Plans submitted last December by DB Group show an increase in the number of apartments for sale at its City Centre development in St George’s Bay, while parking spaces have decreased despite commitments to reduce the size of the development.

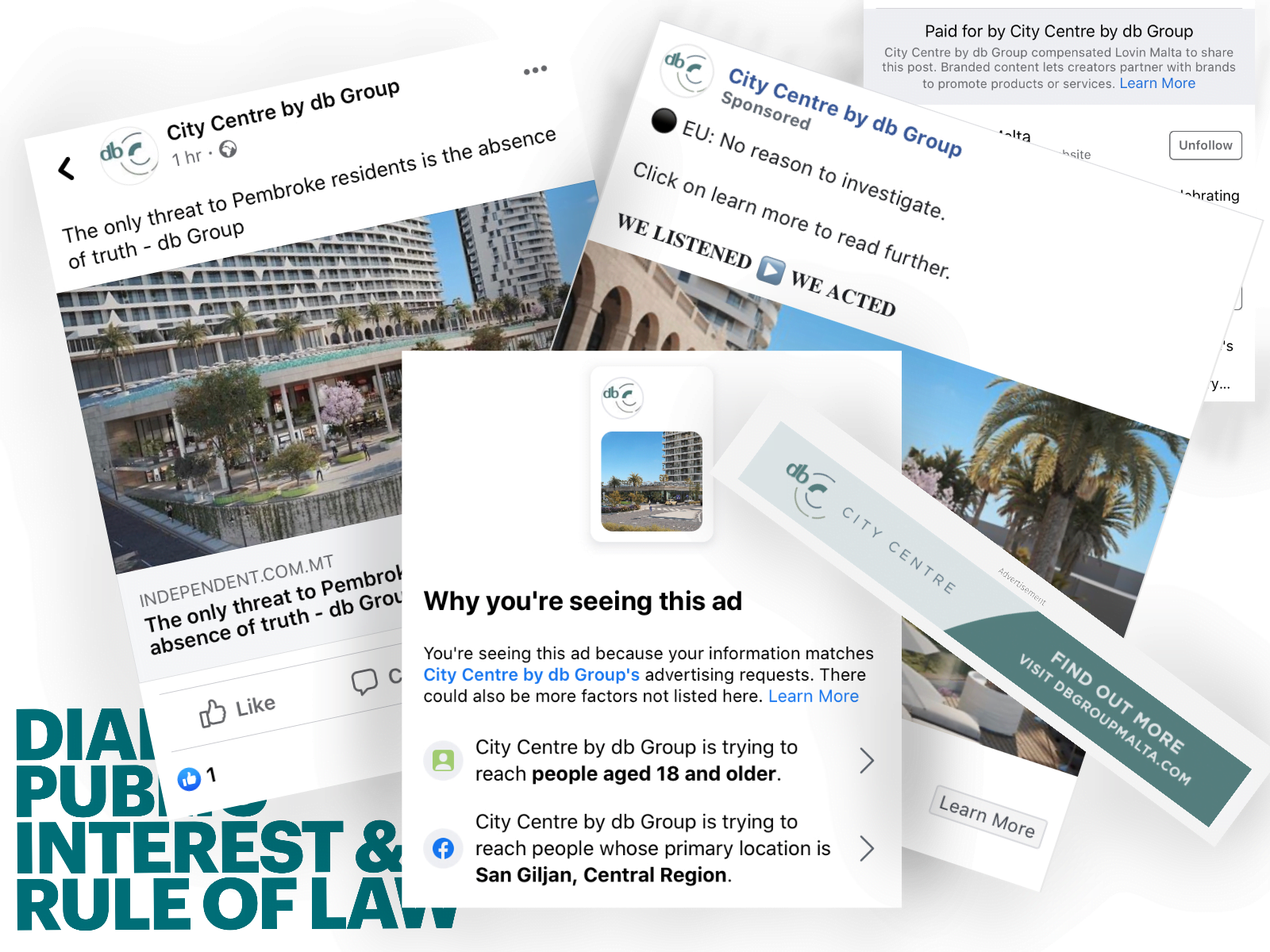

In an aggressive public relations campaign, DB Group had declared that following a ‘listening exercise’ it had decided to half its project at the former ITS site. Yet plans analysed by The Shift, as a new wave of opposition against the project is mounting, show a very different picture from what Silvio Debono’s company wanted the public to believe.

The plans show DB Group will decrease the height of its planned residential tower from 31 to just 17 floors. But it is proposing to build two towers instead, each consisting of 17 storeys.

This means that the group will be building a combined total of 34 storeys of residential apartments instead of the original 31.

In the previous plans with 31 floors, the Group was going to fit 162 apartments. In the revised plans, the developers are proposing to build a total of 179 apartments – an increase of 17 apartments.

The residential apartments have already been put up for sale even though the company does not have the necessary development permits. They will be built on land which was originally earmarked to be used exclusively for tourism purposes.

The residential element in the project is by far the most lucrative part of the whole City Centre idea and the area from which the DB Group is expected to rake in most profits.

DB ran an expensive PR campaign over its City Centre project.

New plans expected to boost profits

According to an economic impact assessment of the original project prepared by KPMG for DB Group, it was estimated that the residential wing of the project would result in profits of €123 million during the first three years.

Industry sources told The Shift that the additional 17 apartments which DB group is now proposing in this highly sought area are expected to boost profits by an estimated €15 million.

Real estate agents have been marketing the tower’s apartments at €950,000 for a one-bedroom flat to €2.1 million each for a three-bedroom apartment.

Former Prime Minister Joseph Muscat cutting a celebratory cake with Silvio Debono, his wife Veronica, and their children.

This is in addition to profits to be generated by other facilities, including a 350-room five star hotel and a 21,000 square metre shopping mall, most of which is up for rent. The project will also include a 2,000 square metre lido and nightclub.

The only real change made to the original plans is that DB group has reduced the size of the hotel, eliminated the original 3,000 square metres of office space and removed the casino which was originally planned as part of the hotel.

The changes may be due to evolving economic and market scenarios. “Office space is not economically attractive any longer as Malta is already full up in this area. With new office developments mushrooming all over the island more office space might be a white elephant,” industry experts said.

“Regarding the casino proposal, DB Group has no licence to operate one and these licences are restricted by the government. DB’s proposal of having a casino was based on thin air.”

The revised plans also show what planners are considering to be a ‘significant flaw’.

While Silvio Debono is proposing an increase in the number of residential apartments, meaning more residents and guests, it has proposed a significant reduction in parking spaces – down by more than 500, from 1,819 to 1,267.

While more people will be living in the area, even when excluding visitors to the hotel, lido and shopping mall, there will be much less space to park. This will increase pressure on the roads around the project, mostly used by Pembroke residents.

A massive killing off public land

The former 24,000 square metre ITS site, situated in what is described as Malta’s ‘golden mile’, was given to DB Group by the Labour administration led by disgraced former Prime Minister Joseph Muscat in one of its most controversial deals.

Through a tendering process, which the NAO found to be ‘dubious’, Silvio Debono’s company was surprisingly the only bidder for this much sought-after land. Potential bidders could only find out that the project included the possibility of building residential apartments, a pivotal element that rendered the project commercially viable, by paying €10,000 for a copy of the Request for Proposals.

The residential element was also significantly played down in the Request for Proposals, something with the NAO also pointed out.

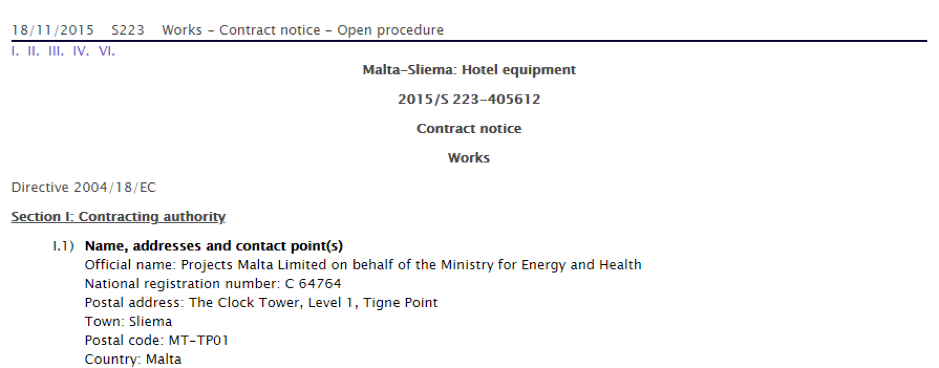

The contract notice advertising the concession in the EU Official Journal misleadingly described the project as relating to the supply of “hotel equipment”.

DB Group got the land for a premium of only €15 million.

Deloitte carried out a study on the 99-year concession based on what DB Group was proposing to build on the land – luxury flats and a hotel – and arrived at the figure of €56 million. A government-commissioned report had put the price, some five years ago, at a conservative €212 million.

On top of offering DB Group great value for money, the government also conceded that the Group was to pay only €5 million upfront for the 99-year concession, with the rest – €10 million – staggered in instalments over seven years.

The government also reduced the payable ground rent of €1.5 million a year to just €1,000 until the project is completed.

The price also does not factor in the €2 million spent from taxpayers’ funds to do up ITS’s temporary premises, the money spent on the ITS’s new premises at Smart City and the multi-million euro investment in infrastructural costs, also to be borne by the public, to service the tower project that includes a new road and tunnel.

The City Centre permit, issued by the Planning Authority in 2018, was struck down by the court after it was revealed that one of the Authority’s board members, who had decided in favour of the project, had an undeclared conflict of interest as he was selling apartments for the same project.

The project is now up for another decision by the Planning Authority, which is once again being opposed by all the island’s major environment NGOs and thousands of residents.

This country is run bu thieves who thrive on other thieves and imbeciles.

And don’t forget their man – amongst others – who formed part of the PA board (now resigned)which approved the project and who was already selling apartments on plan BEFORE the final approval, and who, just as luck would have it, had a real estate branch of a well known international real estate company. And who happened to also be a founding member of a financial advisory firm (since rebranded) that handled disgraced Chief of Staff Keith Schembri’s portfolio.