January.

So far, there has been no explanation on why the department did not send its architects for an independent evaluation.

According to the law, property buyers, except first-timers, have to pay a 5% stamp duty on the actual value of the purchase. Since the prime minister declared the value of his ODZ villa to be €600,000, he paid €30,000 in stamp duty.

The stamp duty on a €2 million purchase would have sent the prime minister and his wife back another €70,000.

The Abelas signed the contract only five days after the Planning Authority sanctioned massive illegalities at the ODZ farmhouse. At the time, the Abelas were serving as the Planning Authority’s lawyers.

CIR sources told The Shift that it is standard procedure at the department that all contracts of a particular value, like the Abelas’, are automatically assessed through an independent valuation by the department’s architects.

When government hides information, it raises suspicion of corruption.

Bloody crooks

Mafiamalta mmexxija mill-korrotti.

To think that this is the politician who ran after Bernard Grech’s twenty years tax problems totalling less than half of the stamp duty he and his charity queen wife “saved” on one of their property deals. Hypocrisy is alive and kicking.

Malta should be renamed Fort Knox. Not because it stores gold bullion, it stores corruption that is worth millions if not billions to Malta’s economy.

Believe it or not most of the nation is accepting all this. Keep it up.

I despair of this country. It’s run by bandits voted for by the general public. Unbelievable.

Lead by example they said.

Does this mean that Robert Abela did not pay any tax?

Or that he did not pay any tax , and the documents vanished so that no proof can be found that he did not pay ? The Leave No Stone Unturned to vacuum clean all evidence? Muscat’s misunderstood double meaning statements.

There must be a bank transaction showing the money transfer from Abela’s bank account and the Income tax department , or did he pay in Cash , he will say ?

Or some friend , who keeps the stolen riches for the friends of friends , Lorry Sant method, paid the tax for him? But the Tax Department is now run by a crook, or am I wrong?

Isin’t the tax commissioner caruana – brother of the ex commission agent who used to work for the ex education minister bartolo? Says a lot eh?