Twenty-four financial services companies have voluntarily handed back their licences to operate to the Malta Financial Services Authority in the two months and two weeks that have passed since Malta was greylisted by the Financial Action Task Force on 23 June.

This comes at the tail-end of a negative trend observed since 2018. From 2018 to 2020, 616 companies operating in the sector have handed in their licence to operate.

Malta’s greylisting, which was largely attributed to the country’s lack of transparency in terms of the ownership of companies and weak financial intelligence on tax crimes, has caused concern to operators in the sector due to the increased monitoring imposed on financial activity linked with the island.

“Undoubtedly, all this will very likely negatively affect international trade and foreign direct investment of the country in question, rendering it difficult for the same country to participate effectively in the global capital market. The reputation risk may also lead to a situation where certain companies would not want to be associated with a greylisted jurisdiction. This may already have happened in Malta,” economist Lino Briguglio said in reply to questions from The Shift.

“The consequences will depend on how seriously this matter is taken by the government of the greylisted jurisdiction. It can actually have beneficial effects in that the country concerned may take advantage of the situation by reforming its ways, especially by upgrading its anti-money-laundering legislation and by improving its institutional framework and governance practices in this regard,” Briguglio added.

Of the 24 companies that surrendered their licences since the greylisting, 16 have surrendered licences to operate while others surrendered licences to operate 12 specific sub-funds, usually used for capital management and accumulation.

While 19 of these companies had registered addresses in Malta, five of the licences that were surrendered belonged to international as well as London-based firms.

AUM Asset Management Ltd, based in the US and in the UK, surrendered its licence to operate a sub-fund it had registered in Malta in 2016. Oceanwood Capital Management Ltd, based in London, surrendered its investment services licence after operating in Malta for 15 years.

HBM Group, a worldwide corporate services group of companies headquartered in The Netherlands, altogether abandoned its local iteration, HBM Malta, which was a previously licensed company services provider.

A majority of the companies in question were financial institutions geared towards handling investment portfolios, with some operating as trustees or nominees on behalf of others. Three of the companies that handed in their licences were also providing corporate services; in other words, anything from tax-related matters to the incorporation of companies and accountancy services.

The worrying trend reflects what has essentially been referred to by sources in the financial services industry as a ‘shadow’ greylisting process that occurred over the past five years as companies quietly divested themselves of their interests in Malta.

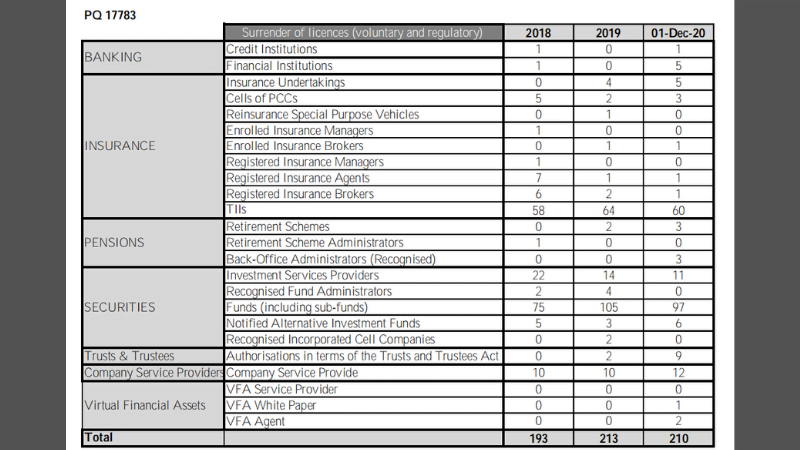

A parliamentary question filed by Opposition MP Ryan Callus in January revealed that between 2018 – 2020 alone, as many as 616 companies relinquished various types of licences from the MFSA.

The data chart answering the parliamentary question filed by Opposition MP Ryan Callus.

Of the 616 licences that were surrendered in those three years, 277 of them were licences for the operation of sub-funds, also known as a portfolio of assets which are normally accumulated with the intent of yielding a specific return.

Another 182 licences were for tied insurance intermediaries, brokers whose job is to sell insurance policies for other, larger insurance companies. Forty-seven licences belonged to investment service providers, with an additional 32 company service providers also throwing in the towel.

These four categories alone make up 87.3% of the licences handed back to the MFSA over a three-year period. The data set attached with the response to the parliamentary question also outlines that 652 licences were approved in the same period. However, the number of companies being formed per category highlighted above was significantly smaller than the amount of licences that were surrendered.

What happened since we got greylisted?

“A jurisdiction that is greylisted by the FATF is considered as unable to control money laundering activities and the financing of terrorism. This is obviously a great reputational downside for any jurisdiction. If a country does not cooperate with the FATF in controlling money laundering, the reputational risk would be intensified with further loss of investment and trade, and if the problem persists, possibly risking being black listed,” Briguglio said.

While Prime Minister Robert Abela has promised that the government will redouble its efforts to get Malta off the grey list, the long list of scandals dogging the MFSA continues to weigh on its reputation, while its chairman, John Mamo, was given an extension in January of this year.

Mamo, who’s been appointed for another three years, has already overseen a period in which the MFSA had registered a multi-million euro deficit as former CEO Joseph Cuschieri doled out millions of euros in direct orders to private contractors that were later lambasted by the National Audit Office for being in breach of public procurement rules.

Another questionable figure on the board of the MFSA is Edwina Licari, Cuschieri’s former Malta Gaming Authority colleague who was immediately recruited by Cuschieri on a €100,000 salary when he became CEO. Licari now makes the same amount of money as a director on MFSA’s board.

Christopher Buttigieg, known as the architect of Malta’s failed ‘Blockchain Island’ project, was also recruited in the role of acting CEO for the MFSA.

The government’s standing with the country’s business owners took a dip when the Malta Employers’ Association released a survey showing that more than 100 companies blamed the greylisting on weak, selective rule of law and the state’s inability to deal with money laundering and institutional corruption.

Credit rating agency Moody’s preserved Malta’s A2 stable rating (meaning the country’s credit risk is considered to be low) while reviewing the country’s overall economic outlook to negative.

The UK also placed Malta on its list of high risk jurisdictions in terms of money laundering on 13 July, further accelerating the rate of companies relinquishing their licences and leaving the island.

Bungle it, and they will go.

Can Christopher Buttigieg declare his conflicts of interests? Come on Chris, let us know with whom you banked and invested in the past years. Or would you rather be forced to reveal that in Courts?

But we have certainly been told – albeit not so repeatedly or pompously – that grey listing would not harm anybody on this darned rock.

Are we being fed lies and expected to gulp them with gusto? Looks like it, doesn’t it!

Malta, the dust bin of Europe, thank you L’aqwa-Zmien Gahan government crooks.

Who is able to enforce the rule of law and bring these crooks to justice??

It is increasingly obvious that the current incumbents charged with the jobs are not going to, so what happens now?

Thank you joseph the corrupt artful dodger. Are you happy now? Go and hide.

,….or go to jail joey, it will help us get de-grey listed

Christopher Buttigieg dan John jidher li jafek sew.

You bunch of liars. Bobby the ice-lolly man had assured us that grey paint is actually a nice colour to look at and will not be a problem.

This is a rubbish article, full of incorrect premises in order to support an agenda. The surrender of licenses primarily reflects commercial decisions. By way of example, management umbrella structures foster easier, cost-efficient, establishment of sub-funds which are not always successful. To suggest that the pre-grey listing activity had anything to do with it is frankly a nonsense, as is the attack on Christopher Buttigieg who has been a stalwart of the MFSA for as long as I have been a licence holder, which exceeds 26 years. There has been no attempt at balancing the argument by the comparing the number of new licenses issued over the same period and the number of existing license holders still operating. I am surprised and disappointed that the Editor allowed this piece to be published.

How come you are defending Christopher Buttigieg? He decides if you are to keep your license. He decides whether you are fit and proper. He came up with the flawed project of Blockchain Island. He promoted it. At the same time, he enjoyed 5 promotions at MFSA. Under his helm, Malta got greylisted. He still considers Pilatus directors as fit and proper. The ECB cancelled the license of Pilatus, while the MFSA was in sleeping mode. These are facts, not opinions.

‘The data set attached with the response to the parliamentary question also outlines that 652 licences were approved in the same period. However, the number of companies being formed per category highlighted above was significantly smaller than the amount of licences that were surrendered.’