Electrogas secured a sweetheart deal with the taxman on its estimated €84 million windfall once the gas pipeline is built, according to leaked emails seen by The Shift.

Described as a “treasure” by Yorgen Fenech, a one-sentence email by now-former tax commissioner Marvin Gaerty to Nexia BT from 2014 exempts Electrogas from paying tax on profits expected upon completion of the government’s EU-funded gas pipeline.

In addition, this brief email by the tax chief also signs off on Electrogas’s proposal to treat the €30 million to be paid to acquire the concession as a VAT-free “tax-deductible expense”, further reducing the consortium’s tax exposure.

Electrogas shareholder Yorgen Fenech stands charged with ordering the assassination of journalist Daphne Caruana Galizia in October 2017, allegedly over corruption she was about to reveal in relation to 17 Black and Electrogas.

At the time of her assassination, Caruana Galizia was researching a large cache of leaked internal emails and a then little-known kickback company called 17 Black Ltd – details of which, prosecutors are saying, if revealed at the time, could have jeopardised Electrogas’ access to external funding and, with it, Malta’s public finances.

With Electrogas successfully raising external financing in December 2017, attention has turned to clauses in the agreements that trigger a multi-million payout to Electrogas and its shareholders upon the completion of a gas pipeline to Malta.

Specifically, increasingly tough questions are now being asked about the morality and legality of EU funds for the pipeline potentially being used, directly or indirectly, to essentially “reward” the assassination of a journalist.

‘Important document, please treasure it’ – Yorgen

In October 2013, after a bidding process widely slammed by the National Audit Office (NAO) as marred by a series of moving goalposts designed “to achieve a predetermined result”, the Electrogas consortium was announced as the preferred bidder.

One glaring example identified by the NAO related to the lack of information on the government’s plans in relation to the Sicily to Malta gas pipeline. Here, the NAO noted, Enemalta refused to divulge any information to other bidders, claiming that anything gas pipeline-related was outside the scope of the Request for Proposals (RfP). Yet it seems Electrogas, or rather some of its promoters, may have been privy to more information than others.

Within months of having been selected, the agreements being negotiated with Electrogas swiftly departed from the assumptions in the RfP and began to contemplate, among other things, a concept called “GSA Exit” – that is, what will happen once the gas pipeline is complete. In particular, how Electrogas will receive a large amount of money.

In May 2014, barely seven months after the bidding process was complete, Enemalta wrote to the tax commissioner through the now-defunct Nexia BT, whose partners Brian Tonna and Karl Cini are facing money laundering charges.

“Enemalta is considering the feasibility of investing in a gas pipeline that would replace the LNG gas plant,” Enemalta wrote. “Enemalta has accordingly requested [Electrogas] for an option to terminate the LNG related contracts at predetermined points to create space for this possible change” the letter continued.

“If and when this change occurs it will naturally constitute a loss of a substantial part of the business structure of [Electrogas]”, which the letter estimated reflected approximately 68% of Electrogas’ turnover.

“Enemalta will compensate [Electrogas] by paying a capital sum to [Electrogas] for the resultant loss of such a substantial part of its business.”

Consequently, the letter summed up, “any sum paid by Enemalta to [Electrogas] to compensate for such loss should be considered as being of a capital nature and not subject to income tax”. Likewise, this payment should, Enemalta asked the tax commissioner to confirm, “fall outside the scope of VAT”.

The letter also touched upon the famous €30 million that disgraced former Energy Minister Konrad Mizzi claimed “helped lower electricity bills” describing it as a “fee” that should be a tax-deductible expense and again asking the tax commissioner to confirm this.

Exactly four months later, on 24 September 2014, Marvin Gaerty sent Nexia BT a one sentence email worth millions: “With reference to the attached letter dated 24 May 2014… we are in agreement and confirm both the technical submissions and ‘set-off procedure’.”

Electrogas’ auditors weren’t too convinced. “Is it normal practice for such confirmations to be given via emails such as the attached?” the senior audit partner asked his tax colleagues.

Despite the unusual form for a determination by the tax commissioner, Electrogas’ auditors noted the import of this email. Yorgen Fenech would later forward the email to Electrogas’s CEO with a note, “Important document – please treasure it :)”.

This was not the only episode of preferential treatment for Electrogas by the taxman. The Shift has already reported in the past how former Minister Konrad Mizzi’s eleventh hour intervention in 2017 “gifted” Electrogas over €40 million by passing the burden of paying excise tax on imported LNG onto Enemalta and ultimately the Maltese taxpayer.

Mizzi is, along with former chief of staff Keith Schembri, presently subject to US sanctions (a travel ban) due to their “involvement in corrupt acts” including specifically their involvement in a “corrupt scheme that entailed the award of a government contract for the construction of a power plant and related services in exchange for kickbacks and bribes”.

In response to questions by The Shift, Gaerty would not comment on the form and contents of the confirmation given to Electrogas, including whether he felt any pressure, citing confidentiality.

Gaerty said, “it is normal practice and taxpayers’ right to request a confirmation of opinion from the [Commissioner of Revenue] on the interpretation/application of provisions of [tax laws]… naturally all replies are in conformity and in accordance with the relevant legislation and department policy as well as government policy on taxation matters”.

What do the Electrogas shareholders stand to gain from the pipeline?

Heavily criticised by the NAO for not being split up and ensuring better offers, the Electrogas deal bundles together three distinct multimillion revenue streams potentially running until 2035:

(a) sourcing and importing Liquid Natural Gas (LNG),

(b) turning that LNG back into natural gas in a process called regasification and supplying natural gas to D3 (BWSC) and D4 (Electrogas), and

(c) operating a gas-powered power station (D4) and selling its electricity to Enemalta.

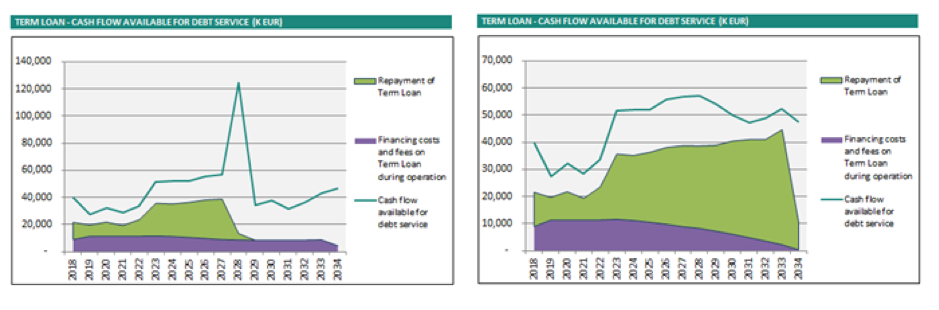

During Electrogas shareholder Paul Apap Bologna’s testimony at the Public Accounts Committee meetings scrutinising the Electrogas deal, Apap Bologna claimed that the shareholders had not made any money yet from the project. Pressed further, Apap Bologna described the Electrogas financial model as following a “hockey stick” model – a financial model that contemplates years of low profits or break even towards the beginning of a project but then sees a big surge in profitability towards the end.

Although the “not made any money yet” line is not wholly truthful given that the Electrogas promoters already paid themselves, among other things, €16 million in “success fees”, a review of leaked Electrogas financial models shows that the description of the Electrogas model as a “hockey stick” is accurate.

Electrogas’ financial models project that although the project initially started off with retained and recurring losses due to large initial outlays, by this year 2022, the project is set to reach a turning point as high debts (including shareholder loans) get steadily paid down through the multi-million euro revenues paid by Enemalta, turning the company to profit.

Electrogas’s sponsor’s financial model shows the dramatic impact on cash flow of a GSA Exit (left) vs no GSA Exit (right).

By 2027, past losses are projected to have been recouped and Electrogas will be able to distribute dividends to its shareholders.

In total, by 2035, Electrogas’ shareholders projected, according to their own financial models, earning over €350 million (around €35 million of which would go to Yorgen Fenech’s family company Tumas, and €11 million to Fenech alone through his New Energy Supply company) in profits and other distributions after repaying all debts.

That is a stunning 1,750% return on the original €20 million in equity invested and 8,750% return after factoring that €16 million out of the €20 million came from the “success fees”.

While the building of a pipeline and the triggering of a GSA Exit, projected for 2028 in both Electrogas’s internal projections and the government’s own estimates, means that Electrogas’ lofty revenues in supplying LNG would be cut short, the contracts ensure that Electrogas is amply compensated.

Energy Minister Miriam Dalli was coy when asked about the exact amount of compensation due to Electrogas upon a GSA Exit, but the consortium internal financial projections helpfully provide a far more concrete figure: €84,896,000 tax-free, assuming a GSA Exit in 2028.

Since the GSA Exit payment is compensating for the “loss” of revenues from LNG supply, Enemalta would need to pay yet more for an earlier GSA Exit and less for a later GSA Exit.

While a GSA Exit and the resulting windfall does grant the shareholders earlier access to profits, retaining the gas supply arrangements in place does, over the longer term, conservatively mean an extra €50 million in potential profits, the financial models show.

Internal correspondence shows that Hussain Fahmi, SOCAR’s financial analyst, was quite aware of this: “Every year GSA exit is delayed, Electrogas stands to gain”. Given SOCAR’s additional mark-ups on LNG, perhaps Fahmi should have added: “As does SOCAR”, Azerbaijan’s state-owned company.

All persons involved deny any wrongdoing. Electrogas directors also claim that following an internal legal and forensic review of itself it found “no evidence of any wrongdoing”.

On one hand we have got the Finance Minister Clyde Caruana saying that the government is going to collect all taxes due. 5,000,000,000 Euros. On the other hand KONRAD gave 40,000,000 tax free to Electrogas and by 2028 Maltese Tax Payers will pay Electorgas 85,000,000 Euos. Can this Labour Government make up his mind regarding TAXES. Does he want to collect the taxes from small business and all Maltese workers so he than gives money away to big consortiums. ‘ Electrogas, Steward Health Care, IC-Caqnu, and many more’

Unbelievable, I hope the EU commission is made well aware of these facts

Aware they are, but will they take heed, unlikely!

The mafia is everywhere! We (Malta) are not unique,

We will end up poorer than the poorest African country. It’s a matter of time, if we get booted out of the Eu you will need 5k in Lira to buy a cheesecake.

Please donate to the Shift in their/our fight for Freedom of Information. The Shift is invaluable for our fight against the rampant corruption that has heaped shame on our country.

Few remember that the Gas Storage Tanker is on lease for 18 years at €20 million yearly up to 2035.The company that owns the lease is Bumi Armada. This company got a scrapped 1st Generation LNG Tanker , for peanuts , described as unsafe , with asbestos , that is why it was also scrapped besides its age , replaced its boiler because it was unserviceable , gave it a good paint job and fixed its engines. After long delays for various strange reasons , the tanker finally was allowed to leave harbour by its owners. This was after BOV guaranteed the payment of the lease, apparently. BOV was supporting Electrogas with its finances.There are still €200 million to be paid in lease to BOV. A total close to a €BILLION , some say was the total BOV forked out to get Electrogas switched on.

SHAME ON OUR CORRUPT DECEITFUL, GREEDY LIARS headed by the most corrupt pm Malta ever had posing as the workers’ party. GO AND HIDE IN SHAME you corrupt lot.

They sure “made the best if it”….with more as back up, i’m sure.