Receipts obtained by The Shift confirmed that Barbajean, the restaurant jointly owned by Infrastructure Minister Ian Borg and his spouse, Rachelle Borg Dingli, failed to issue fiscal receipts upon issuing a bill unless specifically asked for, on at least two separate occasions.

The restaurant is run by Ian Borg’s brother-in-law, Jean-Pierre Dingli Attard.

A non-fiscal receipt such as the ones obtained by The Shift is like a ‘draft’ version of the fiscal receipt, which is what the VAT department will use when calculating money owed to it from the transactions that were recorded.

In other words, a non-fiscal receipt is not considered to be the final transaction, and a fiscal receipt must be issued when the sale is made.

A business or individual operator indulging in regular omissions of fiscal receipts can easily ensure that those transactions are not recorded anywhere that is visible to the eyes of the VAT department.

Malta has a documented, long-standing issue with business owners failing to declare the correct amount of VAT that is owed. In 2019, the European commission estimated that Malta’s ‘VAT Gap’, or lost VAT revenue, hovered at around €176 million.

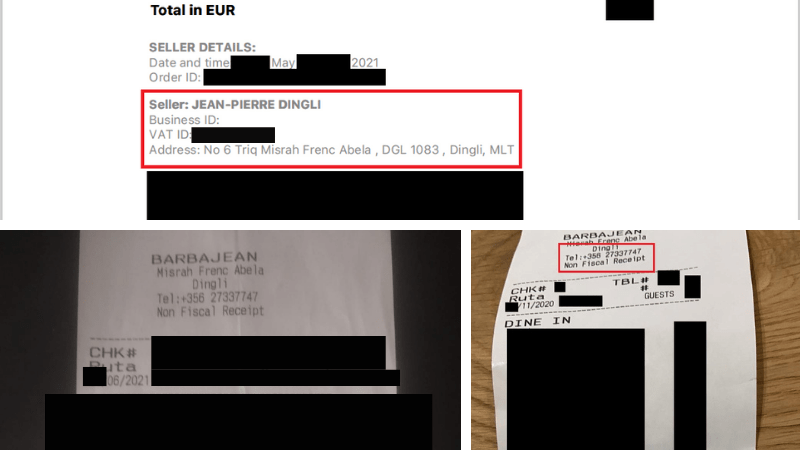

The receipts held by The Shift, obtained in November of last year and in June of this year, clearly state that it is merely a non-fiscal receipt.

Receipts demonstrating ownership of Barbajean and non-fiscal receipts.

When visiting the restaurant to verify information supplied by our readers, The Shift’s journalist was also given a non-fiscal receipt.

Upon further insistence for a copy of the receipt for billing purposes, waiters promptly brought out a fiscal chit, likely printed from a different cash register, stapled to another copy of the same non-fiscal receipt.

A court case from 2016, Police v Anthony Scicluna, reflected a similar scenario in which Scicluna, representing Jubilee 2000 Ltd, was fined €900 for failing to provide a fiscal receipt the moment the sale was made.

Barbajean, a relatively expensive restaurant with mains costing an average of €22.85 per plate and bottles of wine that do not dip below the €25 mark and stretch to hundreds of euro per bottle, had its official opening in June last year.

Infrastructure minister Ian Borg and his family at Barbajean.

Minister Ian Borg’s asset declaration form from 2020 confirmed long-standing rumours of his family’s involvement in the restaurant.

Although the restaurant is not named, the form refers to his spouse being involved in “a catering partnership with no separation of assets”. Public posts on social media confirmed Rachelle Borg Dingli and Jean-Pierre Dingli Attard’s roles in the business.

Barbajean’s relatively short foray into the catering industry so far has been helped along by regular visits from various high-profile figures associated with the Labour party and their friends and families, with gushing endorsements all around, judging from posts on social media.

From top left: Josette Schembri, Filippa Cardona (Chris Cardona’s daughter), Cyrus Engerer, and Michelle Muscat.

Some of Barbajean’s customers include wife of disgraced former prime minister Joseph Muscat, Michelle Muscat, as well as Josette Schembri, wife of equally-disgraced former chief of staff Keith Schembri who is facing charges of money laundering among other financial crimes.

Members of former economy minister Chris Cardona’s family, as well as Labour MEP Cyrus Engerer, have also snapped pictures at Barbajean.

The minister’s assets over the years

The minister owns two residential properties, two tumoli of land and two offices, one in Rabat and one in Dingli, according to his declarations to parliament.

Borg’s declared income increased gradually by almost €50,000 over the eight years the minister and former parliamentary secretary has been in government, a €6,250 increase per year on average.

Cash deposited in the minister’s sole declared bank account with BOV stood at an average of €14,644.38, with the largest fluctuation occurring from 2019 to 2020.

In that one-year gap, money deposited in the minister’s account more than tripled, increasing from €8,780.92 to €26,783.

In 2014, the minister took on a sizeable amount of debt to finance his “matrimonial home” in Rabat, which has been mired in controversy, most recently due to works on the minister’s ODZ pool being finished before a permit was issued.

The land on which the pool was built was also purchased for a pittance from a mentally unwell man, with a court ruling declaring that the minister’s version of events was “not credible”.

According to the minister’s asset declaration for 2020, his debt on the loan to finance the matrimonial home stood at €289,608.58.

In 2019, debt ascribed to the same loan stood at €309,675.08. The minister cut down the outstanding loan by €20,066.5 in just one year, the same year in which his cash deposits tripled.

Shame on all those who support this corrupt muvument. The more you support them the more they screw up this island.

SHAME ON THEM. Shame on all those who are still supporting this corrupted government. Gvern ta records qallu u vera ghax fkollox gejna lewwel fejn tidhol il korruzjoni!

Labour more shades of grey than the Dulux colour range.

In Greece, since 2013, every menu has the following: “The consumer has no obligation to pay, if no receipt is being issued”.

Maybe Malta should copy this idea.

They are ALL in this together. Millions of Euro talk:

Restaurants 1, 2, 3, 4, 5, etc.

Hotels 1, 2, 3, 4, 5, etc.

(Govt.) Projects 1, 2, 3, 4, 5, etc.

Football Clubs 1, 2, 3, 4, 5, etc.

Buildings 1, 2, 3, 4, 5, etc.

Direct Orders 1, 2, 3, 4, 5, etc.

Jobs & Promotions 1, 2, 3, 4, 5, etc.

Tax evasions on 1, 2, 3, 4, 5, etc.

Betting & Casinos 1, 2, 3, 4, 5, etc.

Fuel Stations 1, 2, 3, 4, 5, etc.

Luxury outlets and brands 1, 2, 3, 4, 5, etc.

….anything that renders millions of euro.

If any “normal” Maltese person, working by the book, is awaiting any changes soon, we are just being delusional!! This is NOT going to happen because they are not interested in doing it, of course. Politics pay in millions nowadays not just the mere few thousands!!

Are FIAU officials investigating this?

Vat dept please take note.

Is there someone within that garbage bin which is the Maltese government who is willing to say: Country before party; honesty and rectitude before dirt and corruption? It seems not.

You’re gonna wake up the VAT Department and they will have to leave the airconditioned building in this heat and it’s not fair.

If the VAT loss is EUR 176 Million, then the Tax on profit would be at least equal if not double that. As establishments pay their unregistered employees in cash, there is also NI and TAX there too.

There are nice green chairs in Parliament, especially if you’re a minister. That’s why they all, politicians fight and do whatever it takes to be elected.

I’ve been saying (comments) for years on end how 90% to 95% of all the restaurants in Malta never issue a VAT receipt. If the VAT Department had to employ for starters 100 persons (or many more) just to identify this high fiscal theft, then Malta would become rich overnight. But nothing is ever done and how convenient that is to some business people. With the FAFT greylisting around our necks, I hope that something will be done soon to remedy the situation. Let’s all wait and see how long this is going to take the authorities to start investigating regularly each and every restaurant on the island and dishing out fines.

The figures mentioned in the article are just peanuts. I’d multiply them by about 200 times. Research in further depth.