Malta is one of 17 countries in the world offering a tax regime that enables 36 of Europe’s largest banks to retain more profit than they would in countries with less lenient tax systems, a report published by the EU Tax Observatory says.

The study found that as much as €20 billion in annual profits is being booked in tax haven countries alone.

Malta, along with other tax havens like The British Virgin Islands, the Cayman Islands, and Luxembourg, allows large multi-nationals like Deutsche Bank to benefit from lower taxes on declared profits, lining shareholders’ pockets with money that would otherwise contribute to the country’s taxes.

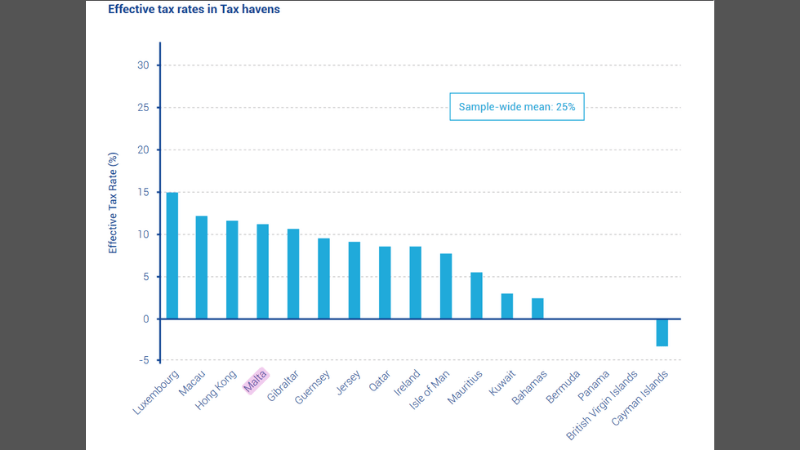

Malta, Luxembourg and Ireland are the only three European Union jurisdictions the report classifies as tax havens. The study pegs the effective tax rate for each country to make calculations about how much would be owed if a minimum rate was introduced.

While Malta’s effective tax rate on corporate profits stands at around 10%, companies in Luxembourg pay 15% and companies in Ireland pay around 8%.

Effective tax rates in all 17 tax havens. Source: EU Tax Observatory

The EU Tax Observatory ‘s report suggests that if all the 36 European banks were subject to a unified minimum corporate profits tax of 15%, which some MEPs in EU Parliament have been advocating for several years, banks would be contributing up to €3 – 5 billion annually more.

While the plan to harmonise taxes within the EU has gained traction over the years, particularly since COVID-19 hit and Brussels-based politicians scrambled to look for funding to replenish economies devastated by the pandemic, EU Member States like Malta have flatly rejected such proposals.

In a rare display of unity, all of the Labour Party’s four MEPs as well as the Nationalist party’s two MEPs have consistently voted against the adoption of any form of tax harmonisation across the EU, in order to safeguard Malta’s competitive advantage over larger States seeking to stop multi-nationals from dodging taxes in their countries.

Malta’s tax system allows for companies that are fully established here to pay an effective corporate rate as low as 5%, although the percentage is technically set at 35%. The system allows foreign-owned companies based in Malta to apply for refunds of up to 30% of that corporate tax. Holding companies set up in a similar manner are able to go completely tax-free.

Maltese MEPs have argued that EU tax harmonisation would interfere with the State’s sovereignty over its own taxation system while also pointing out that small economies would be disproportionately affected by such a move.

According to the Observatory’s report, a consistent pattern of tax avoidance was observed in the banks being analysed. This was measured by contrasting the amount of employees present in a country with the amount of profits being declared in the same jurisdiction.

The contrast reveals how, on average, €238,000 in profits per employee were booked in tax havens like Malta, while only around €65,000 per employee were declared in countries which had less lenient tax regimes.

One of the first to comment on the Tax Observatory’s report, EU Greens MEP Sven Giegold referred to Deutsche Bank as an example of how banks manage to dodge taxes using such a system: “At 27%, Deutsche Bank has the fourth highest percentage of profits booked in tax havens”.

“Deutsche Bank books on average 22% of its total profits in Luxembourg, where they are taxed at an effective rate of 14%. However, the number of employees in Luxembourg corresponds to just 1% of its employees worldwide,” Giegold said.

Conversely, Deutsche Bank books 34% of its profits in Germany but has more than half of its employees based within its home country, essentially meaning that Deutsche Bank declares two-thirds of its profits in other countries like Luxembourg.

Overall, European banks booked 14% of their profits, or the figure of €20 billion, in tax havens.

Besides Deutsche Bank, the report also flags HSBC and Société Générale for having a particularly high presence in such tax havens, singling them out as examples of the problem being investigated by the report’s analysis of each bank’s profit declarations in every country they operate in.

The report also warns that drastic measures such as a 25% overall tax rate across every country may be necessary as European banks have not shifted away from their tax haven favouring practices in spite of growing public pressure for such legislation to be passed.