PricewaterhouseCoopers (PwC), one of the major ‘big four’ audit firms in Malta, has changed its position over its association with Pilatus Bank – defined in court as a money laundering machine – and has accepted to take over a new role at the bank despite a potential conflict of interest.

The sudden change of heart, accompanied by the possibility for PwC to rake in massive fees, possibly running into millions, surprised many in the industry as it came about only a few years after its managing partner David Valenzia declared in court that his firm was not comfortable with continuing its work for Pilatus Bank due to its record.

PwC acted as the bank’s internal auditor between February 2014 and December 2016 and was supposed to serve as one of the bank’s “three lines of defence” when it comes to following proper procedures, including anti-money laundering compliance.

On PwC’s watch, Pilatus was responsible for a number of suspicious transactions which led to the European Banking Authority‘s withdrawal of its licence. During the same period, the Maltese regulator, the MFSA, failed to take any action against the bank despite repeated reports in the press.

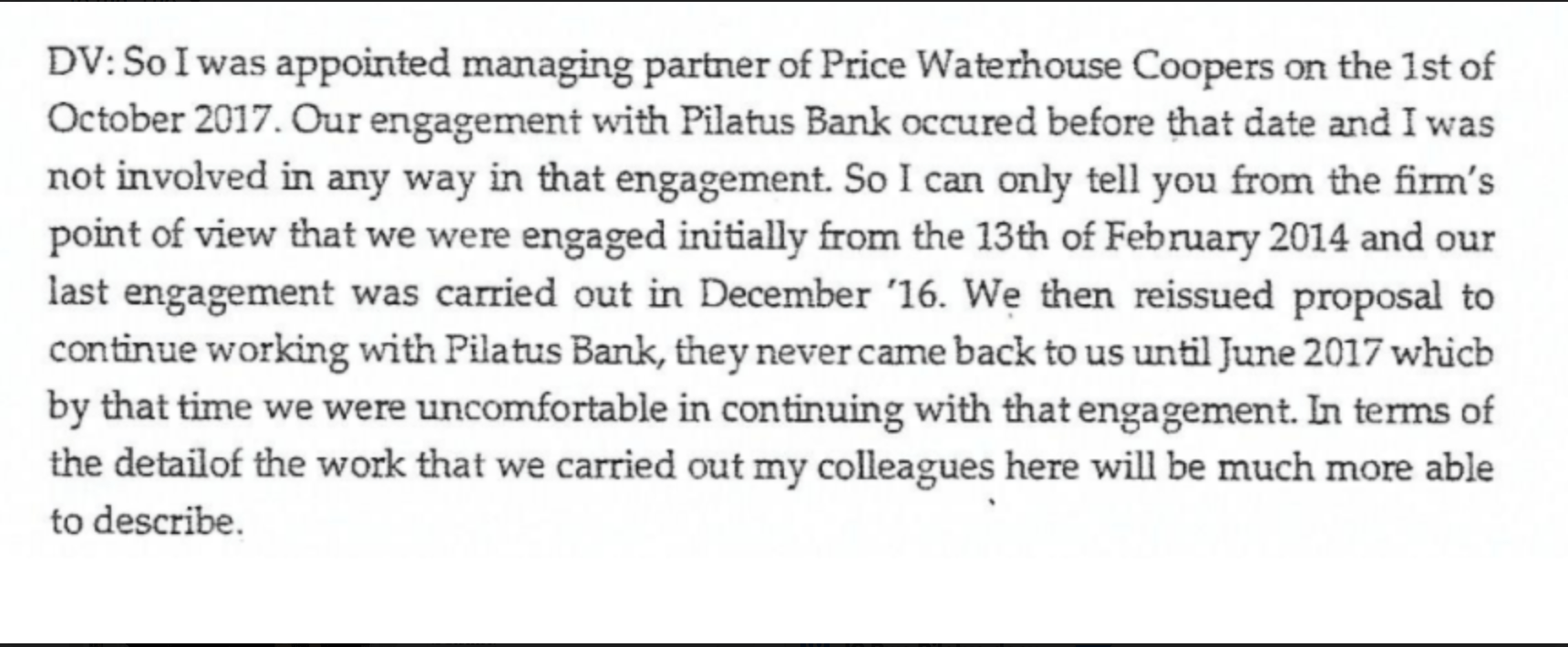

During court testimony in the notorious Egrant inquiry, which dealt with whether Michelle Muscat, wife of disgraced former prime minister Joseph Muscat owned a secret account at Pilatus Bank, Valenzia had said PwC was “uncomfortable” with continuing its work for the bank as more and more stories of impropriety were surfacing in the media.

Shrugging off responsibility for his firms’ role onto his predecessor, former managing partner Kevin Valenzia (his brother), David Valenzia admitted that his firm was still pitching for another contract from Pilatus Bank when problems became public.

“They never came back to us until June 2017, which by that time we were uncomfortable continuing with that engagement,” he told the court.

Extract from David Valenzia’s statement in the Egrant inquiry.

Just a few years after his declarations in court, PwC, still managed by the same Valenzia, is now adopting a new approach.

A few weeks ago, at the invitation of the MFSA, PwC accepted to act as ‘competent person’ for Pilatus Bank, dropping its objections voiced in the Egrant inquiry.

This means that PwC will take over the administration of the bank it was previously ‘uncomfortable’ working for and now charging it, possibly millions in fees for its work.

Pilatus Bank was shut down at the end of 2018 and had its licence taken away over serious money laundering breaches.

Speaking to The Shift, several audit industry sources said they were surprised at the latest turn by PwC. “It is astonishing that PwC has accepted to take on this assignment when it was so close to the embarrassing story of Pilatus Bank,” one financial services expert said.

“It is even sadder that after trying to shrug off any responsibility for what happened on their watch, it seems that a few years down the line PwC is now ‘comfortable’ once again to work with Pilatus Bank and earn their cash. We really have a serious problem in the profession.”

Asked for their reaction, both the MFSA and PwC justified their position.

Without explaining the process of how the financial services regulator decided to choose PwC, the MFSA said it “speaks to a range of potential service providers and considers all relevant issues before making a competent person or skilled person appointment.”

A similar stance was adopted by PwC: “In line with its professional requirements, PwC carries out procedures prior to accepting any engagement. We cannot comment on client-specific matters”.

Big audit firms are a big problem

During the past years, Malta’s major auditing firms have become synonymous with stories of alleged money laundering, breach of rules, fraudulent activities, and lack of ethics as the country has dived in rankings in order to attract the super-rich and wealthy to its shores, including through the selling of passports and citizenship.

After years of absence and failures by the supervisory authorities, pressure by international organisations, including Moneyval, led to a sudden surge in policing, leading to many long-practising accountants and auditors, such as Brian Tonna, Karl Cini, Manuel Castagna and others now facing criminal charges.

The ‘Big Four’ firms in Malta – Deloitte, PwC, KPMG and EY – normally associated with the highest of standards, have not been spared criticism because they went with the flow.

Industry sources told The Shift that PwC’s sudden change of heart is just another example of how these firms have grown too big and are now constrained to sacrifice their ethics, standards and code of conduct at every prospect of cashing in lucrative fees.

In February, The Shift exposed another of the Maltese big four when it resulted that EY had charged more than €10 million in fees when acting as a ‘competent person’ for Satabank – also accused of money laundering activities.

The appointment of EY by the MFSA was made at the time when the financial regulator was led by its now-disgraced CEO Joseph Cuschieri.

The former CEO, who had to resign after a scandal involving him accepting gifts from Yorgen Fenech, used to work for EY as an advisor and was a close friend of the ‘competent person’s managing partner, Ronald Attard.

During the past years, all the big four firms have become increasingly dependent on government handouts, cashing in millions annually in taxpayer funds in direct orders and tailor-made assignments.

These firms that have now expanded to dozens of partners are used by the government and its many entities to write reports and give advice on numerous multi-million euro projects and deals.

They are also regularly assigned to audit government entities, charging exorbitant fees to taxpayers.

Povru haddiem li afdakhom bil- vot is-suppost u spicca jehu l-loqom. Il-*persons of trust* korrotti bil-provi u qisu ma gara xejn. ISTHU

There is a free lunch for everyone, as long as you tow the line. It is best to be the “in” guy to clean up any unsavoury poop still running around in the remain books. Surprising after so many years of clean ups and purges of data.

I will be surprised if there is anything left, notwithstanding the ten years data retention requirements.

If they told me the sky was blue, i wouldn’t hesitate to look up, professional bullshitters who survive on taxpayers easy money for their trade AND non accountable. Ideal for business in Mafialand.

Do you notice the frequency with which accountants use the word “professional”? It seems they believe that talking about it is a good substitute for actually being professional. They are nothing but mercenaries scooping up public money providing consultancies and writing reports that are invariably peppered with numerous caveats effectively absolving them from any responsibility.

Must be a different PwC from the plethora of google suggestions from ‘PwC scandal’.

But once again the MFSA are involved. Why don’t they get investigated?

Not often you get it wrong, but you slipped up badly with “Normally associated with the highest of standards…” I’m afraid. Speak to some small time auditors, and they’ll tell you.

Kuljum b’xi skandlu ġdid u tal-waħx. Għad xi darba jiddispjaċina ta’ dan kollu.

Nibki għal pajjiżi li ntilef fil-ħmieġ tal-korruzzjoni u tfotta għal dejjem.

‘ PwC drops ethical concerns as prospect of Pilatus Bank funds looms ‘Opportunism reigns supreme in this country.

No signs of integrity ever existed by some people in their profession.

How can PWC be appointed ‘competent person’ when they had already been engaged by Pilatus? Do I smell a strong odour of conflict of interest? But then the prospect of earning considerable fees masks the stench!

MFSA and PWC will come up with the lame and invalid pretext of Chinese Walls.