The local branch of international auditing firm Ernst & Young (EY), which was appointed by direct order in 2018 by former MFSA CEO Joseph Cuschieri to act as the ‘competent person’ to manage the affairs of Satabank, has charged the financial regulator over €10 million in fees for its assignment.

The Shift is informed that while the exorbitant fees are now expected to be recouped by the MFSA from the bank’s frozen funds, EY was charging the MFSA some €700 an hour per employee assigned on this job.

Some of EY’s invoices to the MFSA reach a million each.

It is not yet known how these charges will impact the frozen funds of clients, still held at the bank, on EY’s instructions.

Questions have been raised in the financial services industry on how the MFSA decided to hand out such a lucrative contract through direct order.

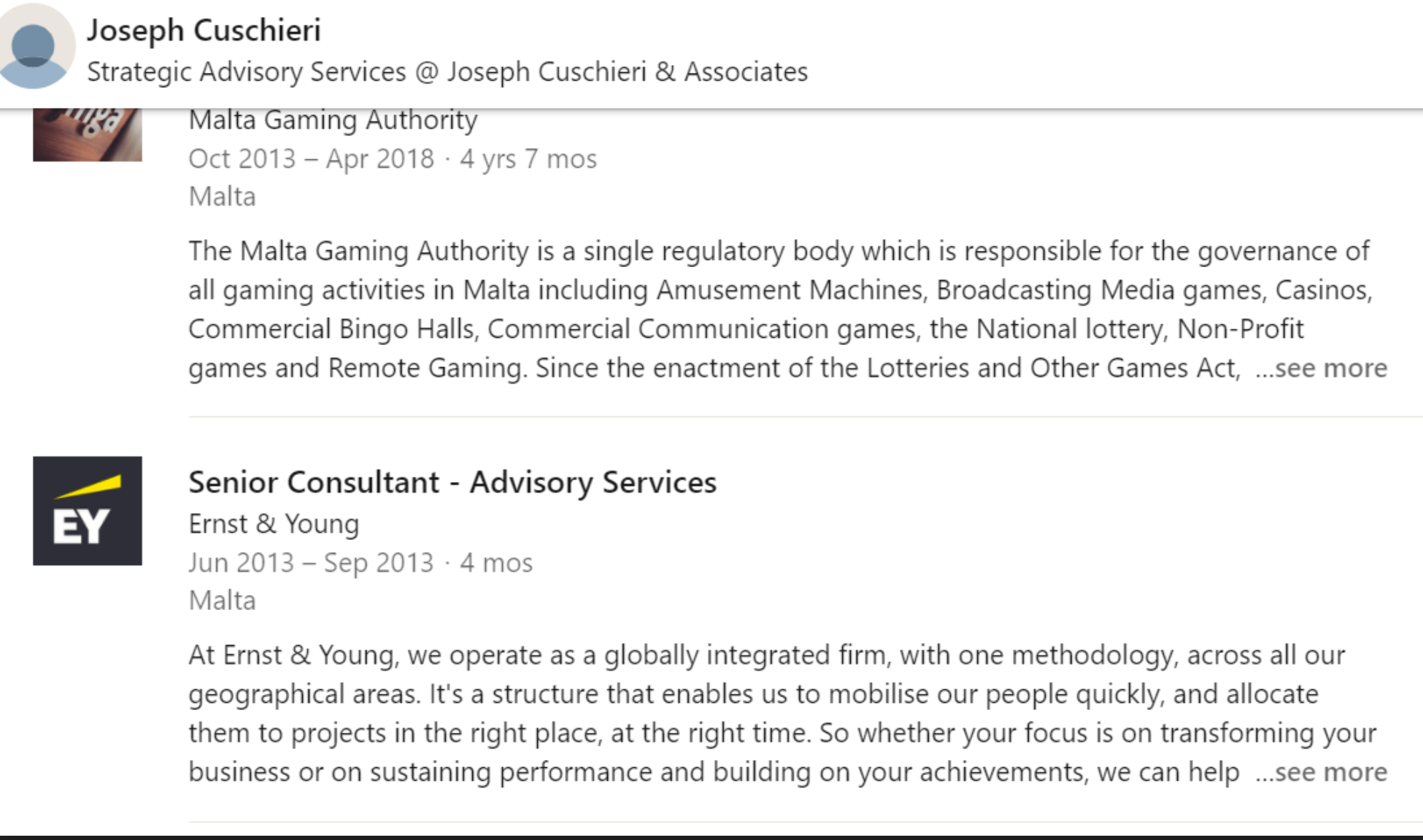

While the MFSA Board of Governors must have had the final say on the selection, sources have drawn attention to the fact that Cuschieri was previously on EY’s payroll.

EY’s Malta Managing Partner Ronald Attard has confirmed that Cuschieri spent some time as an advisor at the auditing firm, when answering questions from The Shift. Yet he insisted that this was a long time ago and pointed out that Cuschieri, following his forced resignation from the MFSA, is not doing any work for the firm.

Joseph Cuschieri’s LinkedIn profile.

“Mr Cuschieri was engaged by EY for a period of four months over seven years ago in 2013,” Attard’s spokesman said.

Cuschieri was appointed directly by former Prime Minister Joseph Muscat as CEO of the Malta Gaming Authority and subsequently appointed to head the MFSA.

Under his stewardship at both entities, EY were among the top recipients of direct orders, worth millions, paid from public funds.

EY’s spokesperson did not address the question on which MFSA official it was who had approached the company for this assignment.

He only said the firm was approached by the MFSA with respect to acting as the ‘competent person’ for Satabank in a monitoring role which “subsequently changed to become the competent person in charge of the affairs of the bank”.

“As part of our global take on procedures we undertook a conflict check and considered the role we were being asked to perform. We concluded there was no conflict of interest in respect of taking on the ‘Competent Person’ role,” EY added.

The Shift can confirm that it was Cuschieri who approached EY to take on the crucial role.

EY’s Malta Managing Partner Ronald Attard with former Prime Minister Joseph Muscat.

Licensed in 2014, the MFSA ordered Satabank to discontinue its banking operations in October 2018 following alleged breaches of anti-money laundering rules. The bank had been hitting the headlines over suspected transactions for years, but the MFSA only decided to take action when international pressure started mounting on Malta.

While all 12,000 accounts held at Satabank were frozen, including more than €300 million in deposits, EY was selected by the MFSA to take over the running of the bank.

Last summer, the ECB, acting on the MFSA’s recommendations, withdrew Satabank’s licence.

Following this development, the MFSA appointed Richard Galea Debono as the bank’s liquidator.

The ECB’s action against Satabank came just a year after Malta’s reputation had been tarnished by the events that took place at Pilatus Bank, which also had its banking licence withdrawn following repeated allegations of money laundering activities.

In various court cases instituted by Satabank, including against the ECB, it complained of the exorbitant fees charged by EY.

Nice job for the boys as usual

EY making hay while the sun shines.

No wonder the government gets high credit rating.

And with that payroll you couldn’t even do you job and get my funds back? Pathetic

And yet we still waiting to receive our funds,

To all the foreign investors – AVOID TO COME TO MALTA

nobody get money abck again?

Kulhadd jisraq kemm jiflah. Meta servejjer iqum mir-raqda il- haddiem onest li qieghed jigi misruq mill-muvument korrott u shabu. SHAME

And still haven’t return to me my money back

I have it from the highest authority in North America that this is, undoubtedly, a scam. A €250 hourly rate would be considered acceptable but 200% higher is criminal. Who can you trust in this sad and corrupt country?